July 31, 2023 | Japan Takes Another Step Towards the Cliff

For a while there, the Japanese government had a sweet deal going. By pushing interest rates into negative territory — which forced bond buyers to pay for the privilege of owning said bonds — it was able to earn money on its national debt.

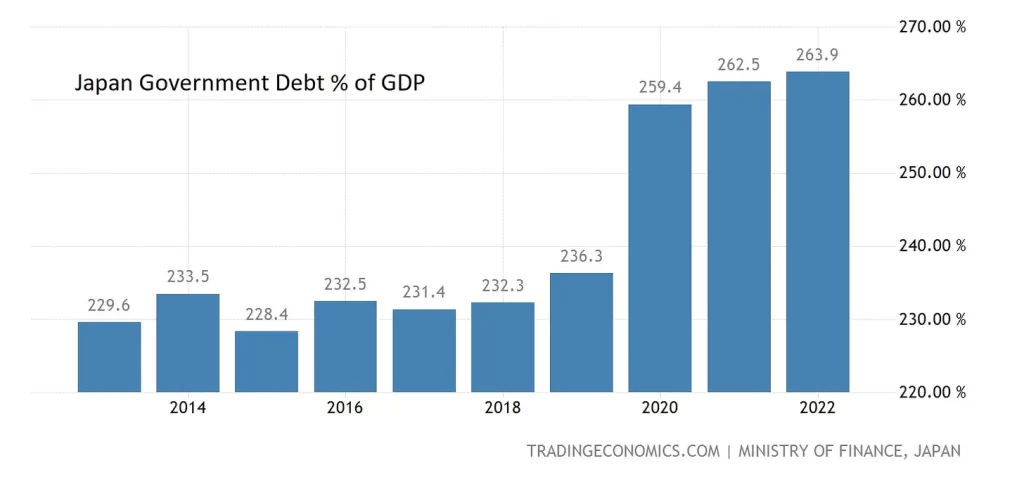

So the more the government borrowed, the more it earned. And borrow it did, with government debt as a percentage of GDP rising to levels unprecedented in modern history.

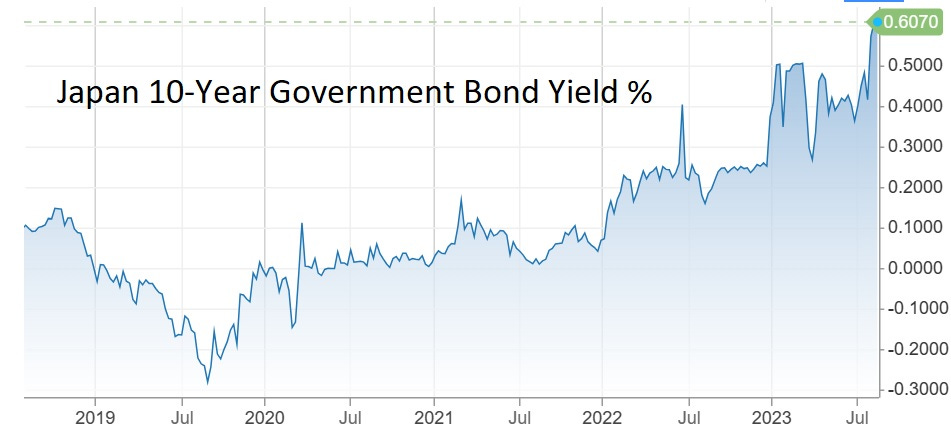

But then came inflation, which made negative-yielding bonds untenable. Japan was forced to allow 10-year rates to rise, first to 0.25%, then to 0.5%. And last week this happened:

Bank of Japan loosens yield curve control, pledging ‘greater flexibility’

Japan’s central bank on Friday loosened its yield curve control, underscoring concerns about its protracted monetary easing on financial markets and the real economy.

In a policy statement, the Bank of Japan said it will continue to allow 10-year Japanese government bond yields to fluctuate in the range of around plus and minus 0.5 percentage points from its 0% target level — though it will offer to purchase 10-year JGBs at 1% through fixed-rate operations. This move effectively expands its tolerance by a further 50 basis points.

The BOJ pledged to “conduct yield curve control with greater flexibility, regarding the upper and lower bounds of the range as references, not as rigid limits, in its market operations,” citing the need to remain nimble given “extremely high uncertainties for Japan’s economic activity and prices.”

The markets correctly interpreted this as a further capitulation, and 10-year yields spiked to .6% (amazing to be writing that an interest rate “spiked” to .6%).

Japan’s average interest rate is still tolerably low thanks to its “yield curve control” policy of keeping short-term rates lower than long-term. But for those short rates to stay low, the yen has to remain stable versus other currencies. That is, a falling yen would force the Bank of Japan to raise rates to prevent a currency crisis.

How’s that working out? So far, not so good. The yen is down about 10% versus the USD this year, and the trajectory is ominous.

When, not if

Is Japan’s bond market (and by implication its government) about to implode? Probably not right away. But all trends point in that direction. A debt and/or currency crisis remains a “when” not “if” proposition.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

John Rubino July 31st, 2023

Posted In: John Rubino Substack