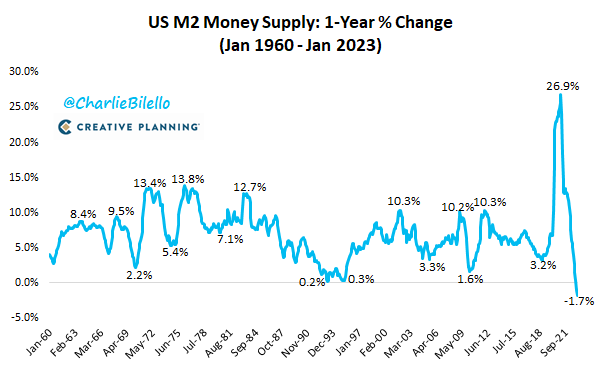

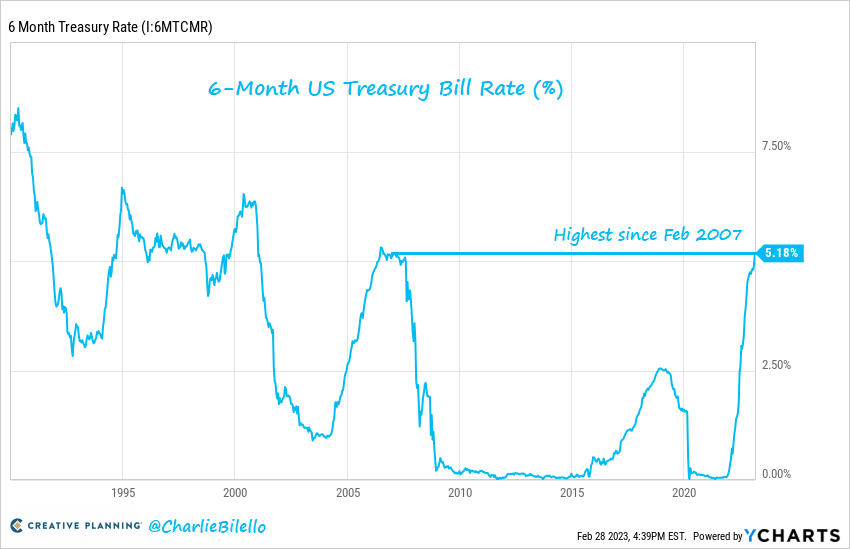

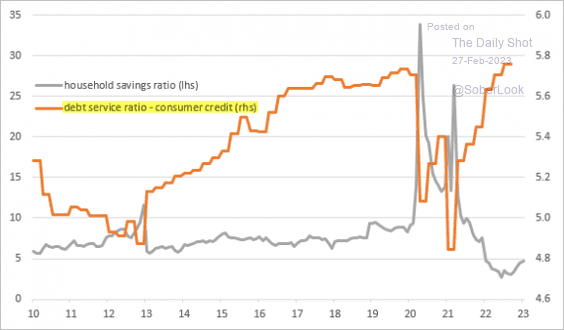

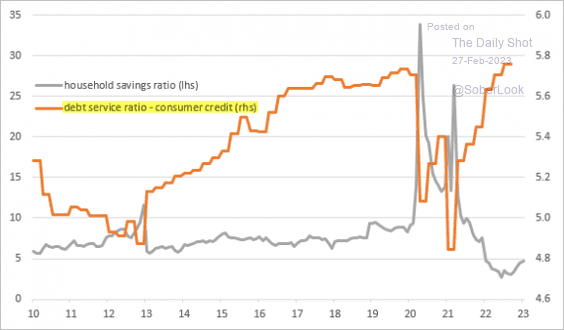

Thirteen years of ultra-loose monetary conditions, followed by the sharpest tightening cycle in 40 years, have wrought record household debt service payments (in orange below, courtesy of The Daily Shot) and a record low savings ratio (grey line)

