April 15, 2023 | Trading Desk Notes For April 15, 2023

Who’s going to be right, and who’s going to be wrong?

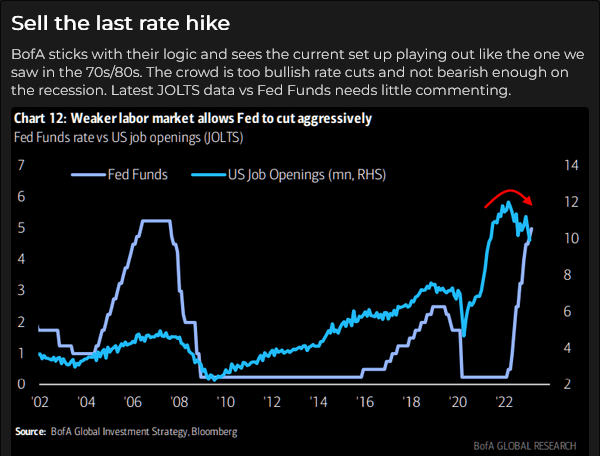

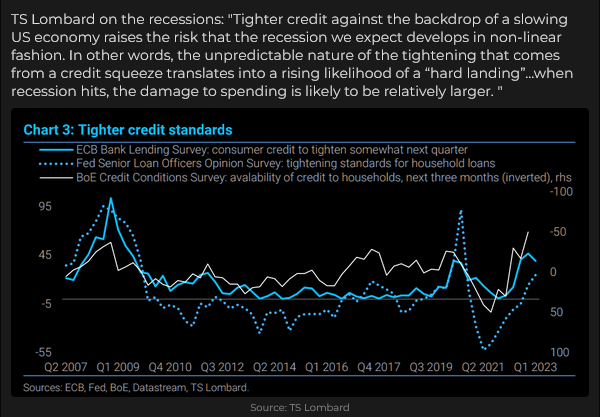

Federal Reserve speakers continue to deliver “mixed messages” about future Fed activities/policies. Some speakers have been calling for a “pause,” while others (most recently, FOMC Governor Chris Waller) believe monetary policy needs to be tightened further. On Friday, Waller said, ” Because financial conditions have not significantly tightened, the labor market continues to be strong and quite tight, and inflation is far above target, so monetary policy needs to be tightened further. How much further will depend on incoming data on inflation, the real economy, and the extent of tightening credit conditions. Another implication from my outlook and the slow progress lately is that, as of now, monetary policy will need to remain tight for a substantial period of time, and longer than markets anticipate.“

The S&P and the DJIA hit 8-week highs before Waller’s comments; the DJIA then fell ~350 points to a mid-day low but rallied back later in the day. The DJIA closed the week ~2,450 points (8%) above the mid-March “banking crisis” lows, its highest weekly close since February 3.

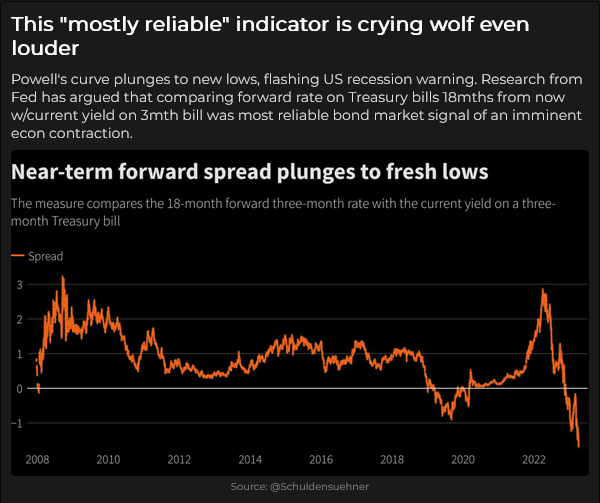

The forward markets are pricing a >80% chance that the FOMC will raise rates 25 bps at their scheduled May 2&3 meeting (to over 5% for the first time since 2007) but will cut rates by ~50 bps by December 2023 and by an additional ~130 bps by December 2024. Fed Governor Powell (and other FOMC members) maintain that the Fed will not cut rates this year.

