December 9, 2022 | How Big Are the Fed’s Losses and Where Can We Go See Them?

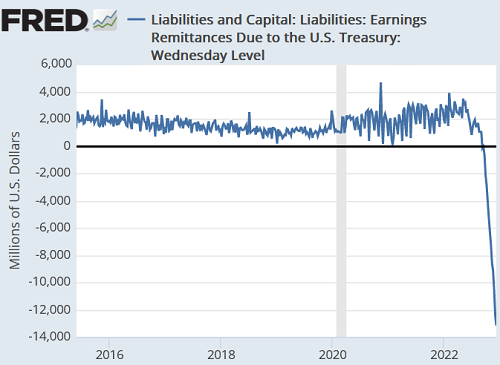

A collapse-chart has been making the rounds in the social media, financial blogs, and the like. It’s being handed around without context, as if self-explanatory, sort of like, look, the world is collapsing. It’s from the St. Louis Fed’s data depository. The title of the chart says, among other things, ominously, “Liabilities: Remittances Due to the U.S. Treasury.” Whatever this is, it’s violating the WOLF STREET dictum, “Nothing Goes to Heck in a Straight Line.”

But beyond the funny aspects of the chart, there is something happening on the Fed’s balance sheet that is taking on momentum and heft: How much money the Fed is losing, where this lost money shows up, and how it derails a taxpayer gravy-train. The chart reflects that in a bizarre manner — it does a switcheroo — that we’ll get to in a moment.

A liability is money that the Fed owes some other entity – in this case, money that the Fed owes the US Treasury Department. But this particular liability account, “Earnings remittances due to the U.S. Treasury,” is kind of a funny creature.

It has a negative balance of -$13.2 billion as of the Fed’s weekly balance sheet released yesterday. On a balance sheet measured in trillions, this is pretty small. But it’s going to get a lot funkier.

The Fed’s income, normally.

The Fed’s revenues come from interest and fees. The biggest source is the interest it earns on its $8.17 trillion portfolio of Treasury securities and MBS, which earned the Fed $122.4 billion in interest in 2021. The Fed also charges fees for various services it provides for the banking system. All combined, in 2021, the Fed had $123.1 billion in revenues.

The Fed’s expenses come from operating costs and from the interest it pays. The operating expenses of the 12 regional Federal Reserve Banks amounted to $5.3 billion last year. It also paid interest on reserves and on reverse repos. Last year, with the interest rate it paid on reserves at only 0.15%, the Fed paid $5.3 billion in interest on reserves and it paid $414 million in interest on overnight reverse repos (RRPs). And there were some other expenses. Total expenses amounted to $15.5 billion.

The Fed also paid dividends of $585 million to the shareholders of the 12 regional Federal Reserve Banks. The shareholders of the 12 FRBs are the financial institutions in their districts.

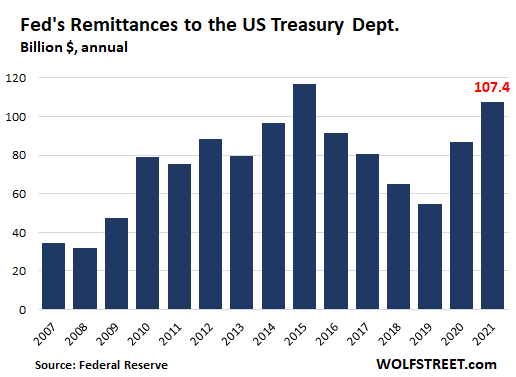

The Fed has to remit its net income to the US Treasury Department. Its net income (revenues minus expenses minus dividends) amounted to $107.8 billion. The Fed has to remit to the US Treasury Department nearly all of its income and any capital in excess of its statutory capital limit, set by Congress. It announces these figures every January, and I dutifully covered it every January, including in January 2022.

Over the past 21 years, the Fed remitted $1.28 trillion to the Treasury Department! Since the start of QE in 2009, it has remitted $1.07 trillion. In this respect, money-printing was a gravy train for the taxpayer.

But this whole thing is going to end because the Fed will have a net loss this year, and for years to come.

How much money can the Fed lose? $280 billion in 2023?

This year, the amount in interest that the Fed pays on reserves (to banks) and that it pays on its overnight RRPs (mostly to Treasury money market funds) has shot up, as the Fed has hiked interest rates from near 0% last year to 3.9% on reserves and 3.8% on overnight RRPs as of early November.

Currently the Fed pays $2.4 billion a week in interest on $3.2 trillion in reserves. And it pays $1.6 billion a week in interest to the counterparties of $2.15 trillion in overnight RRPs. At current rates and balances, that’s a cash outflow of about $4 billion a week ($208 billion annualized).

QT, which destroys money in the financial system, has the effect of shrinking the combined balance of reserves and RRPs. Both of them have come down from their highs, and there are shifts between them. And on a combined basis, both will continue to shrink during QT.

So the balances that the Fed will pay interest on will shrink.

But the interest rates that the Fed pays on those balances will rise by probably 50 basis points next week, and by more next year, and only God knows how far the Fed will go. But each time the Fed raises its rates, it has to pay more in interest.

So if the average combined balances in 2023 of reserves and overnight RRPs is $4.5 trillion, and if the Fed pays an average of 5% on these balances, it will shell out $225 billion in interest.

At the same time, QT will shrink its portfolio of interest-earning securities, and its interest income will dwindle.

The net loss for the Fed in 2023 could be north of $260 billion.

