June 26, 2023 | There Will be Blood

Happy Monday Morning!

Perhaps one of the most fascinating stories of the year has been the resiliency in the nations housing market. Prices have bounced sharply since the depths of the 2022 bear market, surprising even the housing bulls. This is no bueno for the Bank of Canada who is desperately trying to reign in inflation after unleashing a firehose of cheap liquidity the past few years. After shaking markets with a surprise 25bps “unpause” in June, it looks like they’ll be back for more blood come July.

In their recent publication surrounding their policy deliberations, their decision to raise rates in June was partly attributed to “Housing resale prices, which feed into the CPI with a 1-month lag, had increased for 3 consecutive months.”

Rising house prices will not be tolerated, at least in the near term. That’s a difficult concept to swallow for most Canadians, considering the nearly 30 year bull market most homeowners have enjoyed.

It’s almost a certainty the Bank of Canada is going to be too late to ease policy, just like they were too late to tighten policy. Remember the first rate hike came one month after the housing bull market had peaked. No reason to expect anything different this time.

Housing has been propped up by a 20 year low in new listings for nearly six months. This isn’t sustainable, and neither are 6% mortgage rates. Something has to give, and it will soon.

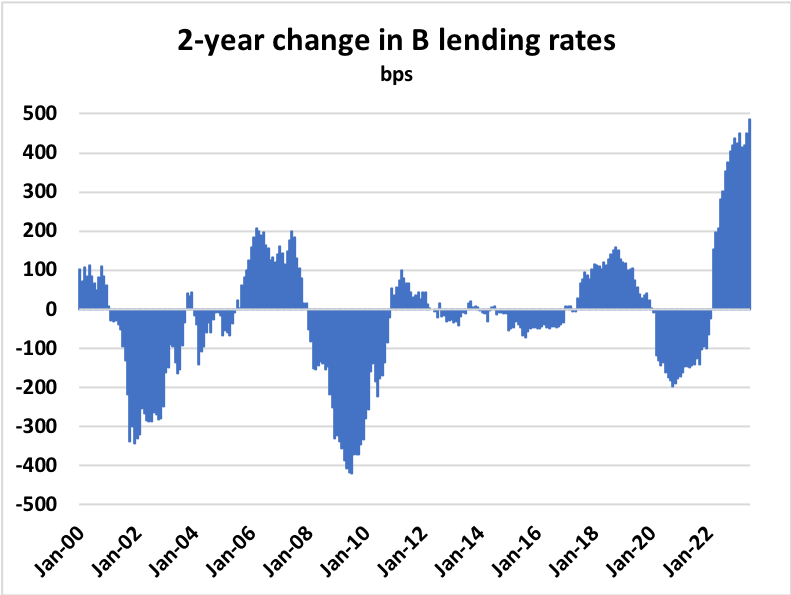

Only a third of borrowers have seen a payment increase but it’s already starting to bite. Per research from good friend Ben Rabidoux, borrowers who took 2 year terms from a B lender ( Home Capital Group, Equitable Group) and are renewing today at approximately 500bps higher.

No shocker that mortgage credit growth has plunged to twenty year lows, at the same time credit card borrowing is surging. In other words, people have stopped taking on cheap mortgage debt and instead are ramping up credit card debt at 22% interest rates.

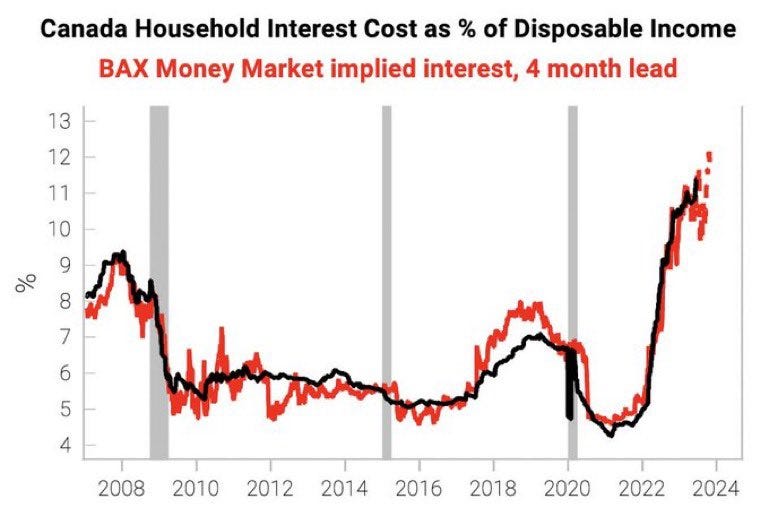

Household interest costs are surging higher, as one would expect under the fastest rate hiking cycle in a generation.

Like I said, the Bank of Canada will over tighten, they already have. Housing is slowing once again, it’s just a matter of getting sellers back to the market. Open houses are quieter, bidding wars are easing, and mortgage rates are back at their Fall 2022 highs across the curve. If this keeps up for a couple months we’ll be back in a balanced market very soon.

Credit is tight and there’s no relief valve in sight. Just this week OSFI raised capital requirements for the big banks as financial concerns mount. The domestic stability buffer or rainy day fund has been increased for the second time in six months.

Meanwhile, CMHC, the head of Canada’s housing agency says measures such as extending mortgage amortizations and changing the threshold to qualify for an insured mortgage are off the table. “That just makes credit more available,” CEO Romny Bowers told The Canadian Press.

“It lowers the monthly payment, but it actually increases the cost to the homeowner over time. It is not a winning formula because it drives up house prices.”

So there you have it, the BOC, OSFI, and CMHC all lobbying in the same week for tighter credit controls.

Now if we could just get the federal government to play ball…

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Steve Saretsky June 26th, 2023

Posted In: Steve Saretsky Blog