The December 2023 SOFR contract was pricing ~5.5% following Powell’s hawkish congressional testimony on March 7&8; five days later, following SVB, the rate was ~3.5%; at Friday’s close, it was ~4.4%, with June 2023 ~5.05%.

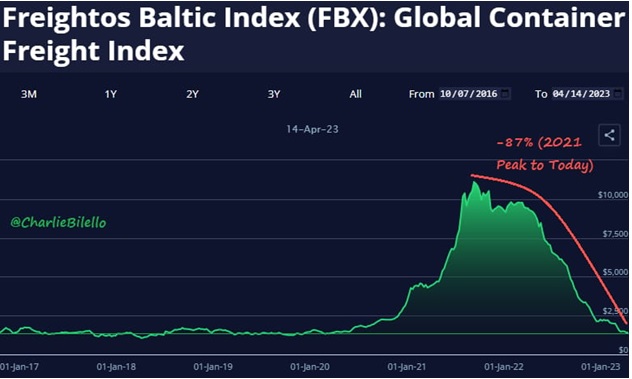

Economic data show that the US economy is slowing, and this week’s CPI and PPI show that inflation is moderating, although YoY core CPI remains at 5.6%. Various other metrics show inflation falling.

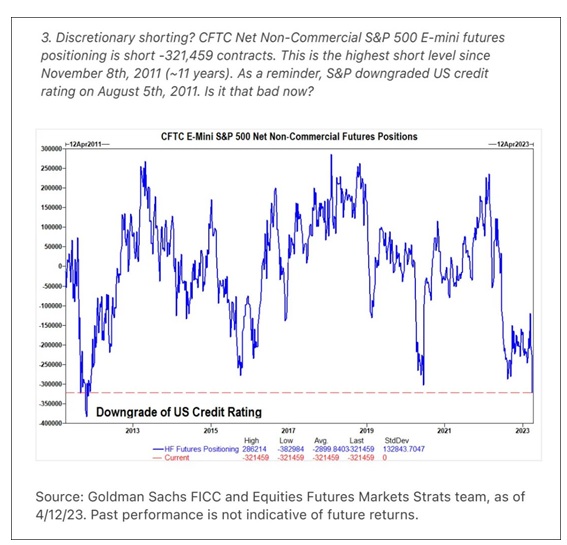

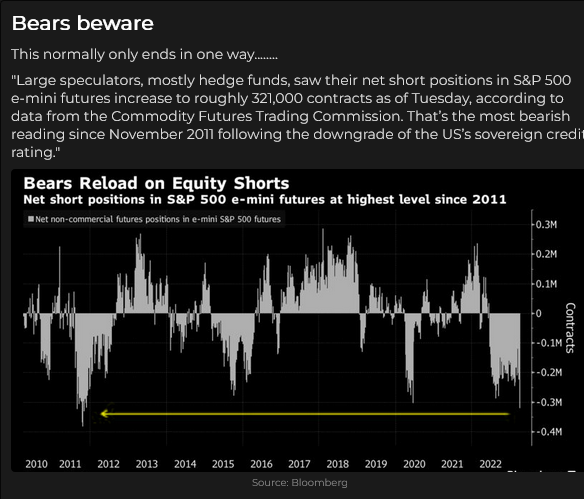

Some folks believe a recession is looming, which will cause stock indices to fall. It appears (from surveys of buy-side participants and positioning metrics) that these folks are currently net short stock indices (hedging portfolios or outright short) in a BIG way. Other folks seem to be laser-focused on the prospect of the Fed cutting rates (falling inflation and looming recession) and are buying stock indices. The buyers seem to be right since the DJIA has been up ~2,500 points in the past month!

Volatility has fallen across equity, credit and currency markets since the spike high one month ago during the “banking crisis.” Stock market Vol is near a 1-year low; the VIX closed this week at a 15-month low.

