July 9, 2023 | Muddled Optimism

“A man hears what he wants to hear and disregards the rest…”

—The Boxer, Paul Simon, 1969

One of the hardest parts of economic forecasting is separating what we expect from what we want. Actually, this is part of the human condition, genetically programmed into us and affecting every part of our society and lives, not just economic forecasting.

The second part (what we want) seems like it should be easy. Everybody wants solid GDP growth, low unemployment, stable prices, and so on, right? Not necessarily.

People have different motivations. Sometimes it’s political, with people wanting economic conditions that favor their side and put the other at a disadvantage. More often it’s just about our station in life. Some businesses see higher sales in a weak economy, so their owners aren’t afraid of recessions. If you’re a central banker who needs to control inflation, higher unemployment might seem helpful. If you have a lot of debt, inflation could be your friend.

I often talk about the limitations of economic data. That’s not the only problem. Even if we all agree on the data, we disagree on what to do with it because we all (or at least most of us) have different desired outcomes. Furthermore, even if we agree on the validity of the data, we don’t agree on what it means or what we should do with it. From there, wishful thinking takes over. Wishful thinking is benign compared to political agendas, which can be terribly destructive. Forecasts become less objective and more extreme.

Politicians tend to choose economists who tell them what they want to hear. This seems to have gotten worse this last decade. The pandemic doubled down on bad forecasting and governance.

In reality, though, extreme events are rare. That’s why they’re called “extreme.” The most likely economic outcome is that we just muddle through. No one gets everything they wanted, nor everything they feared.

I think of myself as an optimist. In spite of all the bad decisions (I will let you decide which are the bad and/or good decisions), the free market, often referred to as Adam Smith’s invisible hand, keeps moving humanity in the direction of economic growth. Yes, there are the occasional bumps that we call recessions, but we get through those.

My recent letters spent a lot of time examining the darker possibilities, so today I want to add some balance by looking on the bright side. Good things are happening… actually, lots of good things must be happening in order for the country not to be rolling over into a depression. Most of those good things are happening on the micro level in various businesses and industries, but they add up and you can see them in the macro data.

The Bright Side of Demographic Reality

The labor shortage is usually described as an economic problem, but it has a bright side, too.

Let’s start by admitting the problem is real. Current demand for labor far exceeds supply. There isn’t some pool of idle workers who could be enticed or coerced to fill the gap. That’s just demographic reality. It’s happening around the globe in every political and economic system, so policy tweaks don’t seem like the answer. Technologies like AI might help, but not quickly. The shortage is here and now.

Economists focus on things they can measure, and in this case, wages are a significant measurable data point. They are rising in most places and industries, to varying degrees. This contributes to inflation, but I think is mostly a good thing. Wages are rising the most in so-called “service” occupations: restaurants, retail, healthcare, construction, etc. These hard but necessary jobs boost living standards for everyone. We all benefit when they are done well. Moreover, these better-paid workers are also consumers. Enabling them to spend more generates growth in ways that higher asset prices don’t.

The bright side of this is less measurable but no less real. The division of labor is a basic principle of economic growth. People are more productive when they specialize in the tasks for which they are best suited. Growth happens when we find ways to unlock everyone’s best talents. The labor shortage is doing exactly that.

Look at what is happening. Given multiple opportunities, people are seeking jobs they find enjoyable and rewarding. Wages are part of that, but not necessarily the most important part. I suspect much of the churn we see in the employment numbers isn’t about higher pay but people leaving jobs that were never a great match. Getting them into something that better applies their skills should make them more productive.

