September 24, 2022 | Trading Desk Notes for September 24, 2022

Is this as bad as it gets, or is the “worst” yet to come?

In last week’s TD Notes, I declared, “Expectations of more Fed tightening is the “most important thing” for financial markets.” That was after risk assets took a swan dive following Tuesday’s CPI data. This week, the swan dive continued, especially after the Fed raised rates by 75bps on Wednesday and indicated that the terminal rate (the level where s/t rates might peak) was expected to be ~4.6% and occur in early 2023.

The expectation of more Fed tightening caused stocks, bonds and commodities to fall, while the US Dollar soared against nearly all other currencies.

The answer to the “Is this as bad as it gets” question depends on your time frame. The short-term “rate of change” across asset classes has been extreme, and market sentiment is highly risk-averse. A classic “bear market rally” is probably overdue, but from a longer-term perspective, it’s easy to believe that the “worst” is yet to come.

Most of my trading is short-term; for instance, catching a 1,000-point move in the DJIA these days is worth my time and attention, but after trading markets for 50 years, I can’t ignore the risks and opportunities that come from big cycle moves. So with that in mind, I’ll look to scalp short-term reversals in negative risk sentiment, but I won’t overstay my welcome if negative sentiment intensifies.

Over the past few months, my “Big Picture” view has been that inflation will remain higher for longer than the market has been pricing. One of the reasons for that view is that I think working people believe they have been “left behind” by income inequality and the soaring cost of food, energy and shelter – and they will push for higher pay to try to “catch up.” Companies will also try to “catch up” to soaring costs – note that FedEx just announced an average price increase of 6.9% for shipping rates, effective Jan 2023, despite their September 15 forecast of a substantial decline in shipping volumes. (Charging more for less is also happening in consumer goods – check out this link to “shrinkflation,” where companies keep prices the same but reduce the quantity sold – the cereal box looks as big as before, but it is “thinner” and holds less cereal!)

After decades of the “Fed put,” markets have been slow to realize that the Fed doesn’t “have their back.” (Some observers might think that the Fed is purposefully stabbing investors in the back!) As Richard Clarida, the Vice Chair of the Federal Reserve from 2018 to 2022, recently explained, “Until inflation comes down a lot, the Fed is really a single mandate Central Bank.” (The single mandate is stable prices, i.e., 2% inflation, forget about the other “full employment” mandate – the Fed has different priorities now.)

Currency markets this week

The US Dollar index surged to a new 20-year high – and short-term volatility was amazing. Emerging market currencies were especially weak. For over 40 years, I’ve had two FX mantras: 1) capital flows to the USA for safety and opportunity, and 2) trends in the FX markets seem to run far longer than makes any “sense,” and then they turn on a dime and go the other way.

The Japanese Yen fell to a new 24-year low after the Fed raised rates on Wednesday, and then the Japanese authorities “intervened” in the market for the first time in 24 years, buying Yen and selling USD. (Markets may have also “priced in” that the Japanese will be selling US Treasuries as part of their intervention – adding to pressure on the already-weak US bond market.)

The Swiss Franc fell sharply on Thursday when the SNB raised s/t interest rates by “only” 75bps.

The British Pound tumbled to a new 37-year low Vs. the USD (and UK bonds cratered) after the BoE raised s/t rates by 50bps and the new government introduced their plan to boost the economy. (The dramatic tumble in UK guilt prices had to have negatively impacted US bond prices.)

The Chinese RMB fell to a 27-month low. (On this chart higher prices means that it takes more RMB to buy one USD.)

The Canadian dollar has dropped ~3.5 cents in eight days, falling to a 27-month low.

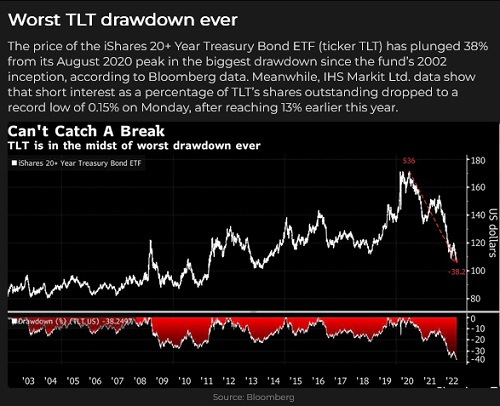

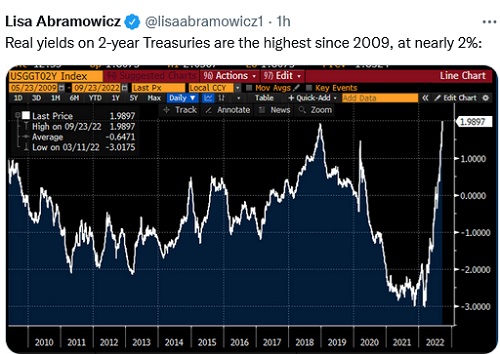

Interest rates

Interest rates across the curve lurched higher following the Wednesday Fed meeting. The 10-year futures contract traded to a 14-year low, trading lower for eight consecutive weeks. The 10–year cash market yield touched a high of ~3.8%, while real yields on the 10-year reached an 11-year high.

