June 20, 2023 | Monetary Policy Magnifying Economic Downturn Most in Decades

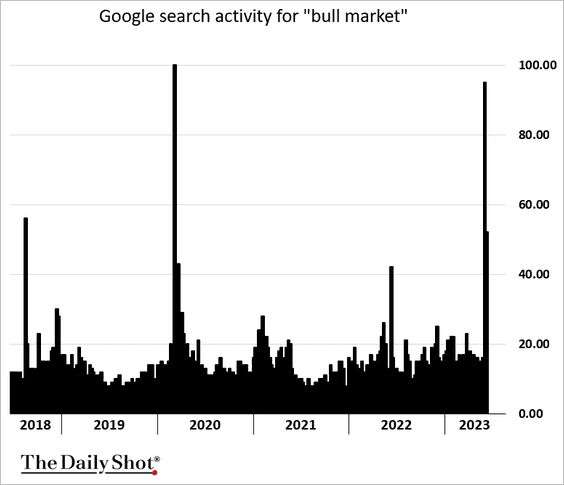

The latest rebound in equity prices has pulled the S&P 500 and Canada’s TSX back to levels seen two years ago in June/July 2021. In the process, bullish sentiment among professional and retail participants is back to the highest readings since November 2021, and the spike in Google searches for “bull market” (below, since 2018, courtesy of The Daily Shot) speaks volumes.

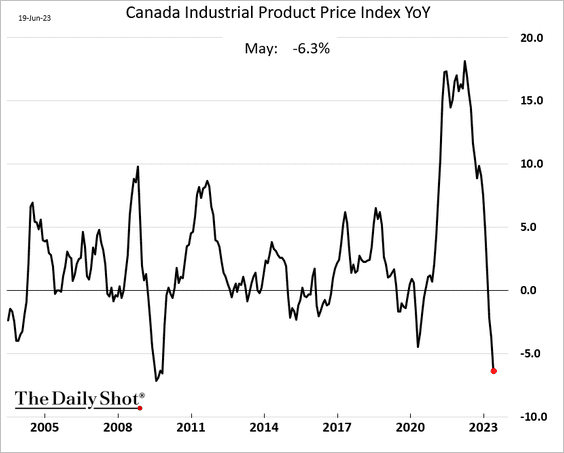

At the same time, in the real economy, Canada’s Producer Price Index (PPI) for May contracted 6.3% year-over-year and the sharpest decline since 2008 (below courtesy of The Daily Shot). Similar downtrends are evident in other major economies.

This is relevant because the PPI has led Consumer Price Inflation (CPI) at a lag of about three months (below, since 2009) and suggests that CPI should drop sharply in the second half of 2023.

Falling demand on credit contraction is a well-established disinflationary force. But how long will central banks leave policy rates at 16-year highs to fight last year’s inflation problem?

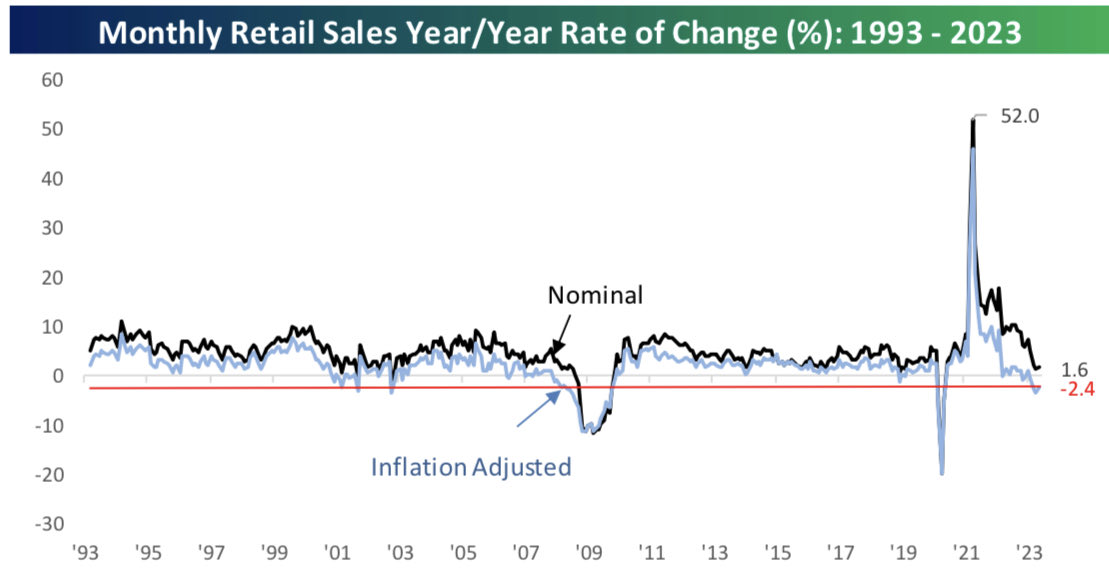

As shown below, via Bespoke, US monthly real retail sales have been negative year-over-year for four months, which hasn’t happened since the 2008 recession. Going back to the 1950s, a contraction in US Real Retail Sales led to a recession in all cases except 1967.

Central banks were starting to ease credit conditions at this point in past economic downturns. Today they say they do not plan to do so for the foreseeable future. Tough talk is due to be tested. EPB’s Eric Bamajian lays out timelines in Three Sequential Signals of Recession. We’re well and duly warned:

The recession is virtually assured, but most investors and the Fed still can’t see it or refuse to believe it.

Only when Signal #3 comes does the Fed panic and investors give up as the waves of job losses create defaults and deflationary pressure.

With the Leading Index deeply negative and the Coincident Indexes below 2%, we have a sustained Signal #2.

This signal was triggered five months ago, and the average recession starts six months after getting a Signal #2.

Policy should be easing already as a result of this, but the Federal Reserve is still raising interest rates targeting lagging economic indicators.

Monetary policy has never been this opposed to the business cycle signals in the last 50 years.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Danielle Park June 20th, 2023

Posted In: Juggling Dynamite

Next: What You Get When You “Play Big »