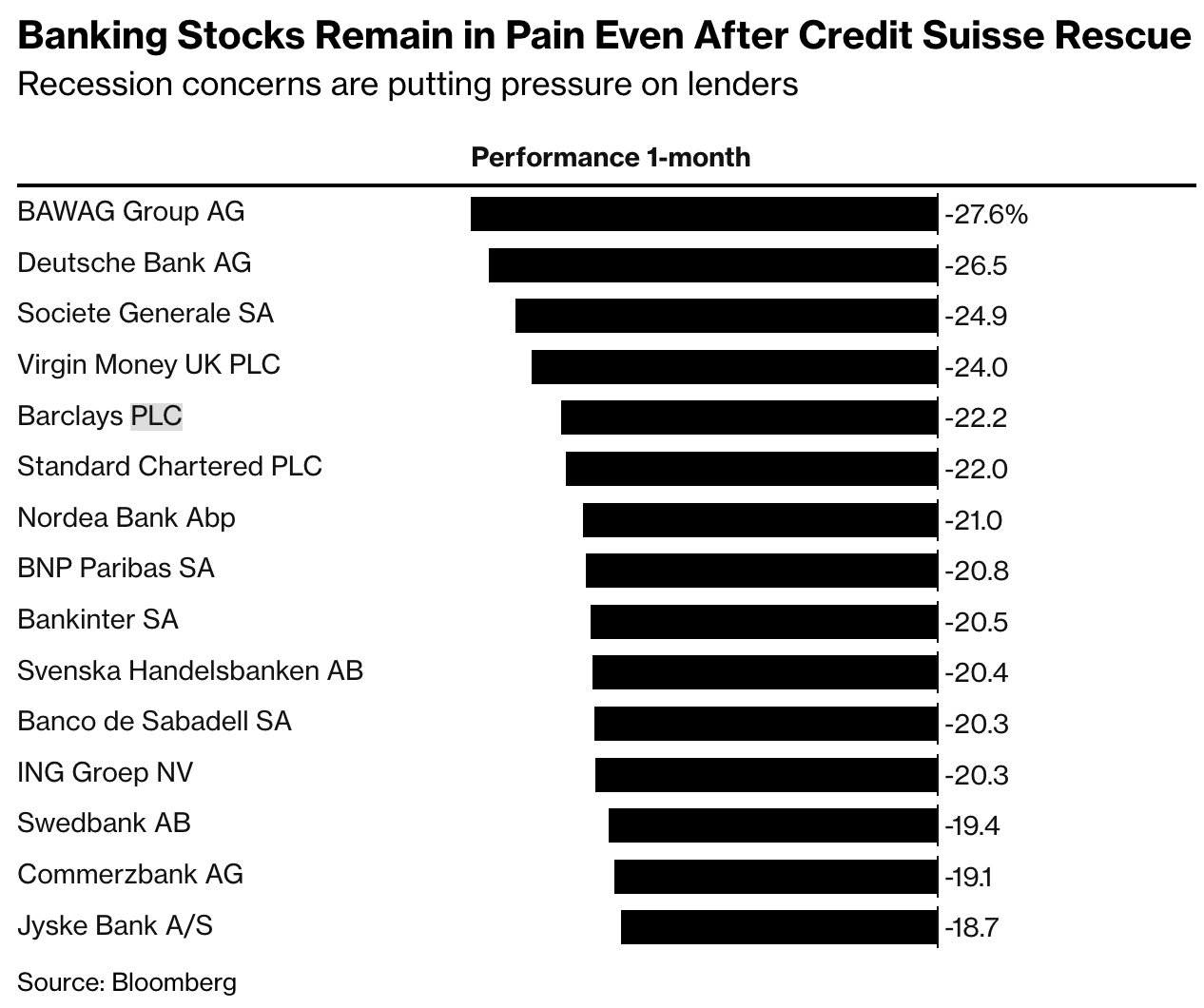

Deutsche Bank shares are off more than 10% this morning as credit default swaps on its senior euro debt blow out. Contagion fears are spreading after Credit Suisse’s shot-gun sale last weekend. Other banks are tumbling in sympathy. As shown below courtesy of Blomberg, financial shares have plunged sharply in the last month; see Deutsche Bank Shares Plunge in Renewed Bout of Stress.

In addition to credit unions and a host of private lenders, Canada’s publicly traded financial sector comprises about 180 companies. Along with the most regulated and capitalized big six banks and three insurers, the rest are tier-two lenders and brokers that grew like stinkweed during the 2012-2022 decade of low rates and mindless lending. There are skeletons to be revealed in them closets, to be sure.

