March 22, 2023 | Fed Today and Done?

At the last FOMC announcement on February 1st, the Fed hiked base rates by 25 bps and said it expected to tighten through 2023, with no easing before 2024, at the earliest. That was before retreating bank deposits sparked a liquidity crunch at highly levered financial institutions. Expectations are now that the Fed will hike 25 bps today, taking the overnight rate to 4.75-5%, and then pause as banking mayhem implodes through the economy.

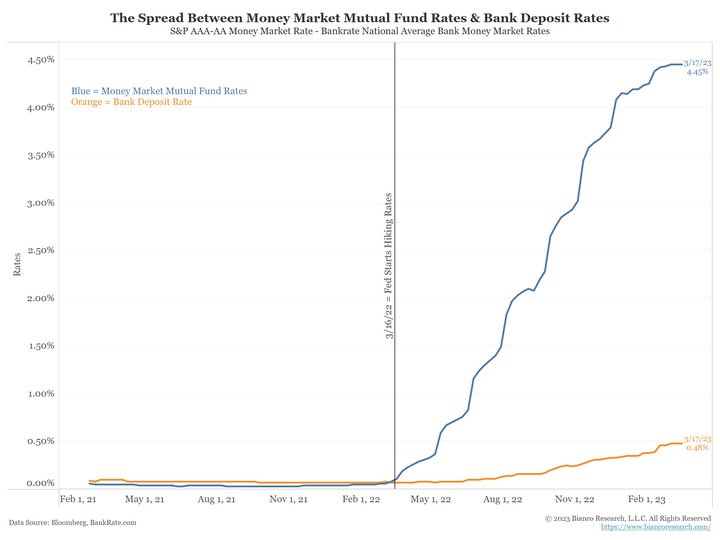

All over the world, banks are losing deposits because they have been maximizing profits by collecting 4.5% on their reserves with the central bank while still paying their customers next to nothing on deposits (orange line below, courtesy of Jim Bianco). Customers have realized that they can get more than 4% if they move into locked-in deposits and money market funds (blue line below).

Banks have always taken deposit rates up like a feather up and down like a stone, but the speed of this central bank tightening cycle was so much faster than average that the deposit exodus has happened faster too.

After a decade of using their customer deposits for free, most institutions are unprepared for the rapid repricing. Many had complacently ploughed large portions of cash into long-duration mortgage back-securities and bonds they intended to hold to maturity. As deposits leave, they will scramble to attract them back with higher rate offerings (which will hurt their profits).

In the meantime, some have to raise cash by selling long-duration assets at a loss (after prices dove last year as central banks tightened). This is a broad problem that was quantified by a recent research paper highlighted by The Financial Times last week in The US banking system is more fragile than you’d think:

Prior to the recent asset declines all US banks had positive bank capitalization. However, after the recent decrease in value of bank assets, 2,315 banks accounting for $11 trillion of aggregate assets have negative capitalization. This calculation underscores that recent declines in bank asset values significantly decreased bank capitalization and bank insolvency risk.

US banks have more than $5 trillion of real estate loans on their books, and the small lenders hold the larger share of it (53.2%). Seventy percent of commercial real estate loans have come from small regional banks in recent years. Some $270 billion of US commercial mortgages are up for renewal this year alone, and several high-profile borrowers have already defaulted, handing lenders the keys.

The delinquency rate in the $3 trillion office sector rose to 17% in this year’s first quarter from 12% at the end of 2022. When subleasing is included, total vacancy rates exceed 20%, twice the pre-pandemic rate (IBISWorld Data courtesy of Danielle DiMartino Booth).

Canadian data is less publicized, but similar trends are evident, with an increasing share of residential and commercial financing coming from non-bank lenders and credit unions over the past few years (CMHC data here).

Swapping loans on their balance sheet for deflating, illiquid real estate is the last thing lenders want right now. But, the appetite for loan securitization has dried up, so selling sketchy paper to investors is no longer easy. Even if the Fed pauses after today’s meeting, firesales appear to be coming.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Danielle Park March 22nd, 2023

Posted In: Juggling Dynamite

Next: The Fed Does Not Back Down »