March 25, 2023 | Trading Desk Notes For March 25, 2023

Classic signs of stress across financial markets

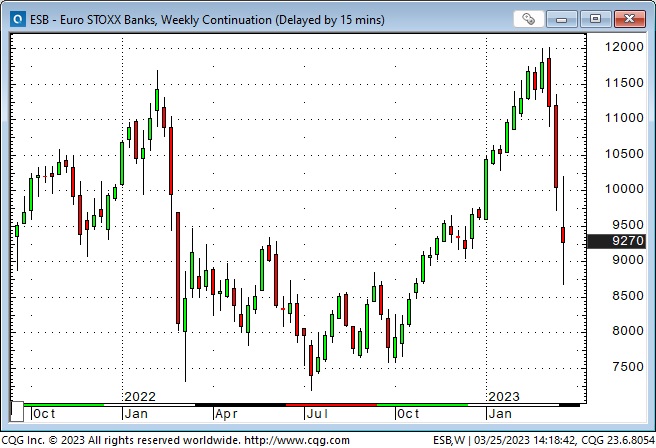

The banking sector has been the epicentre of the “stress” which started over a month ago in the USA and then spread to the Eurozone. A couple hundred billion dollars worth of deposits have apparently left the banks in search of “safe havens,” and bank share prices have fallen.

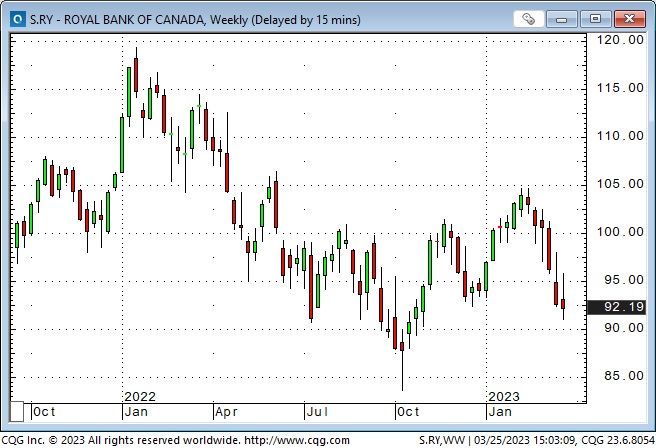

Canadian bank shares have declined over the last six weeks, but not as dramatically as American or European bank indices.

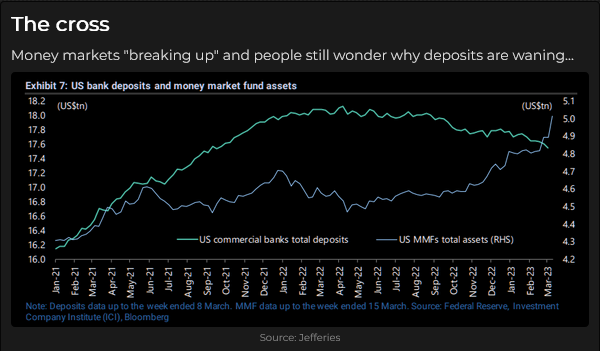

Money market fund assets have been rising as “yields” rose over the past twelve months, but the YTD surge to record highs above $5 Trillion has been accelerated by safe-haven flows from banks.

Government bond prices have soared as capital sought safety – with the rally exacerbated by short covering. The 2-year Treasury yield hit a 16-year high of~5.08% following Powell’s congressional testimony on March 8; it hit a 6-month low this week at ~3.56%.

The 10-year Treasury yield hit a high of ~4.07% in early March, then plunged to a low of ~3.3% on Friday. On this chart of the 10-year futures contract, prices have been at 5-month lows and 7-month highs this month, creating a possible Key Monthly Reversal if the price stays above February’s high at month-end.

