July 17, 2023 | People We Should Know: Ray Dalio

Ray Dalio’s bio is not that different from the typical “hedge fund asshole”: Harvard, Bridgewater Associates, billionaire, best-selling author. And of course he predicted and profited from the last few couple of financial crises.

But instead of coasting on past success, Dalio has shifted gears and become a public figure whose take on the global economy and US politics aligns nicely with that of gold bugs and preppers. He likes precious metals and expects that “debt/financial conditions could worsen, perhaps very significantly, over the next 18 months.”

Here’s an excerpt from a recent, much longer article he wrote for Time:

Why the World Is on the Brink of Great Disorder

Early in my career, I learned though a couple of painful mistakes that the biggest things that surprised me did so because they never happened in my lifetime but had happened many times in history. The first time that happened was on August 15, 1971 when I was clerking on the floor of the New York Stock exchange and the U.S. defaulted on its debt promise to allow people to turn in their paper dollars for gold. I thought that this was a big crisis that would send stock prices down but they went up a lot. I didn’t understand why because I’d never experienced a big currency devaluation before. When I looked back in history, I saw that the exact same thing happened on March 5, 1933 when Roosevelt defaulted on the U.S.’s promise to let people turn in their paper money for gold and stocks went up. That led me to study and learn why—which is that money could be created, and when it’s created, it goes down in value which makes things go up in price. That experience led me to study the rises and declines of markets, economies, and countries which I’ve done ever since. For example, my studying how the 1920s debt bubble turned into the 1929-33 financial collapse led me to anticipate and profit from the 2008 financial crisis. That’s how I learned that it’s critical to take a longer-term perspective and understand the mechanics behind why history rhymes.

A few years ago, I saw three big things happening that hadn’t happened in my lifetime but had happened in the 1930-45 period. These were:

- The largest amounts of debt, the fastest rates of debt growth, and the greatest amounts of central bank printing of money and buying debt since 1930-45.

- The biggest gaps in wealth, income, values, and the greatest amounts of populism since the 1930-45 period.

- The greatest international great powers conflict, most importantly between the U.S. and China, since 1930-45

Seeing these three big things that never happened in these magnitudes in my lifetime led me to study the rises and declines of markets, economies, and countries over the last 500 years, as well as the rises and declines of China’s dynasties the last 2,100 years.

That examination showed me that these three big forces—i.e. the debt/money one, the internal conflict one, and the external conflict one—transpired in big cycles that reinforced each other to make up what I call the Big Cycle. These cycles were driven by logical cause-effect relationships Most importantly, this study of the last 500 years of history taught me that:

- The previously described financial conditions repeatedly proved to be leading indicators of big financial crises that led to big shifts in the financial order.

- The previously described levels of political and social gaps repeatedly proved to be leading indicators of great conflicts within countries that led to big changes in domestic orders.

- The previously described great powers’ conflicts repeatedly proved to be leading indicators of international conflicts that led to big changes in the world order.

…We are in a late and dangerous part of the long-term debt cycle because the levels of debt assets and debt liabilities have become so high that it is difficult to give lender-creditors a high enough interest rate relative to inflation that is adequate to make them want to hold this debt as an asset without making interest rates so high that it unacceptably hurts the borrower-debtor. Because of unsustainable debt growth, we are likely approaching a major inflection point that will change the financial order.

More specifically. it appears likely to me that because of large deficits the U.S. Treasury will have to sell a lot of debt and it appears there will not be adequate demand for it. If that happens, it will lead to either much higher interest rates or the Fed printing a lot of money and buying bonds which will devalue money. For these reasons, the debt/financial conditions could worsen, perhaps very significantly, over the next 18 months.

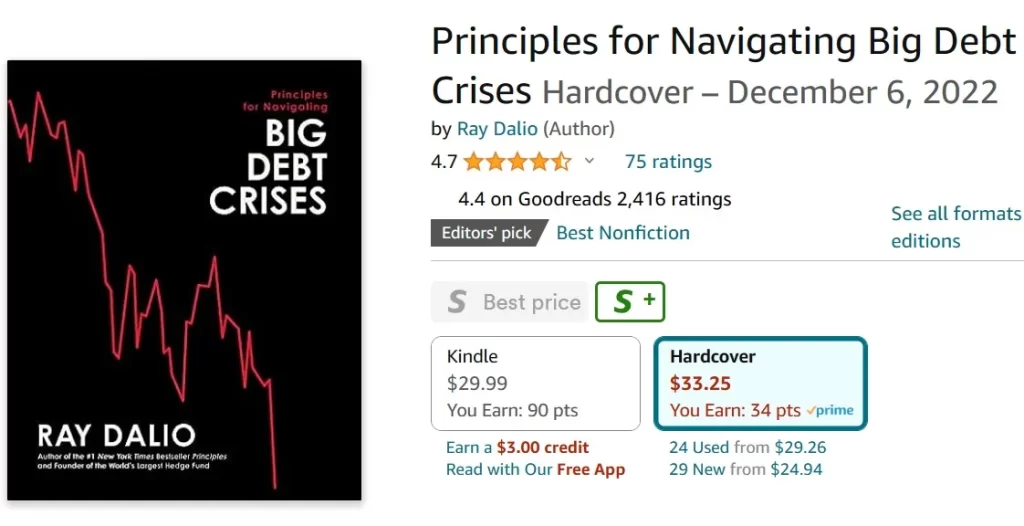

Here’s his most recent book:

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

John Rubino July 17th, 2023

Posted In: John Rubino Substack

Next: NATO – Escalates Nuclear War »