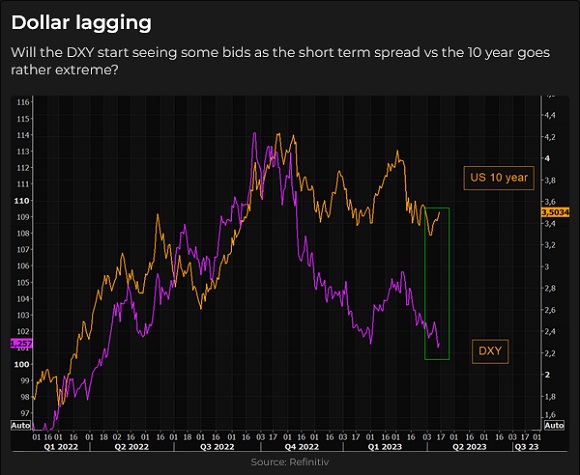

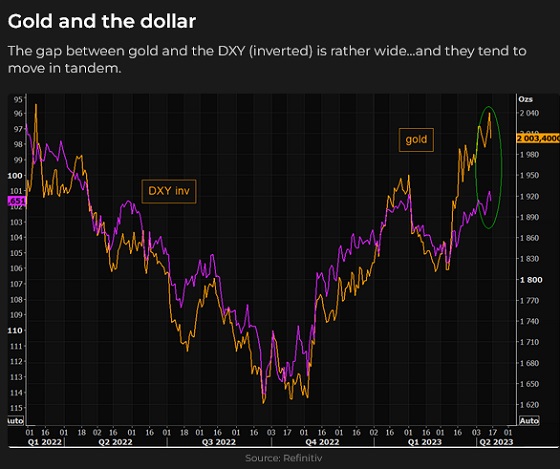

The USDX hit a 3-month high following Powell’s hawkish congressional testimony in early March but fell ~5% to this week’s lows.

The USDX hit a 20-year high in late September 2022 after rising ~28% in the prior 15-month period. Approximately 70% of that rally came after the Russian invasion of Ukraine while the Fed raised interest rates aggressively (capital comes to America for safety and opportunity.)

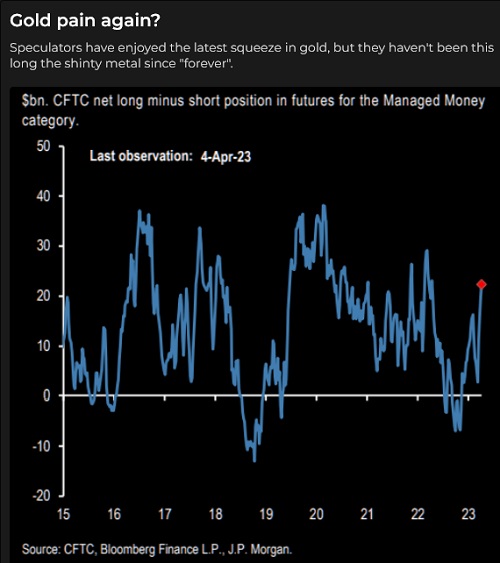

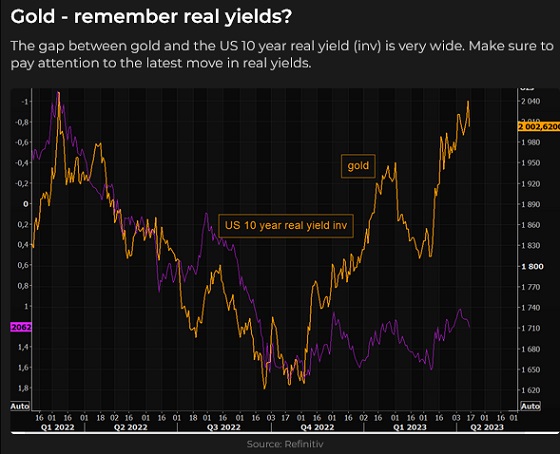

Gold hit a high of ~$2,060 on Friday – the highest price since the Russian invasion, but fell back >$50 by the close. Gold has rallied ~$400 (~24%) in the last five months. Silver has rallied ~$6 in 6 weeks (30%) to hit a 1-year high this week of ~$26. (My friend Martin Murenbeeld points out that the All-Time inflation-adjusted high price for gold was $3,289 on January 21, 1980.)

