April 29, 2023 | Trading Desk Notes For April 29, 2023

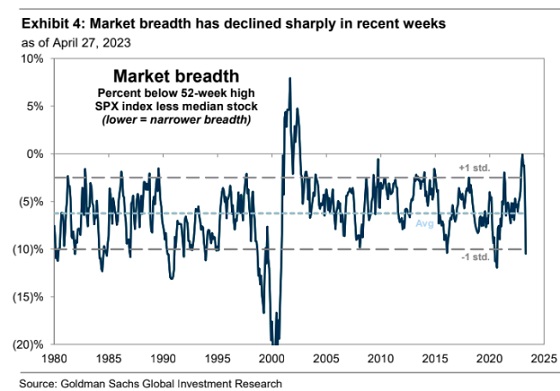

Without Megacap tech, stock indices have gone nowhere

The broad stock market indices tumbled to new April lows Tuesday and Wednesday, but a strong surge on Thursday and Friday, fuelled by soaring Megacap tech, lifted the indices to new highs for the month. The Nasdaq 100 had its best monthly close since March 2021, with MSFT up ~40% YTD and AAPL up ~36%. Those two stocks account for ~26% of the cap weight of the Nasdaq 100 index.

The S&P is up ~9% YTD, with MSFT and AAPL accounting for ~50% of that increase. Add in GOOG, AMZN, TSLA, META, and NVDA, and those seven Megacap tech stocks account for ~90% of the S&P YTD gains. In other words, without the contribution from the tech sector, the broad stock market has gone nowhere.

The DJ Transports Index, which has no Megacap tech stocks, fell to nearly four-month lows on Wednesday (UPS disappointed) and had a half-hearted bounce back Thursday/Friday to close April up ~5% YTD.

The market is not (totally) bifurcated between Megacap tech winners and “everybody else” losers; for instance, XOM registered its highest-ever monthly close, up ~4X from its 2020 lows when it was removed from the DJIA.

Volatility metrics fell to the lowest in over a year as stock prices rallied.

The most anticipated recession ever

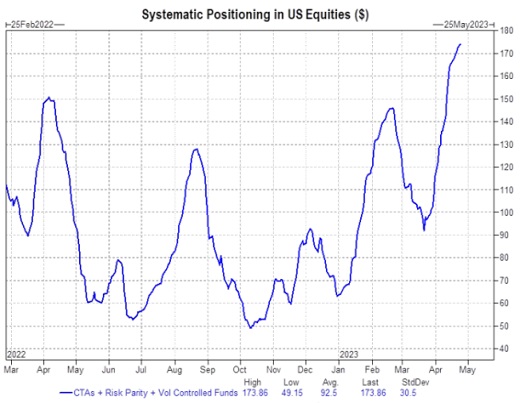

Investor sentiment, and thus positioning, coming into this week was defensive. Investors and analysts had good reasons to be defensive, including a hawkish Fed and a looming recession. A fresh round of “banking concerns” early in the week reinforced defensive/bearish sentiment, and the major indices fell to new lows for the month.

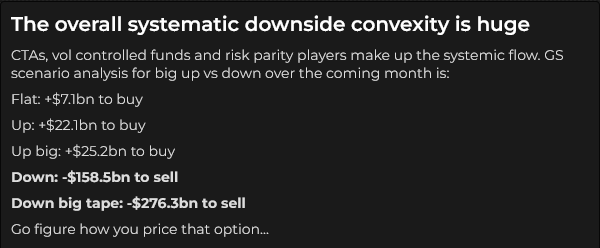

This scenario from Goldman Sachs (Monday/Tuesday) exemplifies the potential selling from “systematic” (CTAs, Risk Parity, Vol control) accounts if the market kept falling (they were all heavily long and would have to sell if the market collapsed.)

But sentiment started to turn with two days to go before month-end. The “pain trade” for defensively positioned portfolio managers was seeing the market, and particularly Megacap tech, rally into month-end. The strong month-end rally looked like short-covering and FOMO buying from PMs who could not afford to be under-weight (let alone short!) Megacap tech. It is also possible that “AI” is suddenly “the new kid in town,” and everybody wants a “piece of the action!”

Alternatively, suppose you were a technical analyst only concerned with price action. In that case, you might see this week’s dip to new monthly lows as a false breakdown, with the strong Thursday/Friday rally (to the highest weekly close since August 2022) signalling a continuation of the rally that began last October.