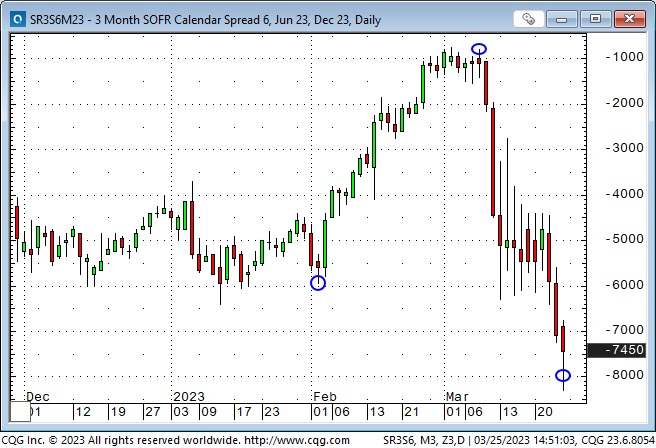

Short-term interest rate futures have experienced astonishing volatility since Powell’s congressional testimony, as the “banking crisis” caused a dramatic re-evaluation of short-term rates. The December 2023 SOFR contract rallied as much as 200bps within five days of Powell’s testimony – on expectations that short-term rates would be falling dramatically over the next nine months.

The swings in the spread between the June 2023 and December 2023 SOFR contracts demonstrate the “sea-change” in the “higher for longer” debate. In early February, the spread had December at a ~60 bps discount to June, as the market expected the Fed to cut rates in H2.

As February progressed, however, the market increasingly priced “higher for longer”, and by the time of Powell’s congressional testimony on March 8, the market had December only 10 bps below June – the market was taking Powell at his word that the Fed would not cut rates this year.

But as the “banking crisis” unfolded over the past three weeks, the market has been pricing the Fed to be slashing rates in Q3/Q4 and yesterday took December to a ~80-point discount to June – despite Powell once again declaring (at the FOMC meeting on Wednesday) that the Fed was NOT planning to cut rates this year (although the Fed seems to see rates declining in 2024.) The market is “fighting the Fed” again, or perhaps just expecting the Fed to begin cutting rates sooner than the Fed expects!)

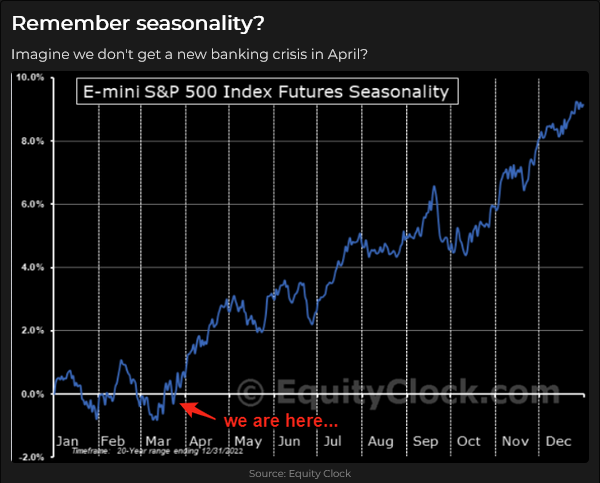

Weakness in the financial sector and then worries that the “banking crisis” would have a recessionary impact on the economy (banks would be tightening lending requirements) dragged the broad stock market indices lower from their early February highs to their mid-March lows – but since then the S&P has moved erratically higher, perhaps in anticipation of the Fed cutting rates. (In previous Notes, I have frequently referred to February 2 as a Key Turn Date.)

“The Inside Of The Stock Market,” tells an interesting story with the tech-heavy Nasdaq outperforming the other indices. The Nasdaq 100 hit a 7-month high this week -as did AAPL. MSFT hit a 7-month high last week.

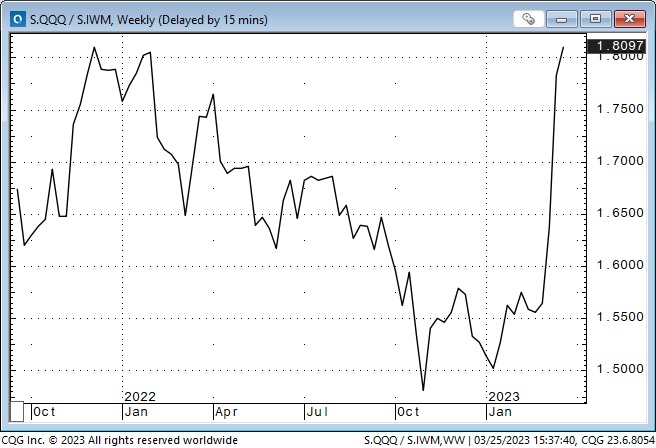

In last week’s notes, I thought Supercap tech stocks were acting like defensive “consumer staples” ahead of a looming recession. This week looking at the spread between the Supercaps and the small caps, I wonder if the difference is about access to financing. This chart shows the recent outperformance of QQQ relative to IWM.