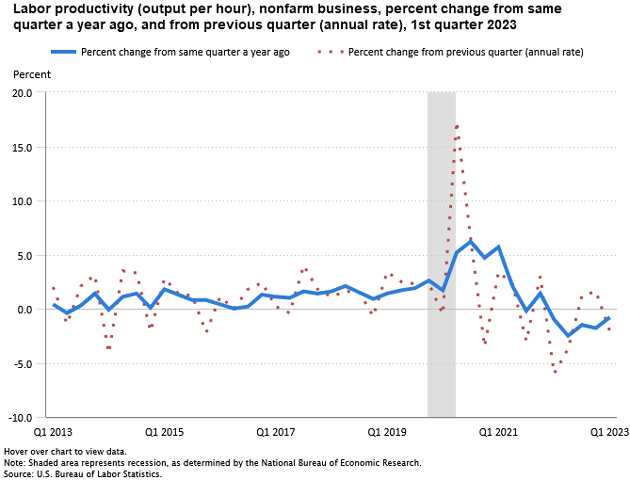

Source: BLS

“Stop right there, John,” you say. “Productivity is plunging. That doesn’t fit your theory.” You are correct, but we expect lower productivity when someone starts a new role. It takes time to adapt to an organization and get into your groove. The most productive workers in any company are the ones who have been there a few years. I’m hopeful the lower productivity numbers are temporary.

We can also quibble with those numbers. Productivity is simply GDP divided by aggregate hours worked. GDP ignores a lot of output. Someone who stays home to care for a disabled or elderly relative doesn’t “work” nor add to GDP, but hiring a caregiver to do the same thing would. The latter is increasingly difficult due to the labor shortage. I score the productivity numbers as at least questionable.

Another term fits here, too: “labor mobility,” or worker willingness to change jobs. As technology advances and workers gain new skills or their life conditions change, their ideal job might change, too. Staying in a job that no longer fits you is suboptimal for the worker, employer, and the economy in general. Today we are in a situation where skilled people in many industries can change to a better role with more confidence.

This is short-term disruptive but long-term positive. Once the current “Musical Chairs” game is over, the economy should have (generally—there are always exceptions) better paid, happier, and more productive workers. That will help everyone, including the overwhelmed employers who for now are so desperately seeking workers.

Messy But Happy

The labor shortage isn’t just changing how workers think. It’s also changing how employers think. And again, I think this is for the better.

My generation of business owners and managers had abundant labor for most of our careers. We owned the scarce goods (jobs) for which there was excess demand. Advertise any kind of open position and you would get dozens if not hundreds of applicants. The biggest problem was sorting through the resumes.

Having spent many years in this environment, some managers came to think it was normal. It was not. In hindsight, it looks more like a demographic accident.

The oldest Baby Boomers reached “prime age” of 25 in 1970. The youngest Boomers left prime age (54) in 2018. In between was the Era of Easy Hiring, which would now be ending even without the pandemic. COVID-19 accelerated the effect by spurring 2.5 million earlier than expected retirements and reducing the labor force via death and disability. It would be happening anyway, though.

Instead of workers competing for jobs, now companies compete for workers, especially skilled workers. This is forcing businesses to be more deliberate in their hiring process. The first question is should you hire anyone at all. Are there other ways to get the task done? Maybe. Finding and implementing them makes the company more efficient.

If a human worker is required, the last thing you want is to go through a long search and then have the person you hire leave quickly. That means you define the position carefully, put a lot of thought into what kind of experience and qualifications to seek, and make sure it’s a good match from both directions.

Employers also have new incentives to reduce turnover. In the Era of Easy Hiring, you could always find replacements without too much trouble. That’s no longer the case. When your competitors are giving your best people reasons to leave, you have to give them reasons to stay. More money may not be what it takes.

This process is playing out in businesses of all types and sizes. It’s messy and painful but I really believe the economy will be better after going through it. When a necessary good is scarce and expensive, and you can’t find substitutes, you look for ways to make the most of your limited supply. This will ultimately produce happier business owners (like you if you own stocks) and happier workers.

In spite of the most expected recession in history, this week’s ADP employment number was a blowout. US private sector jobs surged by 497,000 in June, far ahead of the downwardly revised 267,000 figure for May and much higher than the consensus estimate of 220,000.

