Geopolitical events can move markets, if only temporarily. Crises on a world scale frighten investors, causing them to make hasty decisions that can be harmful to their financial success.

Could a geopolitical event cause investor panic?

The history of geopolitical events shows that markets can survive most events without much trouble.

For example, a shocking event was the assassination of President Kennedy on Friday, November 22, 1963. The stock market plunged immediately following the news of the shooting but recovered sharply the next trading session.

The biggest recent event would be the September 11, 2001, terrorist attack on the World Trade Centre and the Pentagon. Markets were closed for the week following the attack but by mid-October stock market averages recovered to their previous levels that prevailed prior to the attack.

The Bank for International Settlements wrote a report on that event, noting how resilient markets were after the September 11 attack. The stock markets were in a bear market at that time, and markets did not bottom until about a year later, as the overvaluation of many market leaders was erased. But the terrorist attack itself appeared to have little long-term impact on the markets.

In 2023 the list of potential market-moving geopolitical events is long. The war between Russia and Ukraine heads the list. If Russia attacks a NATO country that is helping Ukraine, there would likely be more direct U.S. involvement in the war. Russia could make more convincing threats to use nuclear weapons, especially if Ukraine tries to reclaim Crimea.

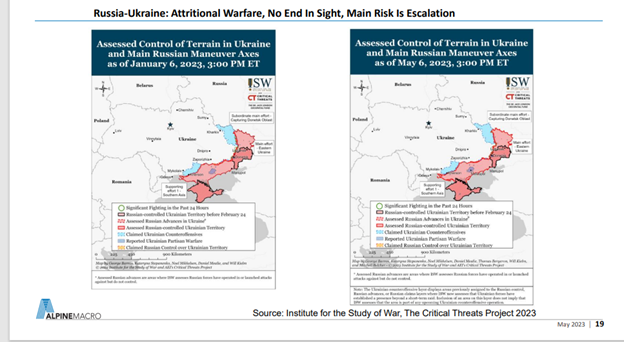

The war has reached a stalemate:

China and the U.S. are making threats over Taiwan and the rivalry between them is heating up. With an election in 2024 the U.S. presidential candidates are likely to make noise about hurting China in various ways, but no action is likely. If China invaded Taiwan, there would be an international crisis and possibly a war as the U.S. pact with Taiwan is triggered. There are many points of conflict between China and the U.S. over trade, tariffs and investments, any of which could come to a boiling point.

Investors outside of China are starting to wonder if China is too risky for investment but the conflict between China and the U.S. will be around for decades and investors cannot afford to ignore China.

China and Chinese companies sell goods to U.S. consumers and, as a result, build up U.S. dollar reserves which are invested in U.S. securities. The threat that China might decide suddenly to sell those holdings has been around for years. It may get more publicity with the concern about default over the debt limit. But there are few investment and currency alternatives for those funds. The U.S. dollar will remain the world’s trading currency.

Investors need to invest based on market valuations and the impact of higher rates and inflation which are still not discounted in the markets. Geopolitical events are not as important as the fundamentals over the long term.

Hilliard MacBeth

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Richardson Wealth or its affiliates. Assumptions, opinions and estimates constitute the author’s judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them, having regard to their own particular circumstances.. Richardson Wealth is a member of Canadian Investor Protection Fund. Richardson Wealth is a trademark by its respective owners used under license by Richardson Wealth.