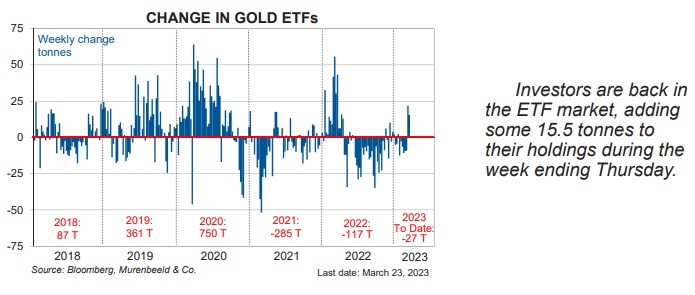

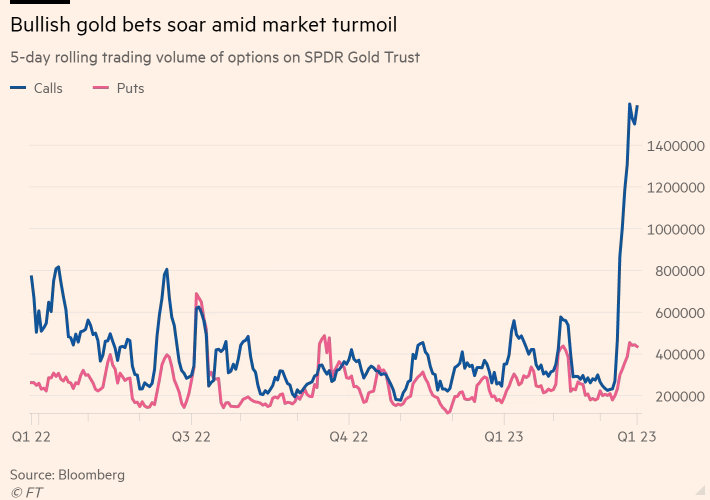

Gold has soared ~$200 (11%) over the last three weeks – trading above $2,000 for the first time since the Russian invasion. The gold rally is a classic sign of stress, but the rally has been aided by a weaker USD and falling real and nominal interest rates.

It’s interesting that gold shares have NOT rallied as much as gold. WTI crude oil touched $65 this week, down ~50% from the highs made on the Russian invasion. Fossil fuel energy costs are a significant factor in mining operations, but that doesn’t seem to be a factor in current gold share prices. Perhaps gold shares are “shares” first and foremost, and shares of any kind (except Supercap tech) are left behind when gold soars on “stress!”

I have more to say about gold in the “On my radar” section below.

My short-term trading

I started this week with small long positions in WTI and the Mexican Peso. I was stopped for slight losses on both positions when risk assets plunged in the Sunday overnight session. (When I looked at markets early Monday morning, I was glad to have been stopped early in the breakdown.)

I bought the S&P on Monday and was stopped for a small loss. I re-bought the S&P and had unrealized gains of >100 points at Thursday’s highs. I trailed stops behind the rally, and when the market tumbled Thursday afternoon, I was stopped for gains that more than offset my Monday S&P losses. (I should have had my stops closer behind the rally, but with the market higher following the FOMC, I thought the rally could keep going – but then Yellen spoke up, and the S&P tumbled over 100 points into Thursday’s close.)

I shorted gold on Monday and had unrealized gains of >$50 by the Tuesday close. I was stopped around breakeven on Thursday.

I re-bought the Peso Monday and trailed stops behind the rally. I was stopped when the market tumbled Thursday afternoon for gains that were a bit more than my previous Peso losses.

I did not re-buy WTI. I was long the S&P and the Peso, and adding long WTI would have been adding concentration risk.

I bought the S&P Friday when the market rebounded after taking out Thursday’s lows. I kept the position into the weekend with >40 points of unrealized gain.

I shorted gold Friday and held the position into the weekend.

Price action across markets was extremely choppy this week, and I’m fortunate to have made a little money.

On my radar

I think the “stress” in the market is creating interesting opportunities. I wrote last week that “babies were getting thrown out with the bathwater.”

