July 20, 2023 | Recession Watch: Real Estate And Manufacturing Seize Up

Rising interest rates don’t hit everything all at once. Some sectors feel the pinch immediately while others keep chugging along, seemingly oblivious to tightening money. But eventually, the pain spreads far enough to hurt and/or scare everyone, which brings on the cycle-ending recession and bear market.

That day is getting closer, as multiple sectors report flat to negative numbers. Some recent headlines:

Office real estate values are moving down so fast that banking giants like Wells Fargo are already bracing for losses

Nvidia and Intel Stocks Drop After Taiwan Semi’s Profit Fall. Why AI Isn’t Helping Yet.

Global Manufacturing PMI in June Fell Further, Points to Intensified Downward Pressure

BofA Cuts Price Forecast For Most Commodities Including Copper, Lead, Zinc and Nickel for 2023 and 2024

Home sales fell in June to the slowest pace since January, limited by near-historic low inventory

Housing starts slump in June as building challenges persist

Complete Paralysis: Just 1% Of US Homes Have Changed Hands In 2023, The Lowest On Record

Mortgage indicators ring alarms as spreads near post-subprime highs

Winnebago stock falls after big revenue miss, amid weakness in motor-home sales – MarketWatch

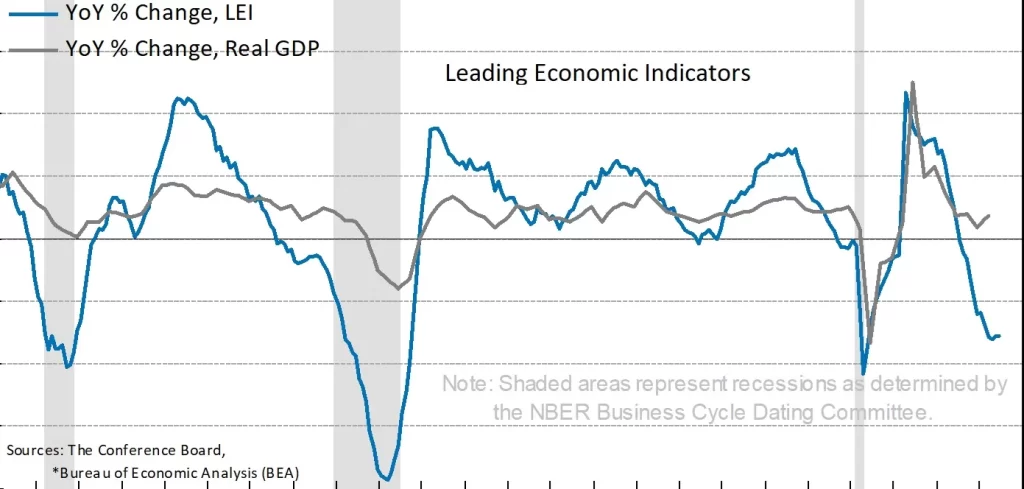

The Index of Leading Economic Indicators captures a lot of the above. And it’s pointing down hard:

The take-away? Time to be defensive

The last time this combination of rising interest rates and widespread slowdown occurred was in 2008, and the result was the ugliest stock market most people had ever seen:

In situations like this cash, for a while, is king. So stay liquid, and you’ll love the bargain basement.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

John Rubino July 20th, 2023

Posted In: John Rubino Substack