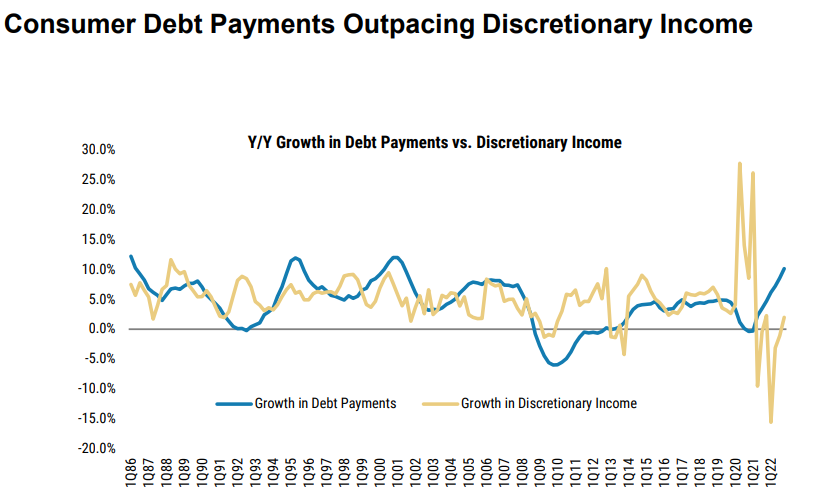

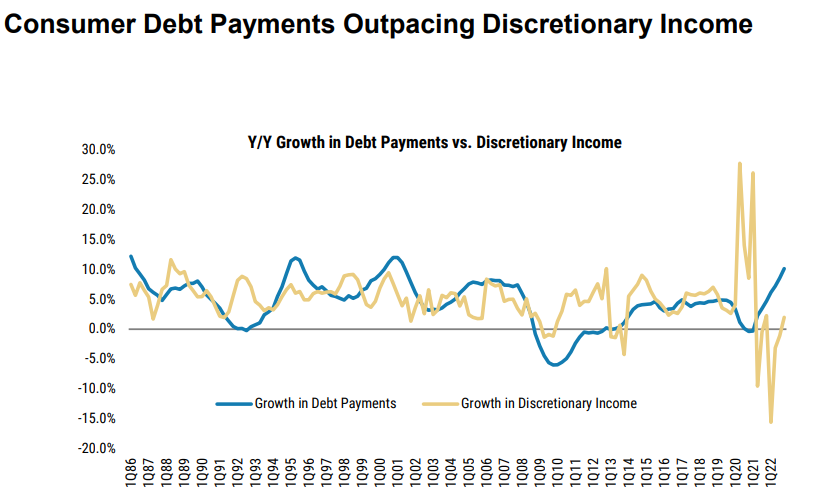

Year-over-year growth in consumer debt payments since 2020 (blue line below since 1986, courtesy of Morgan Stanley) has outstripped growth in discretionary income (yellow line) by the most on record.

