April 19, 2023 | Recession Watch: Cars and Houses Join The List

Banks were already tightening lending standards before Silicon Valley Bank imploded. This chart is from Q4 2022:

Since then the tightening has become a full-fledged rout. It’s now much harder to get a mortgage or a car loan, especially for less-credit-worthy borrowers in overheated markets.

Meanwhile, interest rates are rising again, with the average 30-year fixed-rate mortgage jumping from 6.3% to 6.43% in the past week. This cut mortgage demand from homebuyers by 10%, while refi applications are now 56% lower than they were a year ago.

Realtor Redfin reports that the median U.S. home price is down by 3.3% year-over-year, to a (still ridiculously high) $400,258. That’s the biggest decline in 11 years. And it’s much worse in formerly hot markets like Boise, Idaho (-15.4%) and Austin, Texas (-13.7%). Overall, new listings fell 23.3% in March as sellers adjust to the sudden reversal in price trends.

In another sign of the times, online real estate company Opendoor just laid off 22% of its staff.

Subprime Auto Crash

But housing’s orderly retreat pales next to the panic in sub-prime auto lending. This, readers might recall, was one of the mini-bubbles that got mentioned frequently during analyst diatribes about the “everything bubble.” To say that it’s now bursting would be to understate the case. Some data points (courtesy of the CarDealershipGuy Twitter feed):

- Capital One recently closed all credit lines for auto dealers.

- USA Auto Sales shut down 39 dealerships after losing its credit line from Ally Bank.

- Wells Fargo laid off all its junior auto loan underwriters and dramatically tightened its lending standards.

- Moody’s downgraded a big subset of subprime auto bonds after the underlying loans started to deteriorate.

Wolf Richter, who’s also doing a great job of covering the commercial real estate death spiral, posted some of subprime auto lending’s vital statistics. They are shocking:

Because specialized subprime is the slimy underbelly of the auto business, it always gets a lot worse when you look at it more closely. According to a report by Kroll Bond Rating Agency, cited by Bloomberg, the loans in the ABS issued in 2022 had:

- Average FICO score of 518 (620 and below is normally subprime)

- Average LTV (loan-to-value ratio) of over 150% holy-moly!

- Average loan amount: $20,199. With 150% LTV, it means the vehicle was worth $13,500 at the time of the sale.

- Average interest rate: 18%.

In short, if you wanted to design auto loans to blow up and do a lot of damage, that’s how you’d do it.

And it’s only getting worse for banks

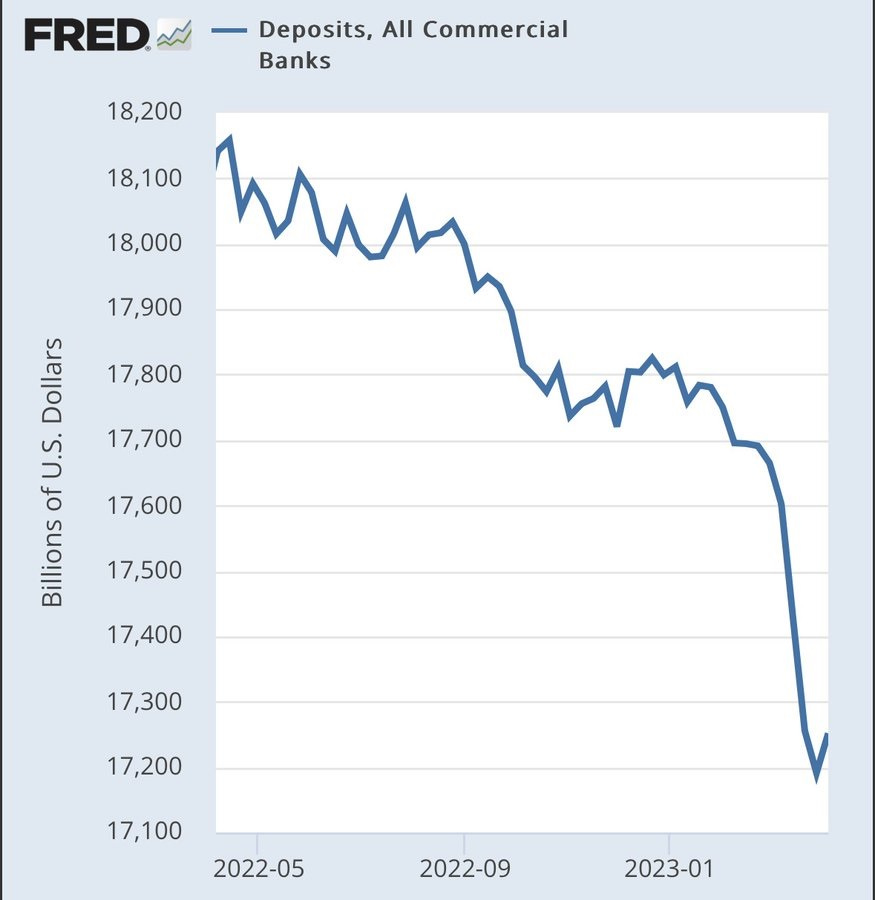

Deposits have been fleeing regional and local banks since Silicon Valley Bank died.

And now Apple is muscling in on banks’ turf by offering a savings account paying 4.15%, which is way more than what most banks currently pay.

Is anything not imploding?

Soaring debt in the face of high interest rates is (obviously!) a recipe for disaster. So it should come as no surprise that dominoes are falling all over the place. With — to repeat this crucial point — interest rates turning up again, there is literally zero chance of stopping this carnage.

So keep that powder dry. Some great assets might get very cheap, possibly very soon.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

John Rubino April 19th, 2023

Posted In: John Rubino Substack