June 10, 2023 | Trading Desk Notes For June 10, 2023

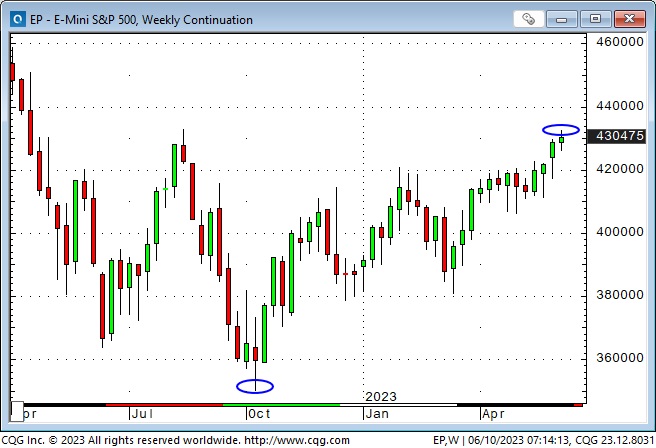

The S&P and the Vanguard Total Stock Market ETF (the VTI) made new highs for the year this week

The S&P is up >22% from last October’s low. The VTI is up ~23%.

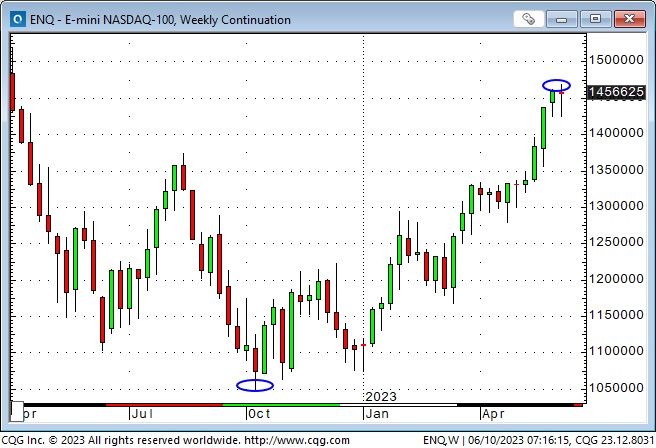

The Nasdaq 100 is up ~40% from October’s lows. The rally in the benchmark indices continues to be driven by big gains in a handful of mega-cap tech stocks. Without those mega-cap stocks, the S&P is up ~2%YTD.

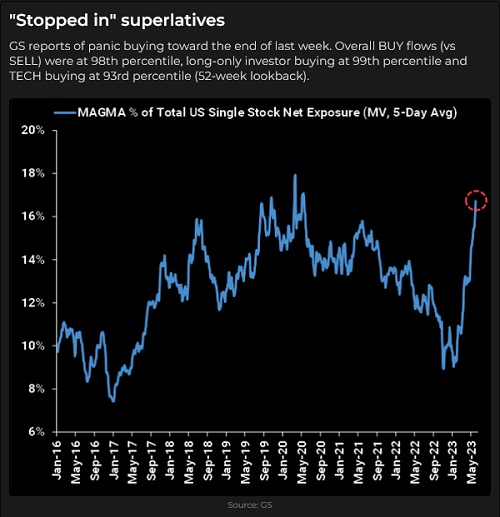

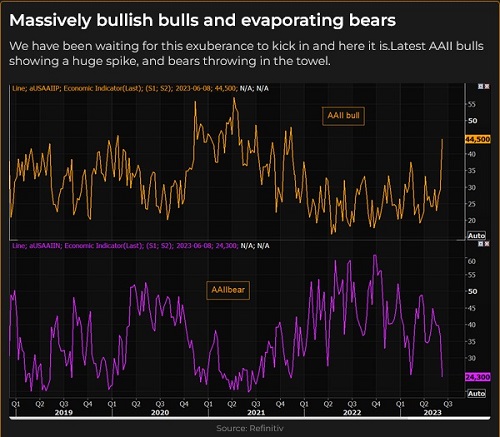

Market sentiment at the beginning of this year, particularly among portfolio managers, was bearish, in part because last year had been a BAD year for both stocks and bonds, but also because of the sharp increase in interest rates from various central banks, which many people thought would lead to rising unemployment, stress in the financial markets and a recession.

YTD inflation has declined but is still well above central bank targets of ~2%. Employment gains have been surprisingly robust, and the recession has failed to arrive. Central banks are in a “higher for longer” mode, with both the BoC and the RBA increasing rates recently after a pause.

