May’s US CPI at 4%–the lowest since March 2021–has increased the prospects of a Fed pause tomorrow; a July hike remains possible. But as I’ve pointed out for months, pauses are not bullish; historically, they’ve preceded the steepest part of economic and market downturns.

The good news for consumers (but not corporate profits) is that recessions are typically disinflationary and deflationary. The 19.3% drop in the price of critical commodities (CRB Index below) over the past year is headed in that direction. Further mean reversion is typical as rising unemployment crimps demand.

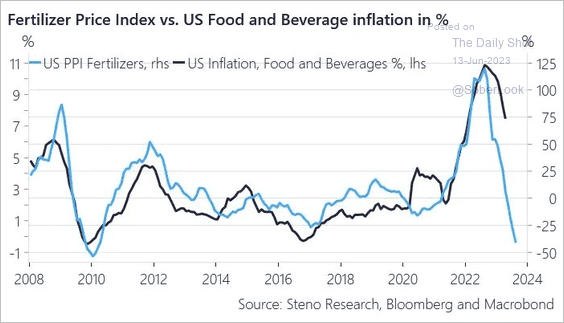

So far, from its 2022 peak, oil (WTI) is -44%, gasoline -20%, nickel -57%, copper -23%, aluminum -47%, and lumber -77%. Food inflation was still 5.8% year-over-year in May, but as shown below, since 2008 (via The DailyShot), fertilizer prices are leading food inflation lower into 2024—some much-needed relief for the masses.

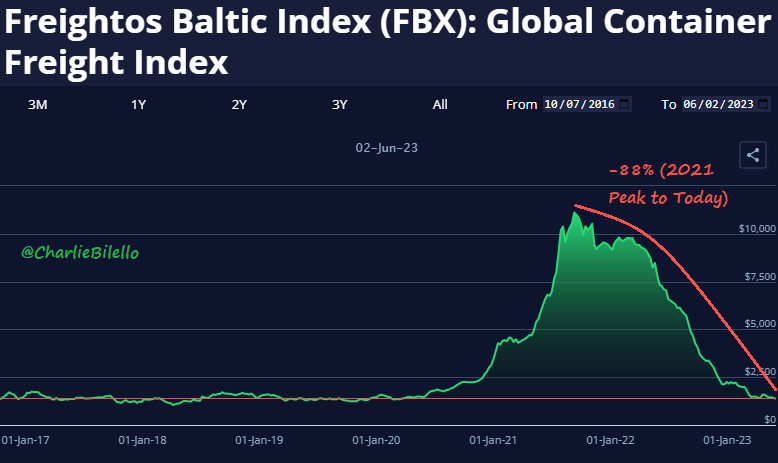

Further supporting disinflationary trends, shipping costs–the Baltic Global Container Freight Index–are -88% since 2021 (below since 2012 via Charlie Bilello) and have given back all of their COVID inflation.

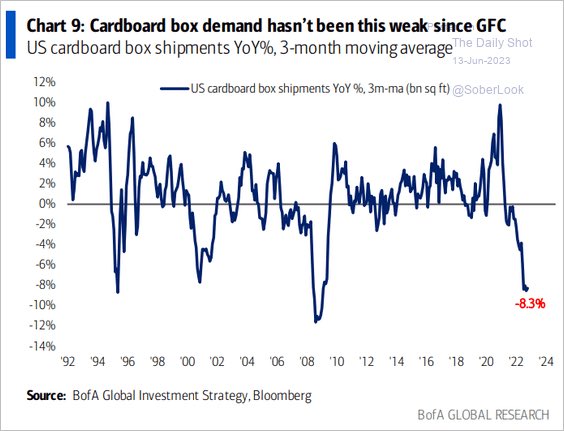

The 8.3% year-over-year decline in US cardboard box shipments is the steepest decline since the 2008 recession (shown below since 1992).

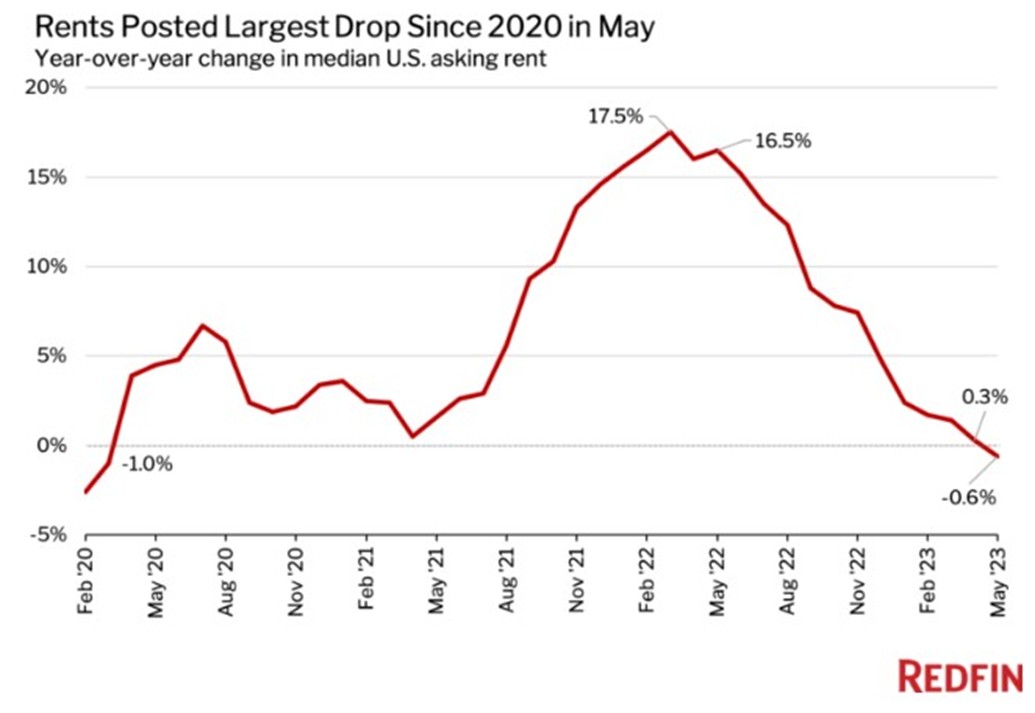

Housing costs continue to weigh on increasingly stressed households–a headwind for consumption-dependent economies. Most homes are presently unaffordable for the majority of would-be buyers and renters. That said, the cure for high prices is high prices, and wildly-inflated housing has earned an extended downcycle. As shown below, since 2020, the year-over-year drop in US median asking rents in May was the sharpest since 2020. More of this is needed–but moving in the right direction.