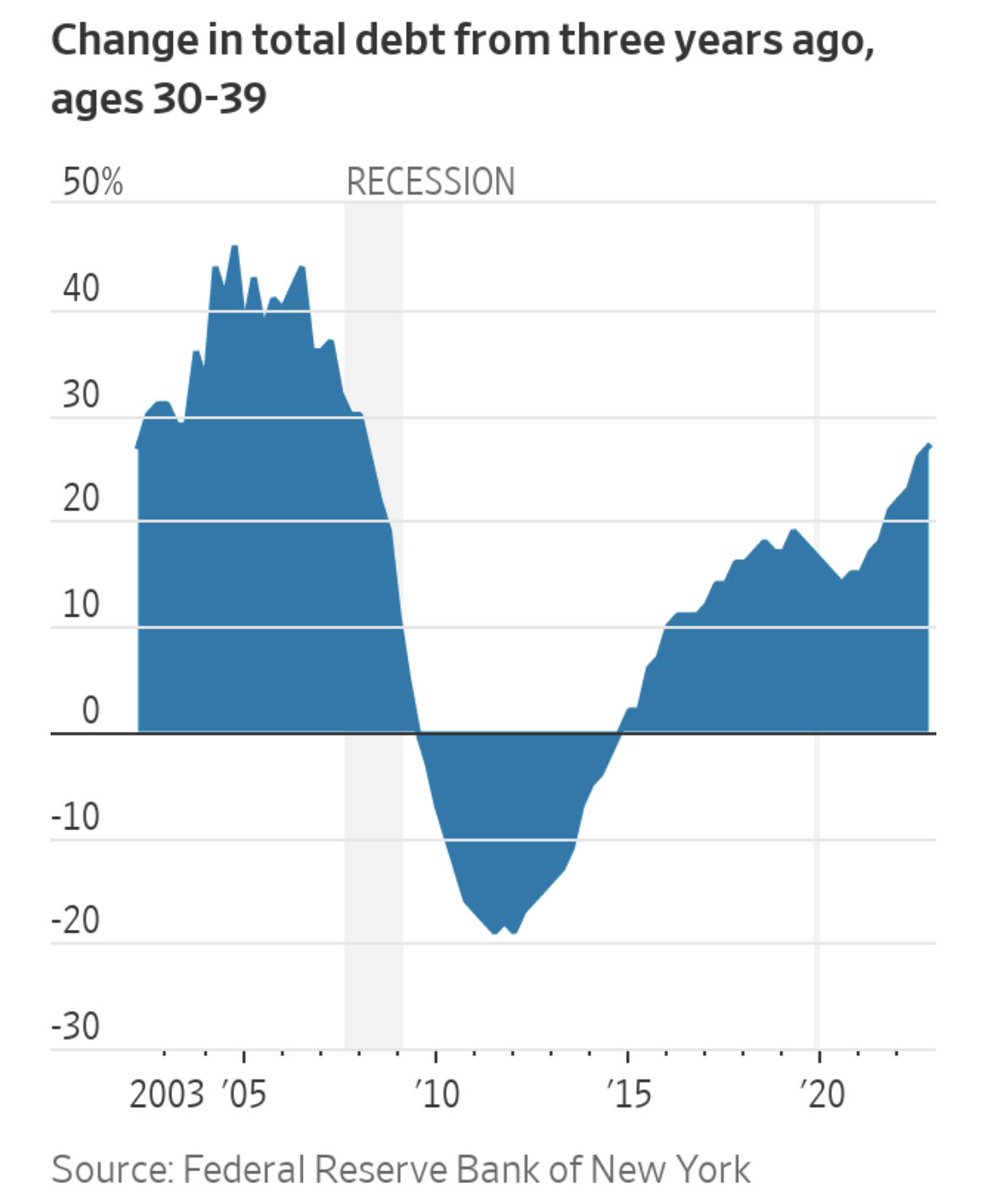

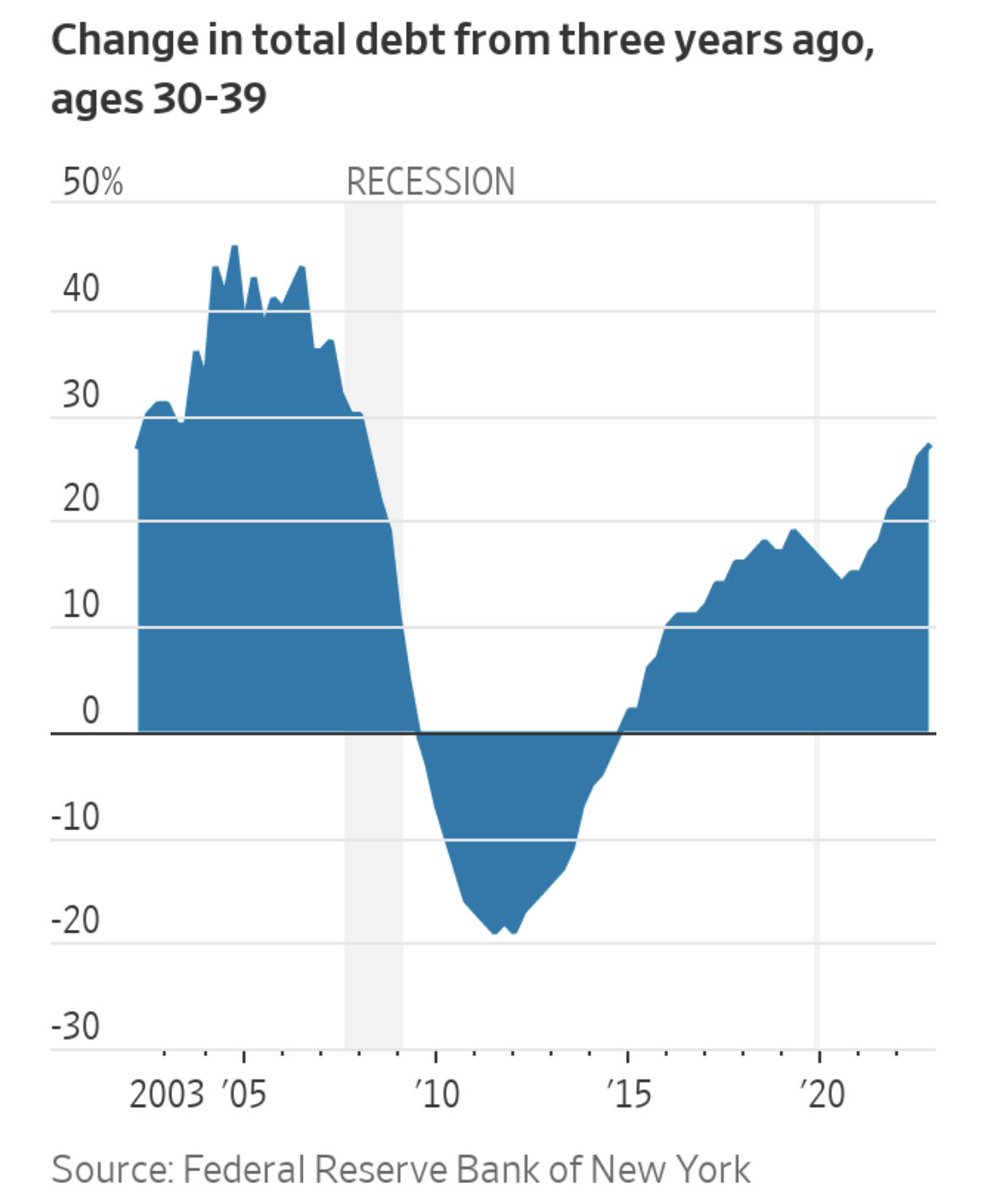

Debt among Americans ages 30 to 39–the group that is supposed to be forming households, starting businesses, having children, helping fund entitlement programs, and buying move-up homes from older folks–has risen to $3.8 trillion, up 29% since 2019 (chart below); see: Americans in their 30s are piling on debt.

In addition, some $10 trillion of US private debt up for renewal in 2023 now faces interest costs 400 to 500 basis points higher than they have been paying (Rosenberg Research).

Inflated prices plus higher interest rates have increased housing costs by the most in many decades, not just in America. For some major global cities, median apartment prices as a ratio to median disposable household income are shown below (courtesy of JP Morgan). Historically, a price-to-income ratio of 4x has been considered affordable.

Cash-strapped landlords are trying to evict rent-controlled tenants so they can relet at much higher rents; see, Eviction applications spike in Ontario as vacancies dwindle:

In 2022, the Landlord and Tenant Board, adjudicating rental-housing disputes in the province, received more than 5,550 eviction applications in which landlords sought units for themselves, family members or new buyers. That was an increase of 41 percent from 2019, according to numbers provided by the province to The Globe and Mail.

The surge is being driven by communities outside of Toronto. In the city itself, the volume of “own-use” filings in 2022 was largely the same as in 2019. In the rest of the province however [where “investor” demand soared during the pandemic], such filings have soared by 59 percent.

But as the supply of available units rises in many areas, the pool of able renters is falling, see, Apartment rents fall as crush on new supply hits market:

“…recent declines are a sign that many tenants have maxed out on how much of their income they can devote to rent, while the specter of layoffs has created new concerns for some. Other would-be renters, living with family or friends, remain sidelined by prices that are still far too high for their budgets.

While some seasonal stalling in rents is normal, the market faces a significant headwind in the biggest delivery of new supply since 1986, according to projections from CoStar Group.