This does not include any losses the Fed would incur if it starts selling outright about $15 billion a month in MBS to bring the runoff closer to the cap of $35 billion. This might push the total loss over $280 billion in 2023.

To summarize:

- QT reduces the Fed’s losses by bringing down reserve and RRP balances that the Fed pays interest on. Enough QT will eliminate the Fed’s losses.

- Rate hikes created the Fed’s losses, and further rate hikes increase the losses until QT brings down the reserves and RRPs.

The switcheroo in the collapse-chart.

The chart tracks the line item, “Earnings remittances due to the U.S. Treasury,” on the Fed’s weekly balance sheet (second “Table 6,” Liabilities). This is normally a line that tracks the weekly increase in the amount that the Fed estimates it owes the US Treasury as the year goes on.

“Normally” means in times when the Fed is making money. Each week adds up. For example, in 2021, all the 52 weekly amounts, each in the range between $500 million and $4 billion, added up to $106 billion that the Fed would owe the Treasury Department. Close enough for an estimate of the $107.4 billion in remittance for the year.

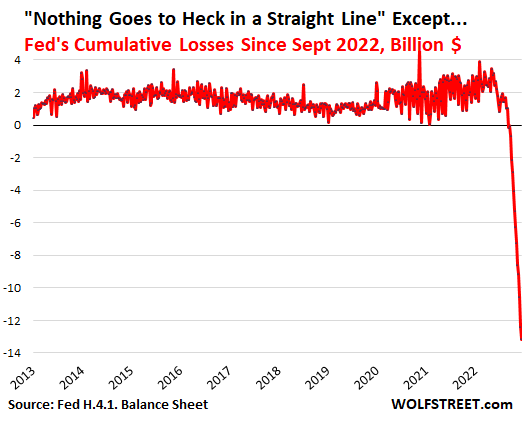

But when the Fed started losing money on a weekly basis in September, the account did a switcheroo. Instead of showing the “weekly change” as during normal times, it shows the “cumulative loss since September 2022.”

In other words, when the Fed started losing money on a weekly basis in September 2022, the account shifted from showing a weekly change of a positive balance, to showing the total cumulative negative balance. It now no longer shows the weekly change but its total loss since September 2022.

This shift from “weekly change” to “cumulative balance” is kind of a funny way of doing something? But it sort of makes sense, and here’s why:

In theory, if the amount that the Fed owes the US Treasury is negative, it would mean that the US Treasury owes this amount to the Fed and would have to pay the Fed. But that’s not their deal. Their deal is that the remittance is a one-way channel, from the Fed to the Treasury.

And when it turns negative, the Fed will just sit on the negative balance that will grow over the years as long as the Fed is losing money. And when the Fed is making money again, the Fed will not remit its net income to the Treasury Department, but will apply it to this pile of accumulated losses until the pile is gone. When the pile is gone, the Fed starts remitting its profits to the Treasury again.

The Fed calls this growing pile of losses a “deferred asset.”

Nope, that wasn’t one of my infamous snide remarks. The Fed calls this growing pile of accumulated losses a “deferred asset.”

Storing losses on the balance sheet as an asset, rather than showing the loss on the income statement right away, is an old corporate accounting trick, encouraged by GAAP, and includes such infamous accounts as “Goodwill” and “Intangible Assets.” The Fed is sort of just sticking to devious corporate accounting 101 here.

The Fed explains this in footnote #8 of Table 6:

“Positive amounts [from January to early September] represent the estimated weekly remittances due to U.S. Treasury.”

“Negative amounts [since early September] represent the cumulative deferred asset position, which is incurred during a period when earnings are not sufficient to provide for the cost of operations, payment of dividends, and maintaining surplus.

“The deferred asset is the amount of net earnings that the Federal Reserve Banks need to realize before remittances to the U.S. Treasury resume.”

In other words, each week going forward, the chart will show the Fed’s total losses starting from September 2022. The bigger the negative number, the bigger the accumulated loss.

And the chart will keep violating the WOLF STREET dictum that “nothing goes to heck in a straight line” and by 2024 could be a hoot.

Sometime in the future, when the Fed starts making money again, the line will begin to curve upward as the Fed’s income is applied to this pile of accumulated losses. And when the Fed has earned all the money back that it had lost, the line will re-enter positive territory, and then the Fed will begin remitting its income to the Treasury Department. And we’ll back to normal. Whew!

The Fed, which creates & destroys money, cannot run out of money.

I mean, we knew this all along. The Fed is not Enron, though the loss-accounting might look similar. The Fed creates its own money. And the Fed’s losses – no matter how large – will not cause the Fed to run out of money because it can always create more. So we can take that off our worry list. For the Fed, a loss is just an accounting entry, not an existential crisis.

The Fed won’t print money to pay for its losses — it won’t need to. But it’ll use some of the money from the QT roll-offs that would have been destroyed and pay interest with it. And so that money for interest payments goes out the door, and the balance sheet will shrink on track with QT.

A new addition to my monthly QT reports.

I discuss the effects of QT on the Fed’s assets on a monthly basis (most recently, “Fed’s Balance Sheet Drops by $381 Billion from Peak: December Update on QT”), and just for our theoretical amusement, I will add the chart of the pile of accumulated losses which should become a real hoot as we go forward, so we can do some rubbernecking here:

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Wolf Richter December 9th, 2022

Posted In: Wolf Street

Next: This Week in Money »