January brought gains across most asset classes, especially for the junkiest debt, equities and crypto-Ponzis.

The bulls are chomping at the bit to convince us that the 2022 loss cycle is now over. However, it bears noting that big rebounds have been a regularly recurring feature within bear markets since time began.

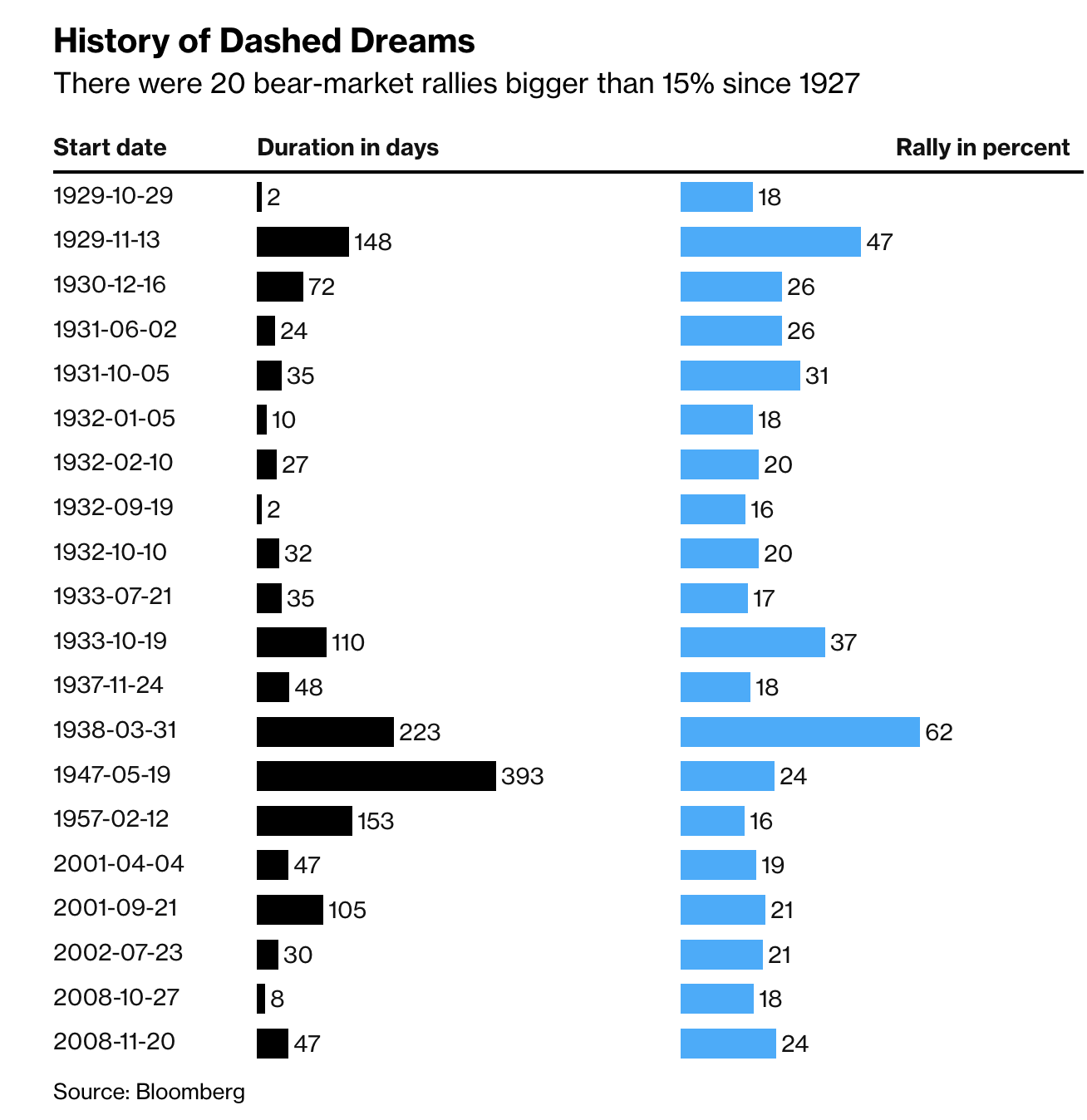

The Bloomberg chart below summarizes the 20 S&P 15%+ rallies within larger downtrends from 1929 to 2008. Buy and holders should beware.

There has also never been a bear market low that occurred before the US Fed paused a tightening cycle. In every case, stocks fell for months after the first cut. Today, the US Fed is still in tightening mode via rate hike plans and ongoing Quantitative Tapering.