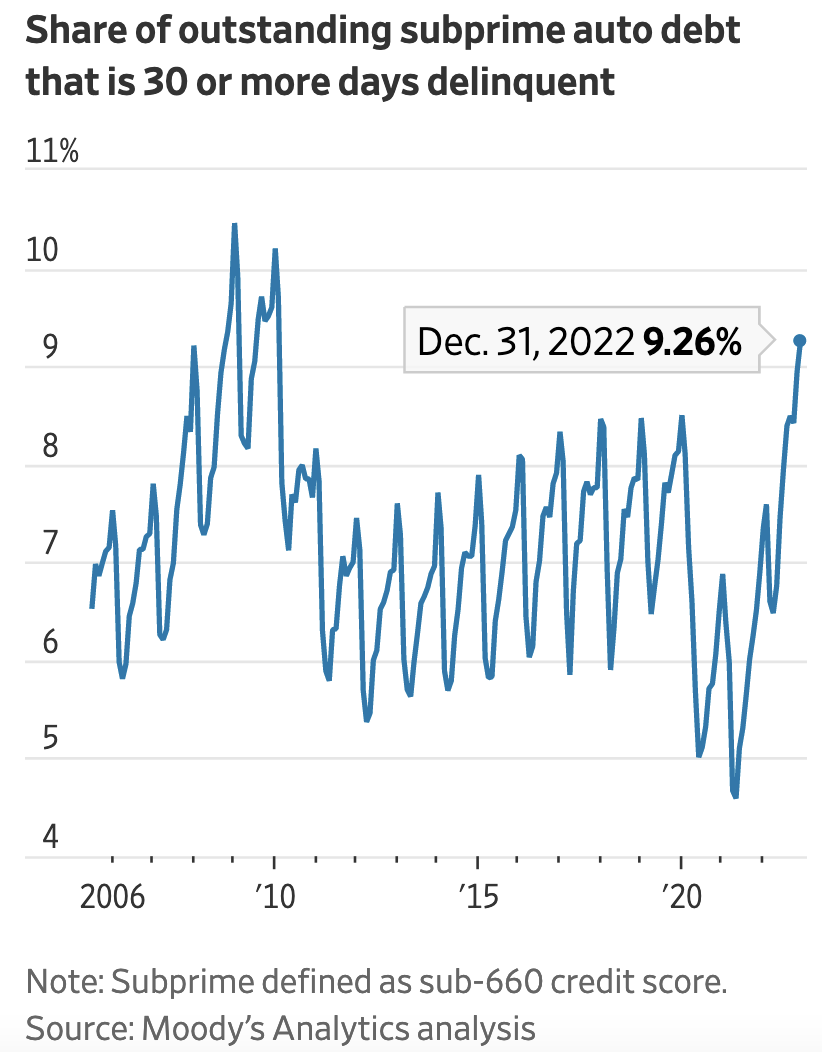

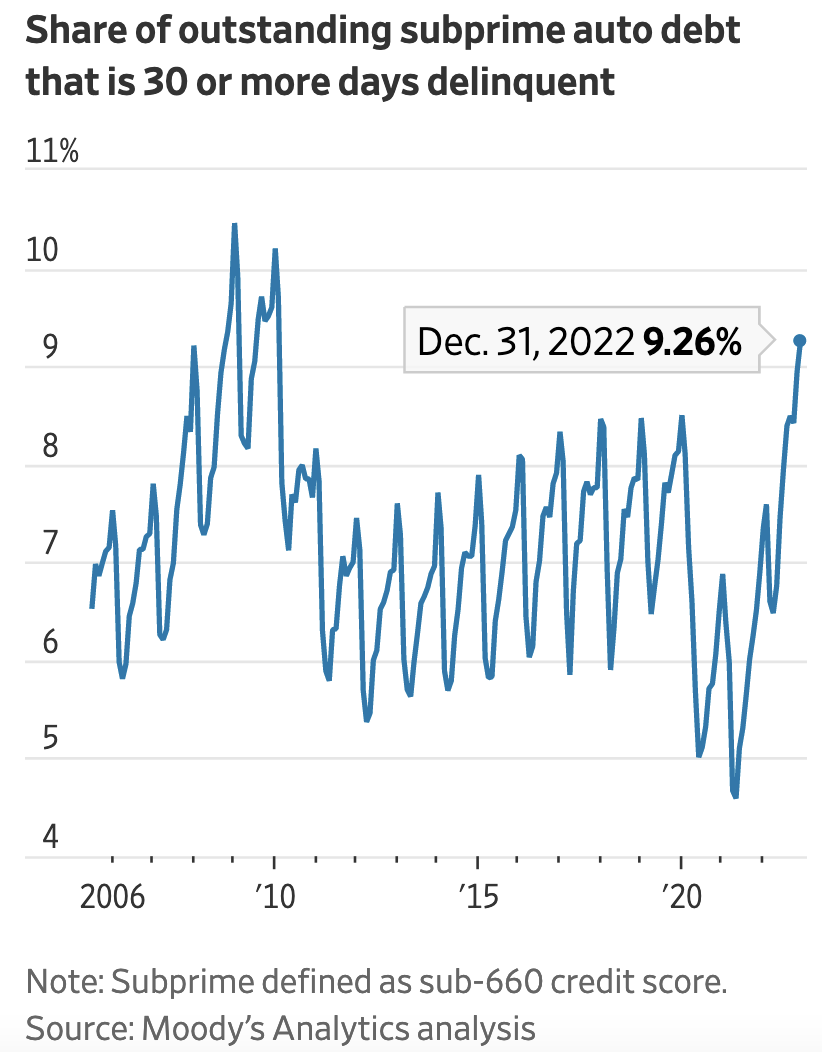

Not surprisingly, stress is well beyond housing. Borrowers who took out big auto loans at the height of the pandemic price boom owe far more than their vehicles are worth, and the percentage 30+ days behind on their payments in December was the highest since the 2008-09 recession. Lenders face losses as loan defaults rise. See WSJ: More auto payments are late, exposing cracks in consumer credit.

All just as employment is just starting to deteriorate. A lagging indicator, the official unemployment rate traditionally does not turn up until two to three months after recessions begin and does not peak until four months after recessions officially end.

