Everywhere today, conversations are being had about what is happening in asset markets and the economy. Many people are in varying degrees of concern, alarm, and distress. Few are yet in a panic. History assures us that they will be.

While 60.9% of investors surveyed in September were bearish in sentiment, as shown below courtesy of Willie Delwiche, no capitulation is evident yet. The average portfolio allocation remains a heavy 63% in stocks and just 22% in cash. This compares with 41% and 38%, respectively, at the March 2009 and other bear market lows. We aren’t there yet.

Many are not yet panicking because they expect that risky assets will bounce back quickly as they did from the March 2020 crash. A realtor told me today that they thought the current downturn in housing is like the 2016 ‘pullback.’ I don’t.

In 2016, inflation averaged less than 2% in developed economies (see here), giving central banks cover to prop up asset prices. Today, inflation is averaging more than 7% and crushing free cash flow, along with support for governments and central banks worldwide.

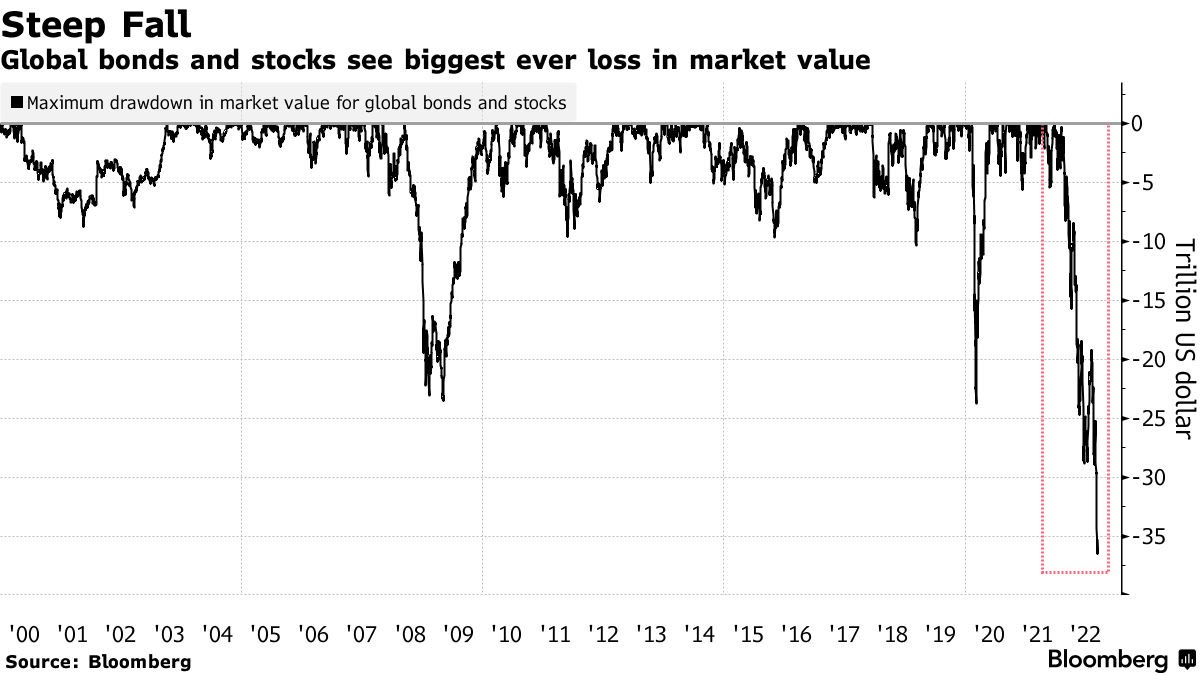

The $35+ trillion plunge in stock and bond markets in 2022 (as shown below) is more significant than any of the drawdowns of the past 20 years, and yet, central banks, far from rushing to the rescue, are intent on tightening financial conditions significantly more.

Shelter prices in North America and several other countries are about twice as high as in 2016, while real income growth is the most negative in decades, and every sector of the economy–governments, corporations and households–is trillions more in debt.

With the bulk of the savings to lose, boomers are older with shorter investment horizons, just as the climate is truly treacherous. Kicked cans are starting to pound down upon us. This is no average downturn. Above-average opportunities will come from it. But only for those who had the foresight to take shelter in advance.