The “pain trade” and the “Max pain trade”

The “pain trade” for defensively positioned investors, and especially for bearishly positioned investors, would be a rally. The “Max pain trade” for those folks would be if they reverse their positioning on FOMO decisions, only to have the market plunge after they “throw in the towel.” (The Max Max pain trade for nearly everybody would be if the stock market fell and kept falling!)

FOMC Tuesday and Wednesday

The ISM manufacturing report is due Monday, and employment reports (for Canada and the USA) are due Friday, but the FOMC decisions and press conference on Wednesday will be the Big Event of the week. The Fed is expected to raise rates by another 25 bps, but will they signal a pause or more increases to come? Inflation has come down from its highs but is still well above the Fed’s target; can the Fed get inflation down without a recession? Will the Fed keep tightening into a recession? The banking sector and commercial real estate have shown the consequences of sharply raising interest rates after a decade of near-zero rates – who next?

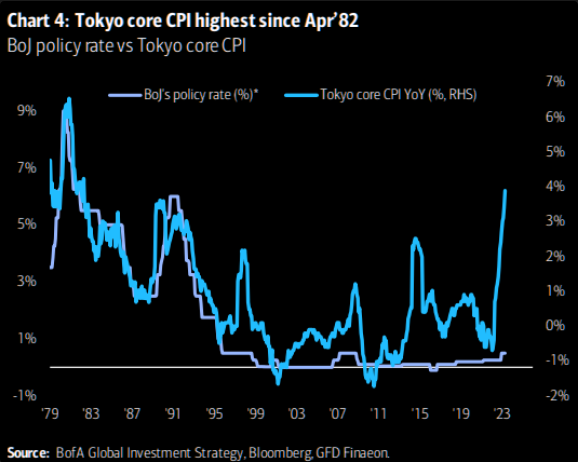

Japan

Despite rising inflationary pressures, the BoJ surprised markets Thursday night with “no change” to their monetary policies. The Yen fell like a stone, and the stock market soared.

Stagflation?

Q1/23 GDP was +1.1% (Q4/22 was 2.6%), while PCE core inflation was 4.9%. Inflation-adjusted consumer spending was 3.7%, supported by 4.8% YoY wage gains. The pre-pandemic average was 2.2%. (Unemployment across G7 countries is at ~50-year lows.) New home sales are robust, with prices near record highs and affordability near record lows (it’s a SUPPLY problem.)

Inflation will remain high

The purchasing power of virtually all currencies continues to fall (see this website for a terrific interactive inflation calculator). This will continue as long as government deficits continue to grow. Traders and investors need to decide, over different time horizons, how to benefit from a continuing decline in the purchasing power of their currencies.

Thoughts on trading

I’ve traded for my own account since my university days, and after retiring from the brokerage business in 2020, I was looking forward to trading as a full-time endeavour.

In my early days in the commodity brokerage business (the 1970s and 1980s), it seemed that most commodity traders aimed to turn $10,000 into a million as quickly as possible. Real Men weren’t afraid of margin calls; their trading plan was “Got a hunch? Bet a bunch!”

In 1983 and 1984, I was the currency analyst at Conti (one of the largest commodity brokerage firms at that time). I traded my own accounts aggressively – margin requirements were frequently more than the trading capital in my accounts – but I generated great returns – for a year or so and then, not so much!

One of my favourite “lines” at public speaking events was that I had watched hundreds and hundreds of brokerage clients lose millions and millions of dollars. The one thing they had in common was an unwillingness to limit their losses. Some people would over-trade (in size and frequency), and others would refuse to use stops – if the market went against them, they would say, “We need to give it a little more time.”

I knew the “stats” that 90%+ of commodity clients lost money, so I resolved to do the opposite of what they did. I would refuse to believe stories (“Copper is going to the moon because of electrical demand”), and I would be willing to admit that I was wrong about any trade I made and manage my risk accordingly. I would trade small enough size never to have a margin call, and no trade would ever be “important.”

I also understood that being a commodity broker was NOT good training for being a trader. Before online trading changed everything, commodity brokers sat in front of their screens, watching markets all day, every day. They got paid every time their clients made a trade, so they had a “tendency” to over-trade. (Many successful traders say watching your screen all day is a great way to lose money! Peter Brandt says that ALL of the money he made trading his own accounts for over forty years came from ~15% of his trades – that a trader’s most important job is to not “fritter” away his winnings by mismanaging the other 85% of his trades!)

