February 20, 2023 | Social Crisis

Happy Monday Morning!

National housing figures dropped this past week, and it wasn’t pretty. January home sales fell 37% year-over-year, a sharp decline from the blistering hot bull market of January 2022. When you zoom out further, this January was the slowest since 2009.

However, balancing this out was a dearth of supply trickling to market. New listings for the month of January came in at their lowest levels since the year 2000. Yes, we just recorded a 23 year low of new listings coming to market. The nations housing market is currently starved of inventory, which is ultimately the largest driver behind the sudden resurgence of multiple offers popping up across the country.

A housing market deprived of sales volume is ultimately a big drag on the economy. When houses don’t transact people don’t need lawyers, mortgage brokers, inspectors, contractors, and new furniture, just to name a few.

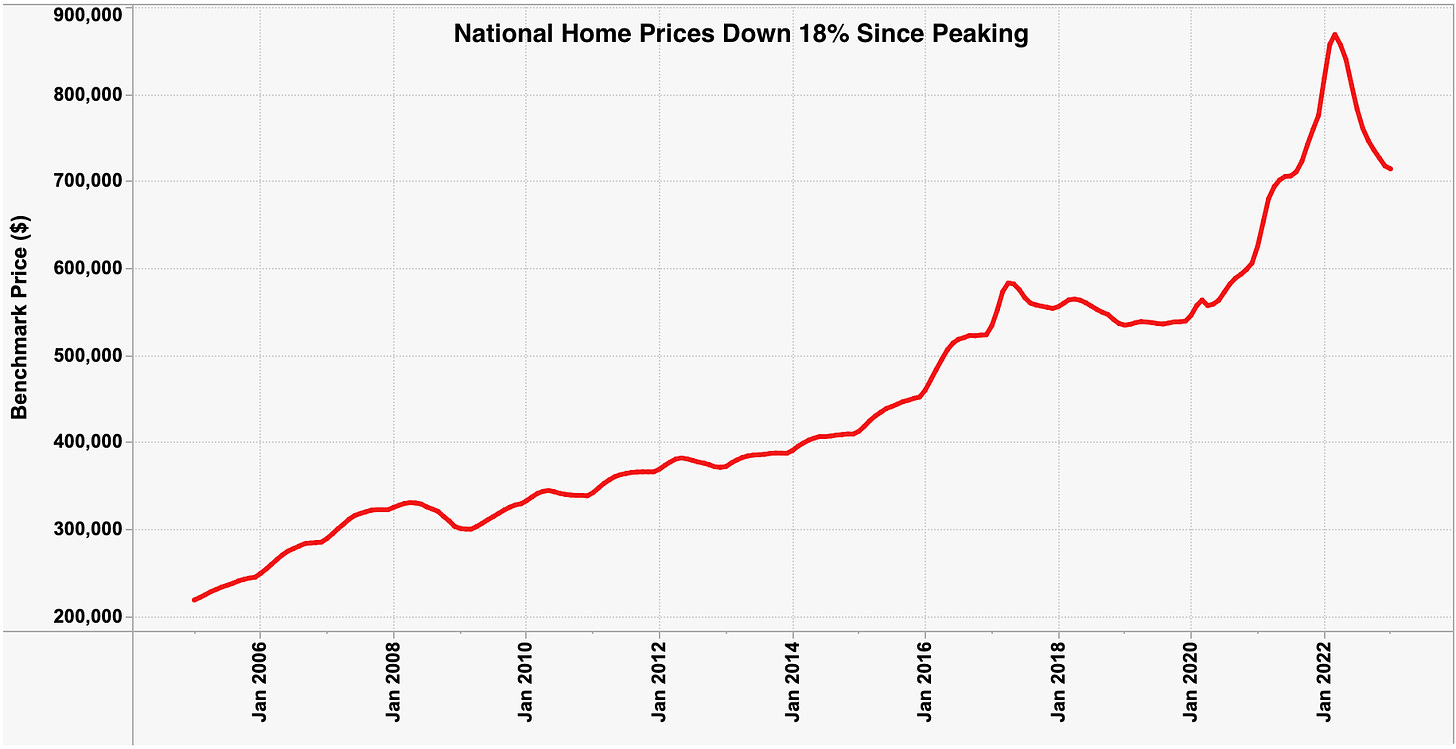

It’s certainly true that the chronic shortage of new inventory coming to market is providing a floor for house prices, although plenty of damage has already been inflicted. National home prices, as measured by the Home Price Index, fell 12.6% year-over-year in January. Since peaking last year, the index is down 18%, by far the sharpest correction since the index was created in 2005.

