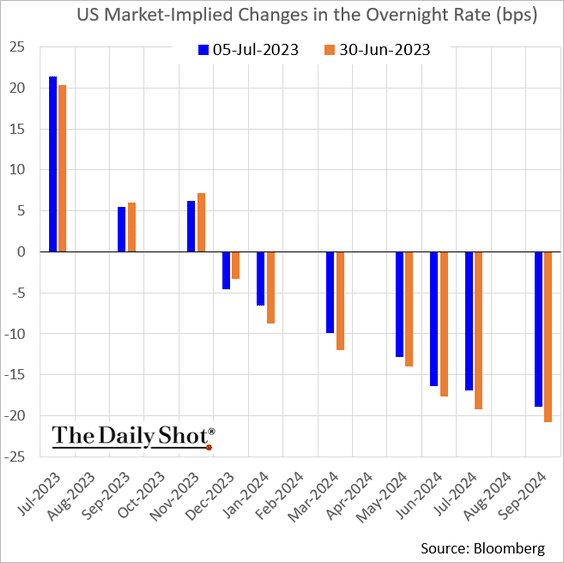

Fed minutes on Wednesday telegraphed that voting members plan another 25 bps rate hike this month and 25 more by November. Market implied rates are shown below in blue versus expectations last week (pre-minutes) in orange. While rate cuts are expected to follow from December 2023 through September 2024, the magnitude of easing anticipated is significantly less than the 500 bps delivered in response to the 2001 and 2008 recessions.

But conditioned by two decades of extreme monetary interventions, corporate debt and equity markets have, so far, mostly whistled past the prospect of higher rates for longer.

Amid record indebtedness., most are banking that a return to zero-rate policies will rescue them again in the not-too-distant future. While rate cuts are the base case through 2024, higher for longer is too–and that’s not priced in. See Higher for longer rates are a death threat. Investors don’t want to hear it yet:

There is an old joke: An optimist jumps from the roof and shouts, “so far, so good!” when passing the first-floor window. Corporate-debt markets are at risk of a similar delusion, particularly where private equity is involved.

Companies will find it expensive to refinance debts they took on during a decade of ultralow interest rates, perhaps more so than expected.

Issuance has now fallen for junk bonds, Dealogic figures show, but not for leveraged loans, which have floating rates and are traditionally the more popular instrument for private-equity buyouts. This is another sign that companies are waiting for rates to fall again before issuing more fixed-rate paper.

If central banks don’t oblige, the extra leverage will weigh. This is particularly true of junk-rated private firms, whose bonds tend to be riskier than those of listed corporations according to classic measures of sustainability such as interest cover and debt-to-equity. Often, private owners build up debt in order to extract more dividends.

Peter Boockvar, Bleakley Financial Group CIO, discussed the implications in the segment below. Here is a direct video link.