I also understood that successful traders are as different from one another as chalk is from cheese – but the one thing they have in common is that they have found a way to trade that suits them.

I’ve experimented with my trading “time horizon” over the past couple of years – I’ve day-traded – but I find that what suits me is a swing trading time horizon of a few days to a few weeks. That gives my tendency to have a “bias” about a market time to “work” and frees me from constantly sitting in front of my screens. I use my “bias” to decide whether to be long or short; I use charts to time entries and exits and to manage risk. I trade much smaller sizes, relative to my equity, than I did when I was younger.

My short-term trading

I started this week short the CAD and the S&P. I had sold the CAD two weeks ago and stayed with the trade, moving my stop lower as the CAD dropped. I covered the position on Wednesday for ~150 points – one of my best individual trades this year.

I had been shorting the S&P on-and-off the past two weeks, trying to position for what I thought could be a 100+ point drop. I had several small wins and losses, with the net result being a slight loss. The trade I put on last Thursday never went against me, but I covered it for a 50+ point gain Wednesday when the market seemed to lose downside momentum.

I did nothing Thursday as the markets reversed sharply higher, but I did try to top pick the S&P near the close on Friday. I took a tiny loss and went home flat.

On my radar

After the strong stock market rally Thursday/Friday, I expect it will open higher Monday (barring an exogenous surprise.) Then its get’s interesting. If the market remains bid, I may try to get long (“try” means find a good entry point instead of making a FOMO buy.) If the rally fades quickly, I may try to get short. The Wednesday FOMC meeting may cause short-term traders to de-risk, so buyers of the Thursday/Friday rally may turn sellers.

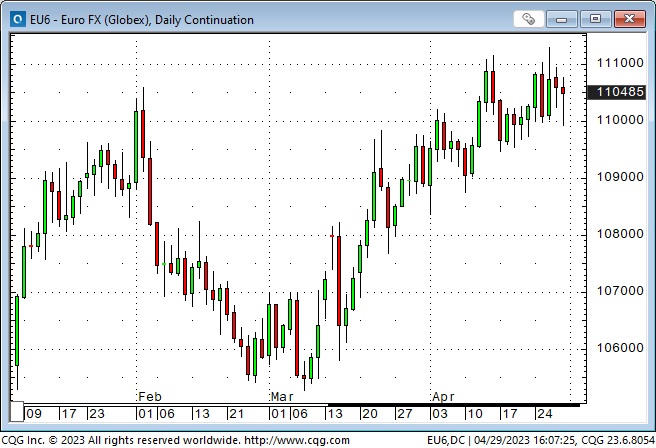

I’m watching the Euro and gold, which have rallied as an “Anti-dollar” trade. Are those trades getting tired?

The Barney report

The weather has turned warmer and drier, and Barney loves the forest trails. I let him run off-leash, and he takes full advantage of the freedom to explore the terrain. He loves to jump up on a log and run back and forth on it with the agility of a squirrel.

The Archive

Readers can access weekly Trading Desk Notes going back five years by clicking the Good Old Stuff-Archive button on the right side of this page.

Listen to Victor talk about markets

I’ve had a regular weekly spot on Mike Campbell’s extremely popular Moneytalks show for >22 years. You can listen to us talk about markets on April 29 on the Moneytalks podcast. Our session starts around the 1.09-minute mark.

Oceanside Special Olympics Charity Golf Tournament at Pheasant Glen golf course June 10, 2023

This event is the only annual fund-raiser for the 50 special needs kids in the Oceanside area of Vancouver Island. If you’d like to play in this event (my team in the photo) or donate money to a worthy cause, click this link.

Headsupguys

I support Headsupguys because I’ve had friends who took their own lives, and Headsupguys helps men deal with depression. If you have a struggling friend, check out Headsupguys, and talk with him.

Headsupguys has had over five million hits on its website, and over a half million men have taken the self-check. Most men who click on the website do so after midnight their local time. Headsupguys save lives.

Subscribe: You have free access to everything on this site. Subscribers receive an email alert when I post something new – usually 4 to 6 times a month.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Nothing on this website is investment advice for anyone about anything.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Victor Adair April 29th, 2023

Posted In: Victor Adair Blog