The base effects from the peak of the bull market last year suggest the National Home Price index will continue to fall over the coming months, even though, in real time, prices are firming up.

Everyone expected a flood of new listings from distressed sellers and instead we got a twenty three year low. Who had that on their bingo card?

Just for a little more context, these inventory numbers are not adjusted for the massive surge in population growth and housing stock created over the past few decades.

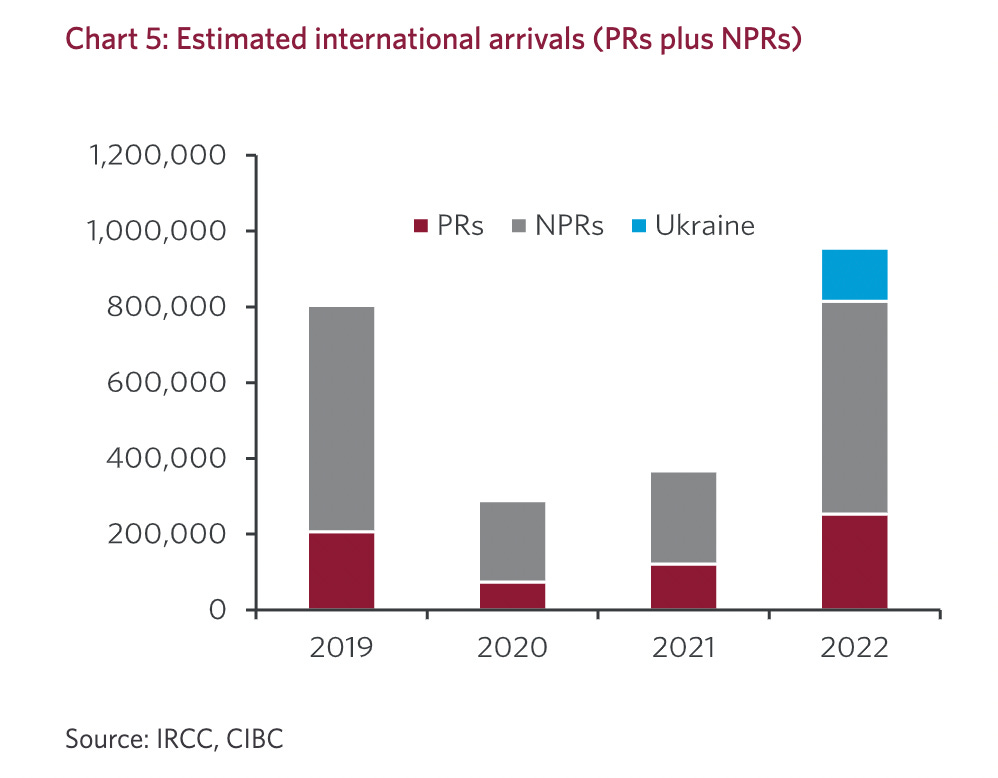

The reality is this country continues to pump in new immigrants at scale. There’s a lot of ongoing debate around how much new housing supply we need. CIBC’s economist Benjamin Tal analyzed the figures this past week and suggests we are not properly counting immigration figures.

We added 465,000 new immigrants last year. However, many of these new permanent residents were already living here and thus didn’t add to incremental demand for housing.

Instead, what we need to be asking is how many new permanent residents were added here from outside the country PLUS how many new non-permanent residents (foreign workers, students) came to the country last year. It turns out we added a whopping 955,000 NEW people to Canada last year. Tal believes the number of new international arrivals in 2023 might exceed one million.

Clearly this is not sustainable. It’s also what prompted Victor Dodig, CEO of CIBC, to ring the alarm bells. Dodig says Ottawa’s decision to significantly increase immigration levels without first shoring up housing supply risks triggering the country’s “largest social crisis” over the next decade unless something is done soon to resolve the issue.

“New Canadians want to establish a life here, they need a roof over their heads. We need to get that policy right and not wave the flag saying isn’t it great that everyone wants to come to Canada,” Dodig said at event hosted by the Canadian Club Toronto on Feb. 14. “The whole ecosystem has to work. If they can’t get a house, if they can’t get a doctor, if they are struggling to get a job, that’s not so good.”

The average listed rent for all property types in Canada rose 10.7 per cent year over year in January, the ninth straight month for double-digit increases, according to the Rentals.ca and Urbanations latest National Rent Report.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Steve Saretsky February 20th, 2023

Posted In: Steve Saretsky Blog