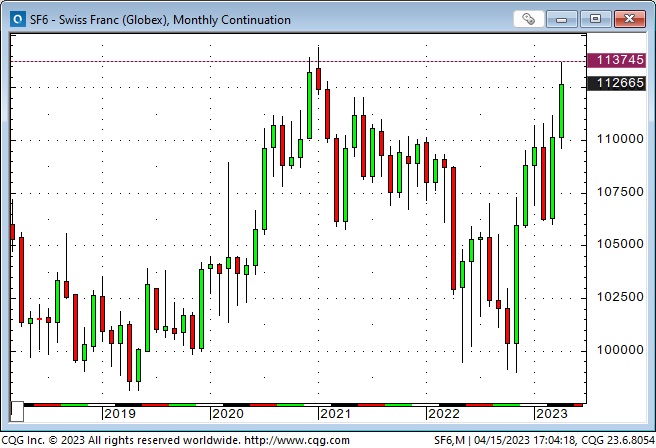

The Swiss Franc hit a 28-month high against the USD this week. Interest on bank deposits in Switzerland is ~0.50%, so capital isn’t going there to earn a great return!

The CAD traded above 75 cents on Friday for the first time in 2 ½ months – up from a ~72-cent low following Powell’s testimony in early March. Net speculative short positioning in CAD futures on the CME remains at multi-year highs. The forward markets see Canadian s/t interest rates falling ~30bps between June and December, even as BoC Governor Macklem cautions that’s not likely to happen.

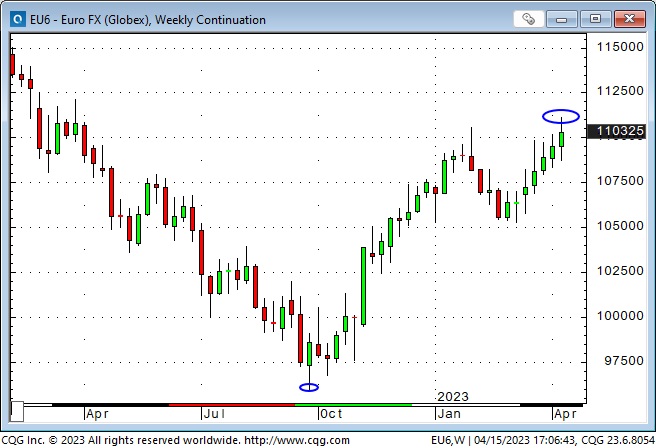

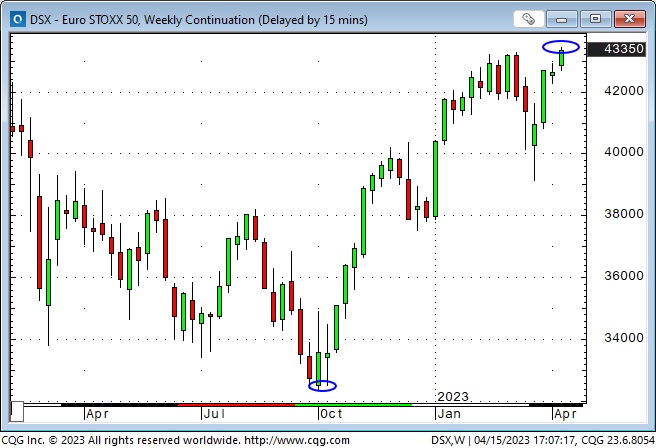

The Euro currency made a 20-year low, and the Euro Stoxx Index made a 2-year low in October 2022. (The war in Ukraine and the prospect of Europeans freezing in the dark during the coming winter due to the “energy crisis” negatively impacted sentiment.)