Gains were widespread. Leisure and hospitality added 232,000 new workers, construction and trade 97,000, and transportation and utilities 90,000. Education and health services saw 74,000 more jobs and natural resources and mining 69,000. Annual pay rose at a 6.4% rate which suggests that costs are still rising. (H/T Michael Lewitt)

Yes, some will see the enormous leisure and hospitality additions as temporary. I agree that many are part time, in response to a blowout travel season. Airports are packed. The employment numbers are a response to demand.

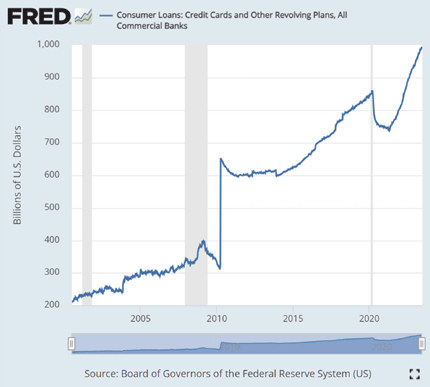

And yes, a lot of that demand comes via credit cards and debt. But credit card debt has been growing for decades. Sometime this summer we will go over $1 trillion of credit card and revolving debt:

Source: FRED

Friday’s employment report, however, painted a different picture. As Peter Boockvar writes:

“Payrolls in June grew by 209K, 21K under the estimate while the private sector print was 50K below expectations at 149K. Also of note, there were net downward revisions of 110K to the two prior months combined. After falling by 310K in May, the household survey got back many of those jobs, rising by 273K. Combine that with a rise in the labor force of 133K and the unemployment rate fell one tenth to 3.6% after jumping by 3 tenths last month. The U6 rate in contrast rose 2 tenths to 6.9% and that quietly is the highest since August 2022.”

Barry Habib texted me with some caveats: Those who could only find part-time work were up 122,000, and those with multiple jobs were up at 233,000. Part-time for economic reasons was up 452,000.

The good news, though, is the economy is growing and employment is up. We muddle through.

Manufacturing Renaissance

The labor winnowing now underway, combined with labor-saving technologies, may well lead to permanently lower headcounts for many employers. The math says it’s almost inevitable. Companies built around an endless stream of low-wage disposable labor may not survive as people find better opportunities.

Where will these new opportunities be? Here we have another potentially very positive development: American manufacturing is back, or at least recovering. That may stun some readers who thought it was gone forever. A curious set of factors are combining into a possible renaissance.

To begin with, let’s think about what happened to this (previously) labor-intensive sector. China’s opening to world trade created a new kind of wage arbitrage. Low-wage Asian workers could easily do the same kind of repetitive assembly-line work as American factory workers. Competitive pressures made sure that’s exactly what happened. Our once-mighty Midwest factories shut down, leaving their well-paid workforces jobless.

This was mostly a function of labor costs. As technology developed, globalized production lost some of its financial appeal. The more automated a factory becomes, the less advantageous it becomes to have it in a place with lower wages.

Now add in geopolitical tension with China, combined with the realization that it’s not great to depend on a potential adversary for important defense-related technologies like microchips. Then the pandemic broke supply chains, reminding everyone that it’s nice to have your own industrial base.

Many businesses, some very large, lost revenue and opportunities when their super-optimized, just-in-time, trans-Pacific supply chains stopped working. That’s not an experience they want to repeat, so demand for domestic manufacturing capacity quickly shot higher.

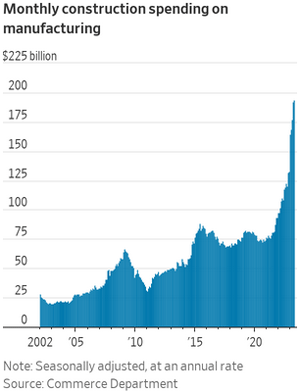

How quickly? Here’s a chart of monthly manufacturing construction investment.

