November 29, 2022 | Cyclical Foresight and Patience Pay

After 12 years of ultra-low interest rates, generous government support, and unprecedented liquidity injections from central banks, the global real estate market is in the midst of a much-deserved contraction cycle. As the Financial Times put it this month, The Global Housing Market is Heading for a brutal downturn, and bubble prices and household debt make Canada a leading train in the wreck:

“…at the end of the third quarter, house prices in major cities were in their second consecutive quarter of growth slowdown. Cities in New Zealand, Canada and Norway are registering double-digit contractions…

Sixty-six percent of Canadians hold some form of real estate, making up more than half of household net worth, which is now shrinking.

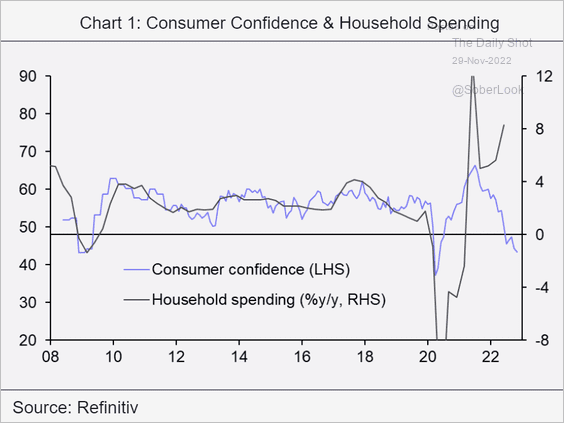

Despite near-record low unemployment (a lagging indicator) in October of 5.2%, Canadian consumer confidence (below in purple courtesy of The Daily Shot) was already at 2008 recession levels (back when unemployment was topping 8%). Debt-stressed, cash-strapped households do not bode well for the spending (in black) upon which the Canadian economy has depended for some 55% of GDP growth.

Of course, it’s not just the residential sector; as the Globe and Mail reported yesterday, the commercial space is ailing too, see Toronto and Vancouver’s office vacancies are on the rise as companies try to get rid of space:

“Office vacancy rates in downtown Toronto and Vancouver are climbing quickly, as well-known businesses such as Plenty of Fish, Air Miles and PricewaterhouseCoopers LLP try to get rid of unneeded space amid the shift to remote work and economic uncertainty.

Toronto’s vacancy rate reached 15 per cent at the end of September, according to new data from commercial real estate firm Altus Group. That is up from 4.2 per cent in 2019 prior to the start of the pandemic. The current level tops vacancies during the Great Recession and marks the highest since 2003 when Toronto was dealing with the aftermath of the dot-com bubble and the vacancy rate was 13.3 per cent. In Vancouver, the vacancy rate hit a two-decade high at 11.5 per cent, according to Altus. That compares to 3.5 per cent in 2019.”

Knock-on effects are magnified thanks to highly leveraged investors in the realty, construction, leasing, and finance sectors with tons of funds, private equity firms and lenders over-concentrated in the space.

Some high-profile funds have already frozen income distributions (most recently Starlight Investments) and halted investor redemptions (Romspen Investments):

“Starlight Investments, one of Canada’s largest owners of apartment buildings and multifamily properties, is halting monthly payouts on two of its funds, another sign that higher interest rates are causing trouble across the real estate sector – even for the most sophisticated managers and investors.”

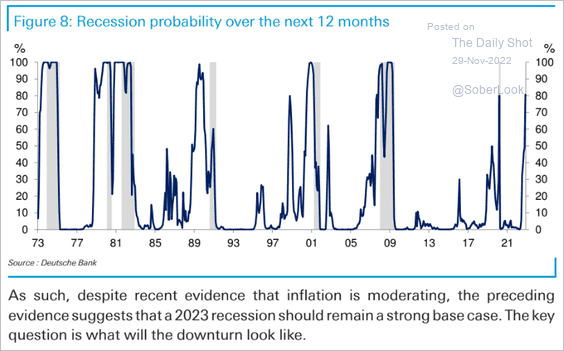

The publicly-traded Canadian real estate investment trust ETF (XRE) is off about 20% since March. So far, that’s less than half of its 58% decline during the 2008 recession, when Canadian real estate was much less levered and vulnerable than today. A global recession is nearly certain over the next 12 months (probabilities below since 1973 via The Daily Shot).

There are a few key points to grasp:

- Even a mild US recession in 2000-02 (with none in Canada) halved stock markets globally when asset bubbles burst.

- Recessions led by real estate downturns have historically been the harshest on record.

- Real estate cycles have many moving parts, and prices typically take years, not months, to bottom, with many more years (sometimes decades) to recover prior cycle highs.

- Stock market bottoms have not historically occurred when central banks are still hiking rates, nor when they pause. Market bottoms have occurred after recessions are widely recognized (nearing their nadir), and central banks have been back easing financial conditions for several months.

Word to the wise: cyclical foresight, preparedness (cash preservation) and patience pay.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Danielle Park November 29th, 2022

Posted In: Juggling Dynamite

Next: One Fell Swoop of The Pen »