The EUR has rallied ~16% from last October’s lows, and the Stoxx has rallied ~34%. If an American had converted USD into EUR to buy the Stoxx in October, sold that position this week, and converted the Euros back to USD, he’d have a gain of ~50%. If he had purchased the S&P at the October lows and sold it this week, he’d have gained ~17%.

American stock indices hugely outperformed other countries’ stocks for the decade leading up to October 2022. The combination of a super-strong USD and cheap foreign stock indices (cheap relative to American indices) set up an opportunity for capital to flow to perceived bargains in other markets last fall.

Capital flowed from the USA to Europe for the last 6+ months; the Euro and Eurozone stocks rose. Now what?

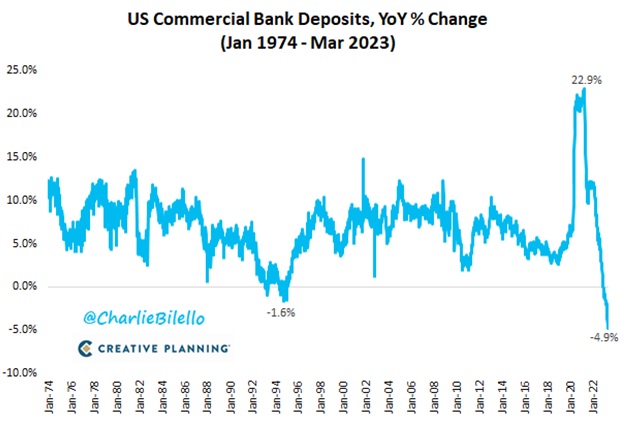

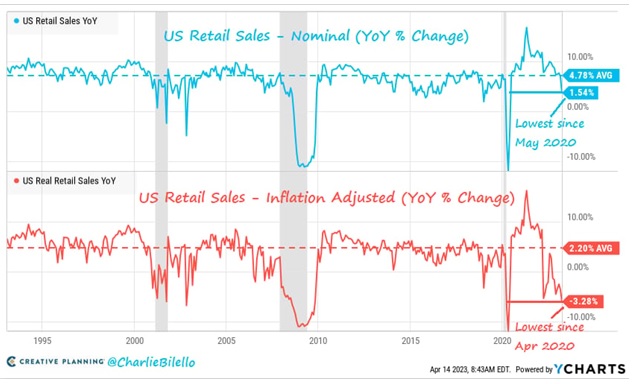

Consumer spending is ~70% of the American GDP, and consumers appear to be struggling

There’s an old expression, “Never bet against the American consumer,” because they will keep spending no matter how “bad” the economy gets!

Well, maybe.

