January 6, 2023 | Speculation on Interest Rates and Inflation in 2023

Speculation on the direction for interest rates will dominate stock market chatter in the first half of 2023. In November 2022 market participants had started to anticipate a decline in inflation which would allow the Federal Reserve to drop interest rates, leading to a new bull market in stocks, bonds and housing.

Will interest rates go down in 2023?

The rally in the U.S. stock market from mid-October to end of November 2022 was based on an expectation that, in 2023, the Fed would choose to back away from its anti-inflation stance, relieving the relentless pressure on asset prices of higher and higher interest rates. But minutes released this week of a December 13-14 meeting of the Fed committee that sets interest rates threw cold water on that optimistic view.

Back in November market participants were basing their expectations on how the Fed acted in past economic slowdowns. Those periods could be characterized as cutting rates in a panic, whenever there was a stock market crash or the hint of recession. But this time the Fed insists that it will not reverse course that easily. Now the market is starting to suspect the Fed might be serious about combatting inflation even during a recession, after all.

Fed officials were quoted as saying that “an unwarranted easing in financial conditions, especially if driven by a misperception by the public of the committee’s reaction function, would complicate the committee’s effort to restore price stability.” These minutes were released Wednesday January 4, 2023.

The chief economist of JP Morgan Chase, one of the largest investment banks in the world, was interviewed on Bloomberg Television saying, “A big concern of their messaging here is that the market is pricing in cuts by the second half of this year”. He went on to say that officials “realizes the risk of overtightening is just something that they have to swallow and stomach.”

There is a Fed meeting in February when the Fed is widely expected to make another interest rate hike, bringing the official Fed Funds rate close to 5 percent and pushing mortgage rates up again.

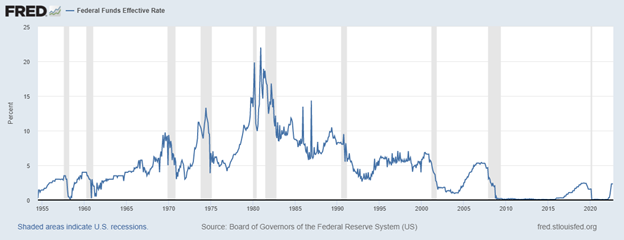

There is only one historical precedent to today’s inflation problem and the Fed at that time kept hiking rates for several years as inflation kept edging higher and higher. The arrival of a recession in 1980 did not convince the Fed to back down. Only when a particularly nasty recession hit in 1982 did the Fed start to change course.

From 1975 to 2002 the Fed funds rate was below 5 percent only for a brief time — in the early to mid-1990s — and that period of low rates could have been a factor in promoting the dot-com bubble of 2000 and the ensuing crash. After the crash of 2000-02 the Fed kept rates below 5 percent for two decades.

This time, expect the Fed to act more like 1980-82.

Market participants betting on a pivot of the Fed anti-inflation stance should hedge their bets.

Hilliard MacBeth

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Richardson Wealth or its affiliates. Assumptions, opinions and estimates constitute the author’s judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them, having regard to their own particular circumstances.. Richardson Wealth is a member of Canadian Investor Protection Fund. Richardson Wealth is a trademark by its respective owners used under license by Richardson Wealth.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Hilliard MacBeth January 6th, 2023

Posted In: Hilliard's Weekend Notebook