Leading economic indicators have been falling for ten consecutive months and suggest that a recession is likely to start by the summer. This indicates that unemployment, loan defaults and distressed asset selling will increase over the next year.

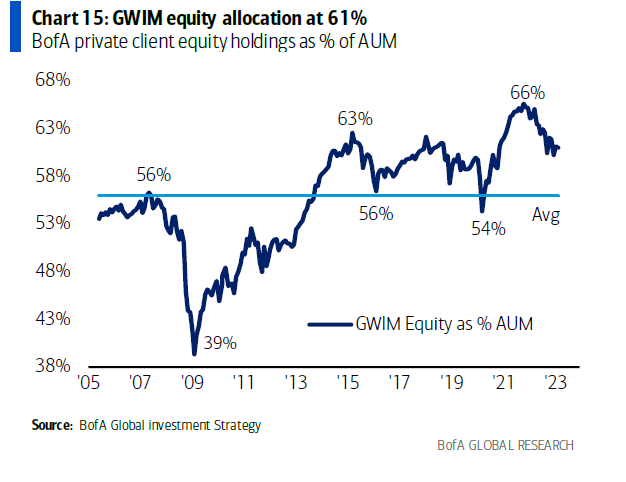

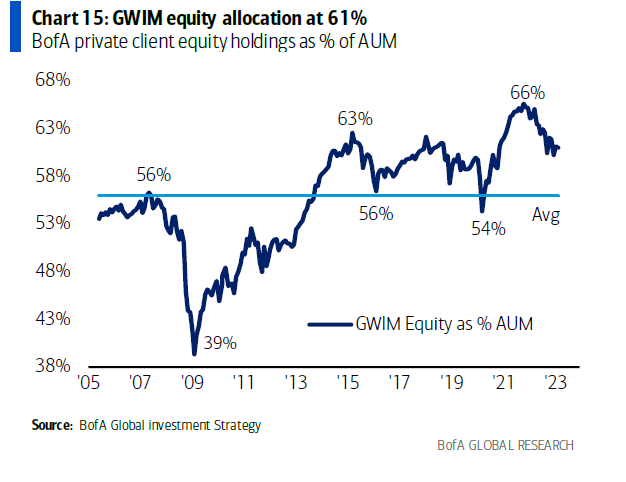

And yet, managed investment portfolios remain, so far, 61% allocated to equities–more downcycle-exposed than the 56% exposure at the 2008 cycle top–and far above the 40% level typical of stock market bottoms. No capitulation means no cycle bottom yet in sight.