June 9, 2023 | The Bank of Canada Turns Hawkish Again

The Bank of Canada delivered a surprise rate hike to 4.75 percent on Wednesday, reversing an April 2023 decision that paused the interest rate hiking cycle.

As a result, mortgage rates, prime lending loans and almost everything else in the debt business will get more expensive.

At what point will the BOC stop its rate hikes?

The monetary policy followed by the Bank of Canada (BOC) is expected to moderate expansionary phases before the economy overheats and causes bubbles to form. On this metric the BOC policy has been a dismal failure as rates were kept too low for too long.

Now the BOC is determined to get inflation under control, which means rate hikes. The CPI has remained stubbornly high at 4.4 percent and even the Core index, which excludes food and energy, has been sticky in the 3.5 to 4.0 percent range.

Of course, the cost of housing, known as shelter, has continued to push inflation higher. Some of the key components of CPI’s shelter are rent and mortgage interest costs. Both of these have been marching higher, even during a downturn in house prices that we saw for a few months since the BOC started to hike rates. Shelter is the largest weighted component of the CPI at about 32 percent for the headline and 40 percent for Core. It will be impossible to get inflation to 2 percent if shelter costs keep rising.

The BOC commentary was hawkish, saying “The Bank remains resolute in its commitment to restoring price stability for Canadians”. They are disappointed that substantial policy tightening has not pushed inflation significantly lower.

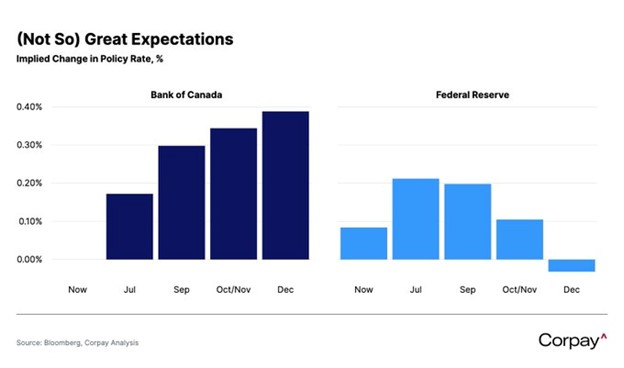

The BOC rate hike this week caused a huge change in expectations, which are now much above expectations for increases by the Federal Reserve, according to foreign exchange experts Corpay:

With both Australia and Canada hiking in the last two weeks the Fed may decide to push through with another hike, even as signs abound of a desire to pause. One Fed voting member — Harker from Philadelphia — said “the FOMC is nearing the point it can pause rates”. Fed Governor Jefferson said, “a pause in rate hikes at the June 14 meeting should not be taken as a sign that the FOMC tightening cycle is over.” Harker also said “personal consumption expenditure has slipped from its 7 percent peak last year, but remains above its … 2 percent target … There is still significant room for improvement.”

A major problem remains with a key indicator for the Fed — inflation expectations. The Fed and the BOC worry about inflationary expectations getting “embedded” with the consumer. There are difficulties with measuring expectations but there are anecdotal signs that the consumer is close to adapting to a higher inflation environment, confirming the worst nightmare of central bankers.

Once inflation becomes normalized it becomes much harder to get CPI down to the 2 percent target.

Watch both the Fed and the BOC continue to struggle as they fight rising inflation expectations.

Hilliard MacBeth

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Richardson Wealth or its affiliates. Assumptions, opinions and estimates constitute the author’s judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them, having regard to their own particular circumstances.. Richardson Wealth is a member of Canadian Investor Protection Fund. Richardson Wealth is a trademark by its respective owners used under license by Richardson Wealth.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Hilliard MacBeth June 9th, 2023

Posted In: Hilliard's Weekend Notebook

Next: Mission Accomplished? »