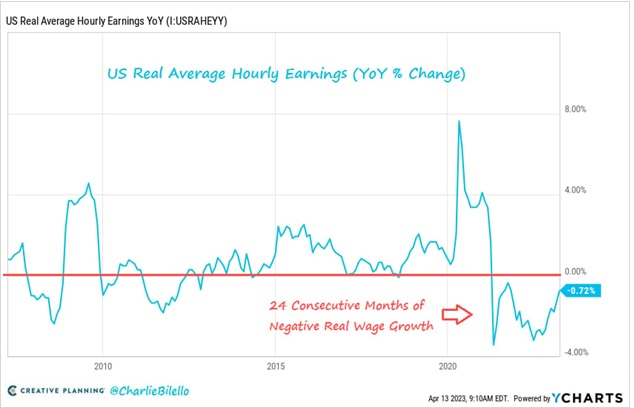

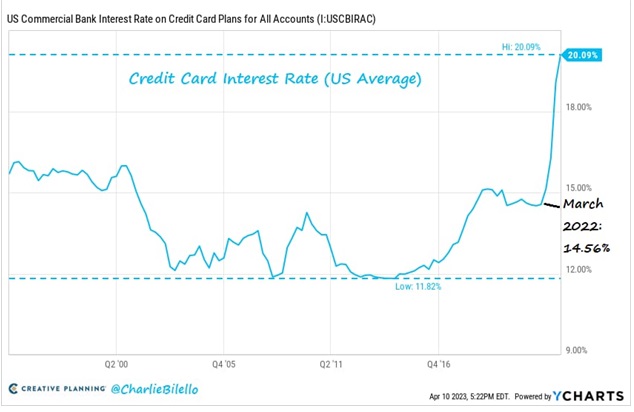

Here are three charts from Charlie Bilello’s latest weekly report that make me wonder if American consumers are close to “running on empty.” (I highly recommend Charlie’s free weekly service.) Charlie reports that ~80% of new car purchases are financed and that the average monthly car loan payment is now a record high of $770 – nearly double what it was in 2019. The reason? Higher car prices and higher interest rates.

Nominal retail sales have been soft. Inflation-adjusted retail sales look horrible.

A tight labour market means labour is in the driver’s seat when negotiating higher pay. But wages aren’t rising as fast as prices.

Not paying off your credit card every month is getting expensive!

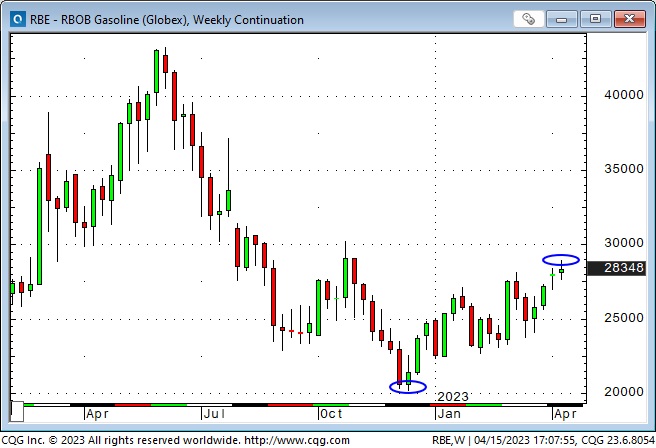

Wholesale gasoline prices are up ~45% from December lows – more pressure on consumers.

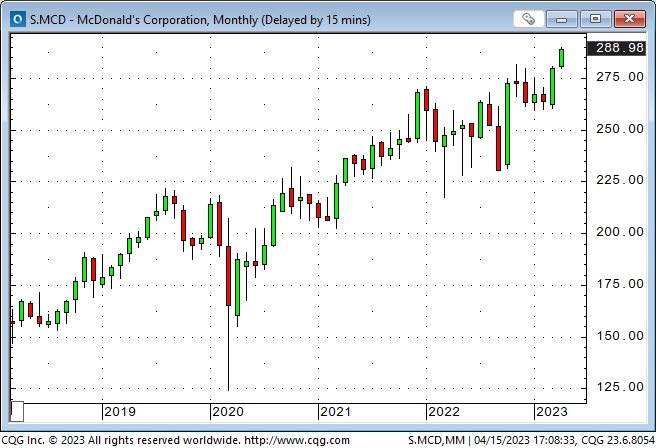

Given that American consumers are under pressure from rising prices and rising interest rates, where do you think they go to eat?