Many portfolio managers who are underweight stocks, particularly hot sectors, have to increase their weight or risk losing client assets – they have to chase stocks that are racing higher.

There is a risk that high-flying stocks could reverse course and tumble. One argument in favour of stocks rising is TINA. But with TBills at 5%+, that may not be true. Another argument is that stocks are a hedge against inflation. But at what price?

I trade psychology, and from a risk management perspective, I’m willing to look for opportunities to short stocks here rather than buy them.

The Bank of Canada

The BoC raised short rates by 25bps this week to the highest level in 22 years and hinted they might have to raise rates higher. They said, “Policy wasn’t sufficiently restrictive,” and “CPI inflation could get stuck materially above the 2% target.”

Some analysts were “surprised” by the BoC’s decision, and the CAD jumped as much as three-quarters of a cent following the announcement of higher rates. (In the last few seconds before major scheduled notifications, bids and offers are often cancelled in many markets, and the “machines” run markets up and down within a few seconds before liquidity returns. This is a one-minute chart of the front-month CAD futures contract. The spike higher happened immediately after the BoC announced the rate increase.)

On Friday, the Canadian employment report showed a loss of ~17,000 jobs after several months of robust gains.

OPEC+ announced another production cut

OPEC+ (Saudi) announced a 500,000 bpd cut at their scheduled meeting last weekend, and WTI futures gapped ~$3 higher to ~$75 when trading resumed on Sunday afternoon. By Thursday, prices had dropped to ~$69 and closed the week at ~$70.

Thoughts on trading

I’ve watched several videos of Denise Shull over the past few years and am impressed with her views on trading psychology.

One of my favourite quotes from Denise is, “You don’t trade based on your process; you trade based on how you feel about your process.”

Here is a link to a recent interview. The interview is for a German audience and starts with a one-minute introduction in German – but then switches to English for the balance of the discussion.

My short-term trading

I started the week short the Euro. I lowered my stops as the Euro dropped and was stopped for a decent gain when the market rallied on Wednesday. I re-shorted the Euro on Friday after it had rallied Thursday and went into the weekend short. I’ve been shorting the Euro since early May.

I shorted the CAD on Friday after it (and the S&P and the Euro) fell from the week’s highs. I remain short into the weekend.

I shorted the S&P on Friday after it fell back from making new multi-month highs. I remain short into the weekend.

I have tight stops on all of these “top-picking” trades, and I’m trading small sizes, respecting the up-trend and the correlation between the positions.

On my radar

The US CPI is reported on Tuesday, and the FOMC meeting concludes on Wednesday. Both of these events could have a significant impact on markets.

The Barney report

We’ve had a houseful of guests the past couple of days – much to Barney’s delight – he loves people!

We’ve had some great walks on the forest trails this week. The mountain in the background of this photo was covered in snow this winter; within another few weeks, it will be all gone.

The Archive

Readers can access weekly Trading Desk Notes going back six years by clicking the Good Old Stuff-Archive button on the right side of this page.

Listen to Victor talk about markets

I did a five-minute interview with Mike Campbell on his top-rated Moneytalks podcast on June 10. We discussed how Megacap stocks are soaring and pulling the whole market higher; why money managers who have had good reason to be defensive now have to chase the market. Mike’s special guest is Robert Bryce, who has some “sobering” insights into the difficulties ahead as the world tries to transition away from fossil fuels. You can listen to the podcast on this link.

I did a 30-minute interview with Jim Goddard on This Week In Money on June 3. We discussed my macro market views and what I think about several individual markets – especially the stock, currency, interest rate and gold markets. You can listen to the podcast here.

Oceanside Special Olympics

The annual golf tournament starts later today, and I’m happy to report that we are sold out! If you want to know more about the event or donate to this worthy cause, click this link.

Headsupguys

I support Headsupguys because I’ve had friends who took their own lives, and Headsupguys helps men deal with depression. If you have a struggling friend, check out Headsupguys, and talk with him.

Headsupguys has had over five million hits on its website, and over a half million men have taken the self-check. Most men who click on the website do so after midnight their local time. Headsupguys save lives.

Subscribe: You have free access to everything on this site. Subscribers receive an email alert when I post something new – usually 4 to 6 times a month.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Nothing on this website is investment advice for anyone about anything.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Victor Adair June 10th, 2023

Posted In: Victor Adair Blog