Source: The Wall Street Journal

That sharp climb on the right side of the chart began in early 2022. It was impressive already, then in August the government did what it does best: throw more fuel on the fire. The CHIPS Act provided funding and incentives for semiconductor production while the Inflation Reduction Act offered subsidies for electric vehicles and green energy technologies. Businesses are taking the money and starting construction.

Needless to say, this isn’t what you typically see in an economy headed toward recession after a year of rising interest rates and tighter credit. The subsidies are likely intensifying it, but this looks like real expansion, at least in the manufacturing arena.

It makes more sense if you see it not as new production capacity, but as replacement of production capacity currently located overseas. If so, this has staggering implications. Globalization is changing drastically. COVID may have accelerated events that were coming regardless.

Now, if this is a US manufacturing renaissance, don’t assume it will look anything like the factories that closed 20 years ago. We won’t have assembly lines of workers drilling holes. These new facilities will be highly automated with robots doing the repetitive tasks. But they will have some human workers, and the numbers will add up.

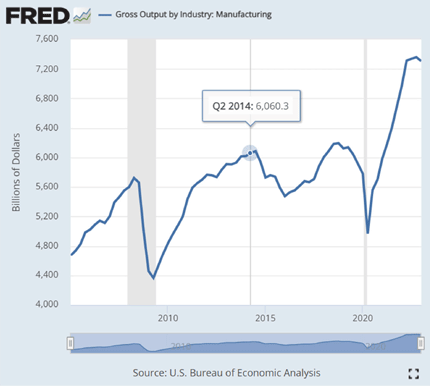

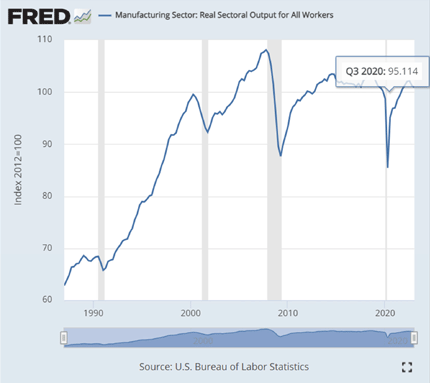

We should all note that even as many were claiming a loss of manufacturing capacity in the US, the amount of goods that we have been producing has been rising over the last 50 years. Here is the longest-running data that I can find. Yes, there are ups and downs but the direction is clearly up. This is nominal and not real terms.

Source: FRED

Taking inflation into account (chart below), manufacturing is basically at the same level as it was 10‒20 years ago, with wild swings up and down, due to recessions. You can certainly see negative aspects to this chart but given the level of manufacturing that was moved offshore, you could also see it as a positive in that we have maintained a rather large manufacturing base. And now that we are seeing reshoring? We are going to see an acceleration in manufacturing in real terms over the next decade.

Source: FRED

Before we reach that point, the design and construction of all these factories will itself generate new skilled labor demand. This will be well-paid labor, too, which will in turn generate more consumer spending. That spending will support other kinds of demand.

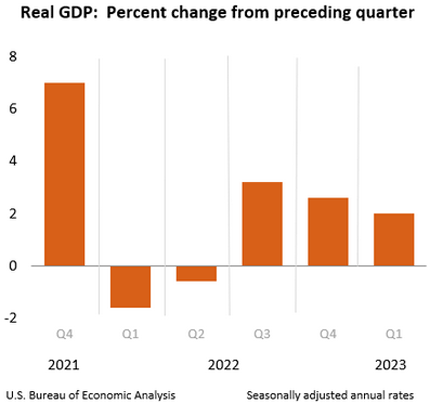

How do you get a recession in this environment? Some argue we already had a recession when GDP dropped slightly in the first two quarters of 2022. The official committee didn’t call it, but in the chart, it sure looks like one—albeit a mild one.