Different kinds of inflation

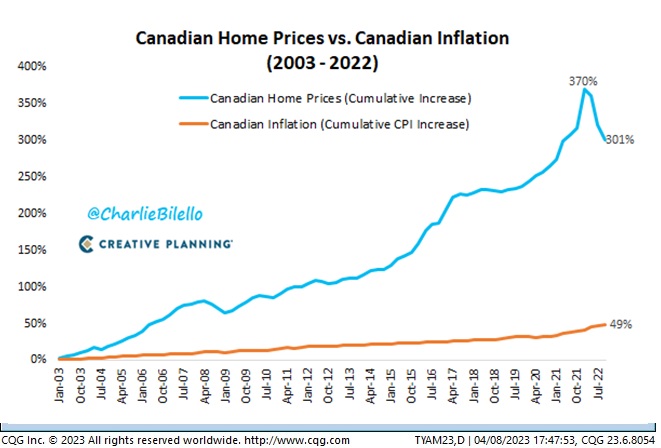

Stock and real estate markets made HUGE gains from 2009 to 2021 (while interest rates remained near zero), and we called it “asset inflation,” while CPI drifted along at a ~2% annual rate. But following the “Covid crisis,” CPI soared while stock and real estate markets weakened. Inflation “alarm bells” rang loudly, and Central Banks worldwide raised interest rates aggressively to “fight inflation.”

My short-term trading

I started this week short CAD and S&P – positions I took before the Easter long weekend.

I thought if the S&P broke support around 4,100, it would build downside momentum, but it tested that level on Monday and bounced (again!), so I took small profits and went to the sidelines.

I shorted CAD last Tuesday and was ~50 points ahead on the trade going into the weekend. The market traded lower Monday but then rallied for the rest of the week as the USD weakened and stocks rallied. Since I’ve been trying to lengthen my trading time horizon (stay with winning trades longer), I left my stop unchanged and was stopped for a slight loss on Thursday.

The S&P rallied to new highs for the week on Wednesday on the weaker-than-expected CPI, then started to fall, and I re-shorted it but was stopped for another slight loss when it rebounded Thursday.

I shorted both S&P and CAD Friday following Waller’s “higher for longer” comments and was nicely ahead on both positions at mid-day, but I covered the S&P at breakeven when it rallied back in the afternoon and stayed short CAD into the weekend.

My bias this week was that “risk assets” (particularly S&P and CAD) were vulnerable to a breakdown (Fed interest rate stubbornness in the face of growing recessionary signals). Still, I had to respect the strong upside momentum and keep my stops tight.

On my radar

The USDX hit a 1-year low this week and reversed Friday. Speculative sentiment and positioning are heavily bearish on the USDX, and I’ll watch price action for an opportunity to buy USD.

The price action in gold and silver on Friday could signal a correction. If the USD strengthens and real interest rates increase, I may short gold or silver.

My bias is that there will be a recession, likely triggered by consumers “pulling in their horns,” and that stock indices and risk assets will fall. I’ll look for price action to confirm.

Earnings season started this week (with JPM reporting solid earnings – the shares jumped) and will continue for the next few weeks. If important companies are cautious about the future, the indices may weaken.

The Barney report

Barney and I were home alone on Masters Sunday. Barney picked Rohm to win; I picked Koepka. Smart dog!

The Archive

Readers can access weekly Trading Desk Notes going back five years by clicking the Good Old Stuff-Archive button on the right side of this page.

Listen to Victor talk about markets

I’ve had a regular weekly spot on Mike Campbell’s extremely popular Moneytalks show for >22 years. You can listen to us talk about markets on April 15 on the Moneytalks podcast. Our session starts around the 58-minute mark.

I recorded a 30 interview with Jim Goddard on April 8 for This Week In Money. I talk about my Big Picture view of what impacts all the markets (changing Fed policies) and drill down to several specific markets. You can listen here.

Oceanside Special Olympics Charity Golf Tournament at Pheasant Glen golf course June 10, 2023

This event is the only annual fund-raiser for the 50 special needs kids in the Oceanside area of Vancouver Island. If you’d like to play in this event (my team in the photo) or donate money to a worthy cause, click this link.

Headsupguys

I support Headsupguys because I’ve had friends who took their own lives, and Headsupguys helps men deal with depression. If you have a struggling friend, check out Headsupguys, and talk with him.

Headsupguys has had over five million hits on its website, and over a half million men have taken the self-check. Most men who click on the website do so after midnight their local time. Headsupguys save lives.

Subscribe: You have free access to everything on this site. Subscribers receive an email alert when I post something new – usually 4 to 6 times a month.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Nothing on this website is investment advice for anyone about anything.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Victor Adair April 15th, 2023

Posted In: Victor Adair Blog