As a result, I’ve been trading risk assets (stock indices, WTI and Mexican Peso) from the long side, and I’ve been shorting gold.

I think it’s important here to underline that these are very short-term trading ideas. I try to find good entry points, I’m trading small size, and if the markets move against me, I’m out quickly.

Gold has jumped >$200 in the last three weeks, and I think that is mostly in reaction to the “banking crisis” story. A weaker USD and lower interest rates have helped the rally, but it’s mostly been about the “banking crisis,” and I think “retail” has been buying the highs. I’m willing to take the other side of that trade and lose a little money if I’m wrong.

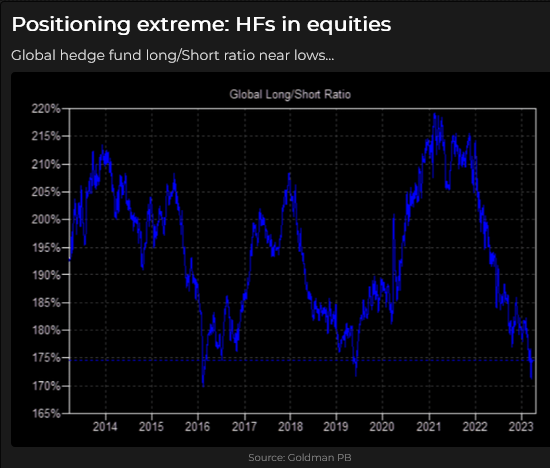

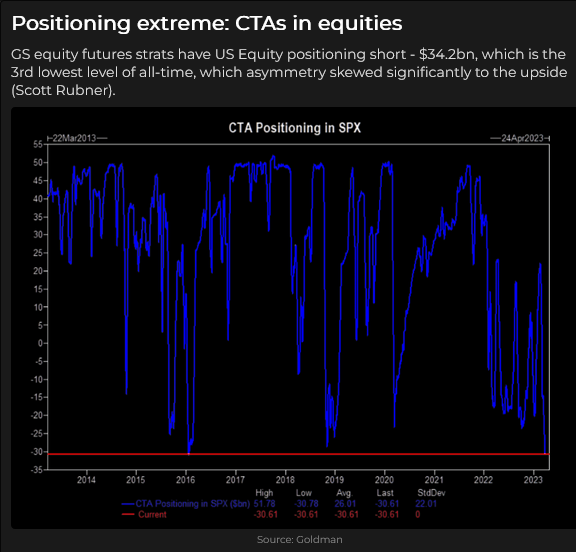

I think aggressive speculators are heavily short stocks, and if prices rally from here, they will be covering.

The Barney report

The weather is better, with warmer temperatures and very little rain, and the days are longer, so Barney has been getting some extra-long off-leash walks on the forest trails. He always seems to find a good mud puddle to play in, so he gets hosed off when we come home, then he has a nap before his suppertime walk. What a life!

Here he is in a contemplative mood – probably thinking about rabbits or squirrels.

The Archive

Readers can access weekly Trading Desk Notes going back five years by clicking the Good Old Stuff-Archive button on the right side of this page.

Listen to Victor talk about markets

I’ve had a regular weekly spot on Mike Campbell’s extremely popular Moneytalks show for >22 years. You can listen to us talk about markets on March 25 on the Moneytalks podcast.

Headsupguys

Headsupguys recently raised ~$140,000 at a fundraising event in Vancouver. The founder, John Ogrodniczuk, is a professor at the University of British Columbia in Vancouver, and he did a wonderful 5-minute interview with Melody Jacobson from the CBC about Headsupguys.

I had a couple of tears listening to John telling Melody, “what to do” if one of your friends seems depressed. Well said, John!

I support this project because I’ve had friends who took their own lives. Headsupguys helps men deal with depression. Headsupguys has had over five million hits on its website, and over a half million men have taken the self-check. Most men who click on the website do so after midnight their local time. Headsupguys save lives.

Subscribe: You have free access to everything on this site. Subscribers receive an email alert when I post something new – usually 4 to 6 times a month.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Nothing on this website is investment advice for anyone about anything.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Victor Adair March 25th, 2023

Posted In: Victor Adair Blog

Next: Recession Odds Rising »