Source: BEA

Later this month we’ll see the initial estimate for Q2 GDP. If it’s still showing something in the neighborhood of 2% annualized growth, recession will look much less certain. Note also, this week’s minutes of the last Fed meeting showed the staff saw its recession forecast as a close call.

And there are an increasing number of analysts who now think we will avoid a recession. Let’s look at what my friend Ed Yardeni says:

“Instead of the economywide recession that was widely expected to result from the Fed’s monetary tightening, recessionary weakness rolled through different areas of the economy at different times. Now that rolling recession is turning into a rolling recovery. Accordingly, we’re raising our Q2 real GDP forecast from 1.0% to 2.0%, followed by 2.0% in Q3 and Q4. We now see a 75% chance of a soft landing (up from 70%)—subject to change depending on what the Fed does, which depends on what inflation does. …We expect inflation to continue to moderate, with a headline PCED rate closer 3.0% by year-end, down from 4.6% in May…”

However, if we do get a recession (or another one, if you think 2022 was recessionary), I don’t think it will be a normal cyclical recession. It will be an induced recession, the result of the Fed’s aggressive anti-inflation policies.

Personally, I won’t blame Powell too much in that scenario. He did what had to be done (belatedly), and inflation looked like a serious threat for a while there. They had to knock it down and leave no doubt. What if they keep tightening from here?

This illustrates what I was discussing above: Different people see the same data and have different interpretations of what to do. New data from the New York Federal Reserve shows underlying inflation may have slowed faster than the headline measures that have kept US central bank officials poised for further interest rate increases.

Unless we see a shockingly lower CPI number next week, the Fed seems poised to raise rates again. The most reliable data I can find says that inflation will still be above 3% at the end of the year.

I have outlined some reasons for optimism and reasons to think the Fed will screw it up. Throw them in the blender and what do you get? Not a boom, nor a bust, just a steady, unremarkable muddle-through pace.

Which, given what we all went through the last few years, I will gladly take.

Memphis, Dallas, and Paris

My partner Ed D’Agostino sat down with Jared Dillian for a conversation about how to invest in this economy. Jared answered dozens of questions many of you submitted. You can catch their discussion here.

Or, if you’d rather, here’s a link to the transcript.

While they are offering a great deal on all of Jared’s letters, this is most definitely not a promotion. Take some time to watch (or read) if you are active in the markets.

I am looking forward to once again returning to FreedomFest, this year in Memphis. Longtime friend Mark Skousen (40 years!) has put together his best conference ever, a celebration of libertarian philosophy and economics. I will see lots of old friends (looking forward to dinner with George Gilder [assisted by a local reader] and then a night at BB King’s) but there are some people I really want to meet who will also be there. I will be speaking/on a panel at least three times and you will be able to find me near the King Operating booth. If you decide to attend, use the special code MIKEROWE77 to get a $77 discount. Mike is a featured speaker whom you may know as the host of “Dirty Jobs” and as an advocate for technical trade training. Presidential candidates, economists, and a lot of fun. Barbecue and blues. Look me and Shane up if you come.

Then Dallas in the second week of August and Paris and Europe in early September for Charles Gave’s 80th birthday. And on a fun note:

How It Started and How It’s Going

June 29th was the birthday of my twins, Abigail and Amanda. We adopted them at 6 months. Here they are at two years on the cover of Twins Magazine:

And here they are last Thanksgiving:

I won’t show you the baby pictures we were sent from the adoption agency, but let’s just charitably say that they were not good. I know that one family turned them down because the pictures were not indicative of future results. We got lucky. They have great husbands and I have three beautiful granddaughters. I think it’s going pretty well…

And with that, I will hit the send button. You have a great week!

Your looking forward to friends, BBQ, and Blues analyst,

John Mauldin

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

John Mauldin July 9th, 2023

Posted In: Thoughts from the Front Line