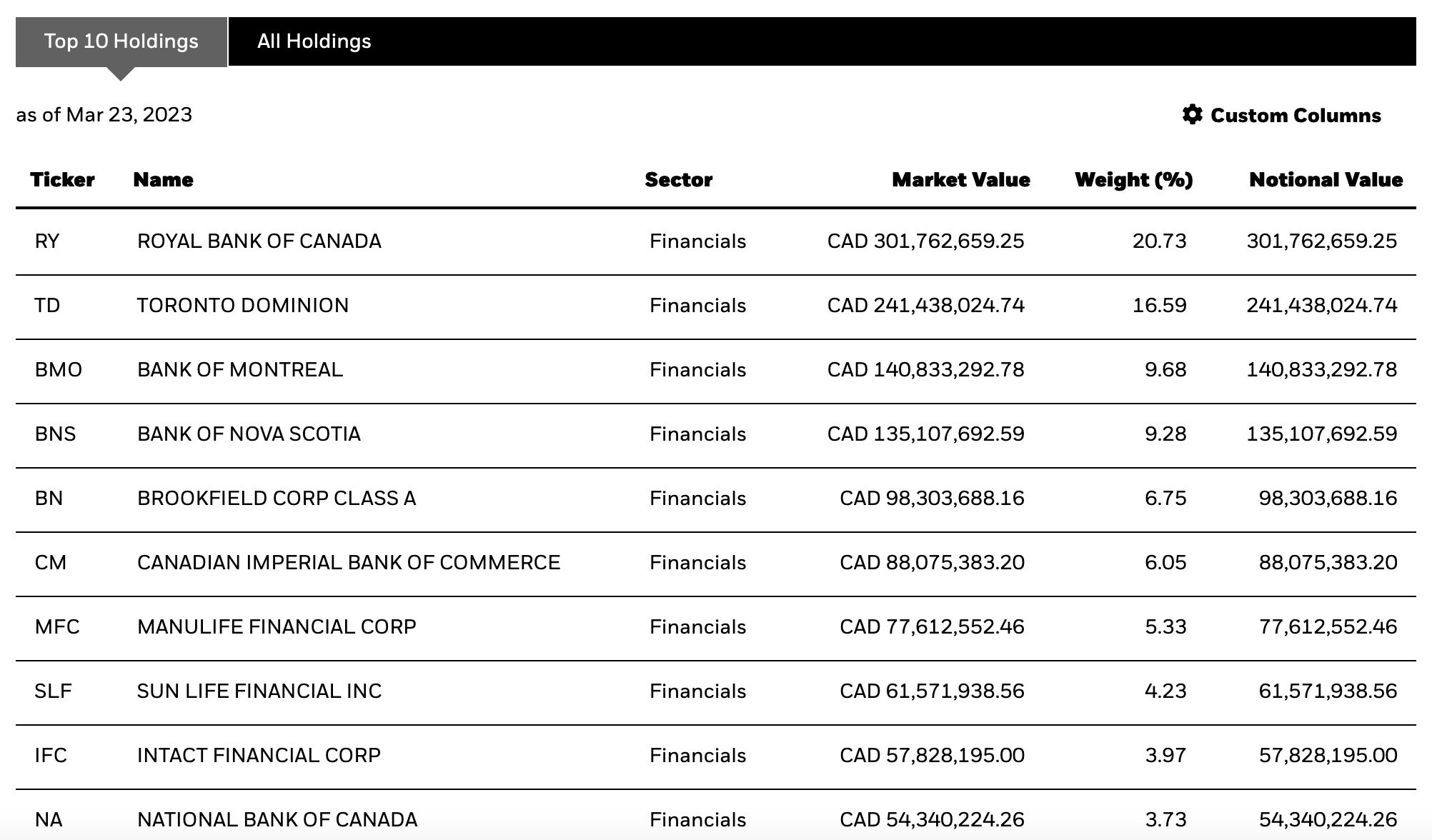

The Canadian financial sector ETF (XFN) comprises 40 different finance companies, making up nearly a third of the broad TSX index (which many mutual funds and portfolios mimic). The largest ten holdings by market capitalization are listed below (courtesy of BlackRock). This best-in-class financial basket has fallen about 9% over the last month and more than 20% over the previous 13 months. In the 2000-02 and 2007-09 bear markets, these companies all survived, but the basket of shares lost about half its market value both times. Most present holders (including moms and pops) have no idea how heavily exposed they are to this risk. Sadly, they believe they are conservatively invested.

This best-in-class financial basket has fallen about 9% over the last month and more than 20% over the previous 13 months. In the 2000-02 and 2007-09 bear markets, these companies all survived, but the basket of shares lost about half its market value both times. Most present holders (including moms and pops) have no idea how heavily exposed they are to this risk. Sadly, they believe they are conservatively invested.

Below is a worthwhile update on central bank policies and banking stress.

Danielle DiMartino Booth joins David Lin to discuss recent banking issues and the Fed — TDLR. Here is a direct video link.

Danielle’s paper, “Too Small To Not Fail, ” discusses the unfolding banking crisis.