January 12, 2023 | Monetary Policy Changes are Felt Slowly and Then All At Once

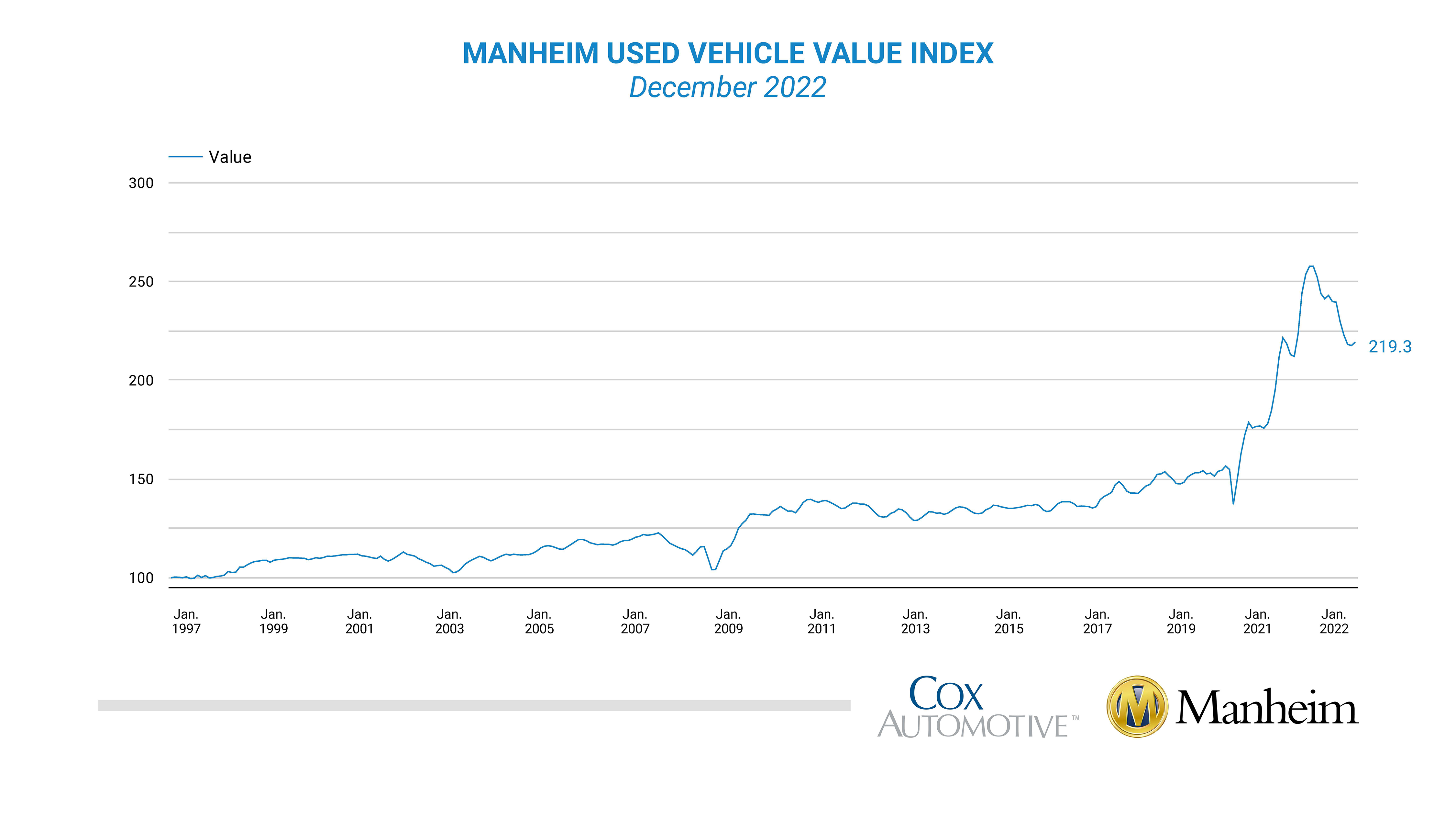

Used car prices fell nearly 15% year over year in December, and as shown below, since 1997, prices would need to fall another 30% to return to pre-COVID norms.

Monetary policy changes move through the economy in 12 to 24-month lags. This happens for a few reasons. First, many interest rates are fixed for set terms, so carrying costs do not increase or lower until a loan is renewed. Another reason for the time lag is human behaviour. People will typically keep up payments at the expense of discretionary spending and tap other credit for as long as possible. If they do fall behind, it takes time for lenders to claim any collateral, sell it, and write off deficiencies as bad debt.

Monetary policy changes move through the economy in 12 to 24-month lags. This happens for a few reasons. First, many interest rates are fixed for set terms, so carrying costs do not increase or lower until a loan is renewed. Another reason for the time lag is human behaviour. People will typically keep up payments at the expense of discretionary spending and tap other credit for as long as possible. If they do fall behind, it takes time for lenders to claim any collateral, sell it, and write off deficiencies as bad debt.

Would-be sellers are also often reluctant to admit that prices are falling. This is particularly evident in housing and big-ticket items like automobiles, where owners will keep asking above-market prices for some time in the hopes of reclaiming a past cycle peak.

Eventually, a lack of patience, financial resources, time and other constraints ultimately prompt capitulation selling and, finally, deep value for buyers. But it takes time, liquidity and discipline to take advantage of the cycle.

The segment below does an excellent job of explaining the lag between mounting inventory and falling prices in the used auto market.

Dealerships and Banks are in Trouble Dealerships Refuse to Lower car Prices. Here is a direct video link.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Danielle Park January 12th, 2023

Posted In: Juggling Dynamite

Next: Global Political Instability »