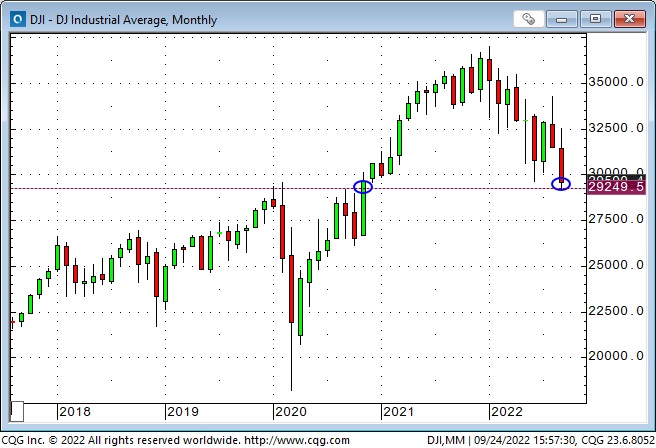

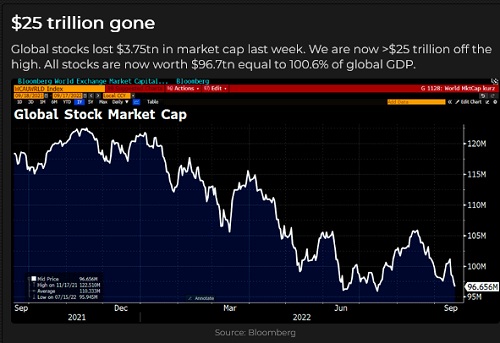

Equity markets tumbled

The DJIA dropped ~3,250 points (~10%) in the ten days from the September 12 high (the day before the CPI report) to Friday’s lows. The Friday low was the lowest price since November 2020 – when Biden won the election and Pfizer announced the covid vaccine.

Private equity: Many major pension funds have been increasing their allotment to private equity over the past several years to diversify their investments and increase overall returns. The time horizon of these investments may “suit” the time horizon of their payout liabilities, but there is always the “question” of how to value non-mark-to-market assets. This private equity ETF may provide a glimpse into the “performance” of some parts of the private equity world – which has had its problems lately with soaring interest rates vis a vis high leverage. (Note that the ETF is down ~50% from the ATH made late last year.)

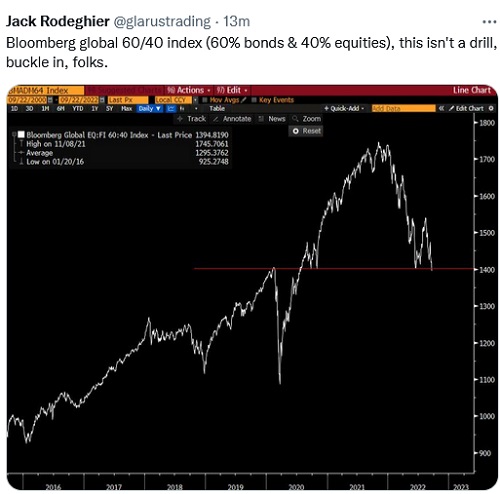

The Bloomberg 60/40 stock/bond index is down ~20% YTD, a steeper fall than during the Covid Panic of March 2020.

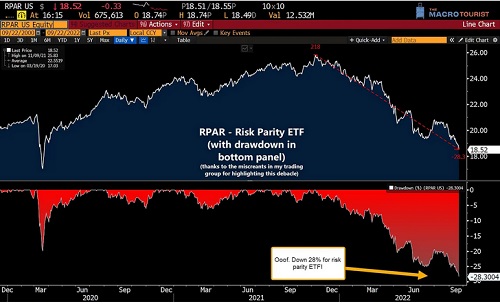

Risk Parity taking a big hit

Risk parity is essentially a strategy to hold a stock/bond portfolio – but to jazz it up with “risk-weighted” leverage – and, no surprise, this risk parity ETF is down more YTD than a “plain vanilla” 60/40 portfolio. (H/T to Kevin Muir for this chart.)

Commodities

Front-month WTI crude oil futures dropped to ~$78, the lowest price since early January, down ~ $42 (~35%) from the highs made following the Russian invasion of Ukraine.

The (energy heavy) Goldman Sachs commodity index also fell to its lowest since early January, down ~ 29% from the post-invasion highs.

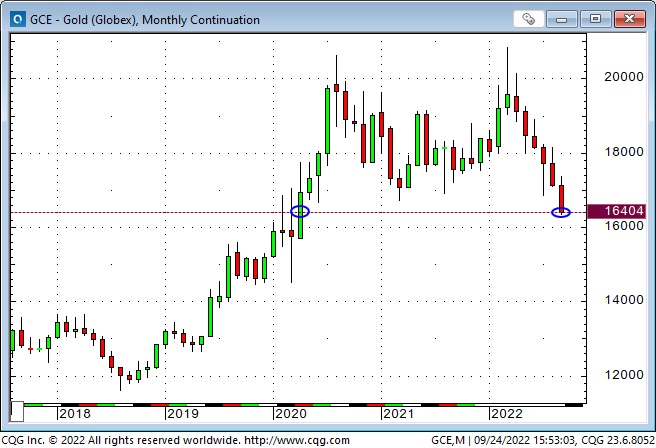

Gold fell to a 30-month low this week – the surging USD and sharply higher real interest rates continue to be toxic for gold – despite high inflation.

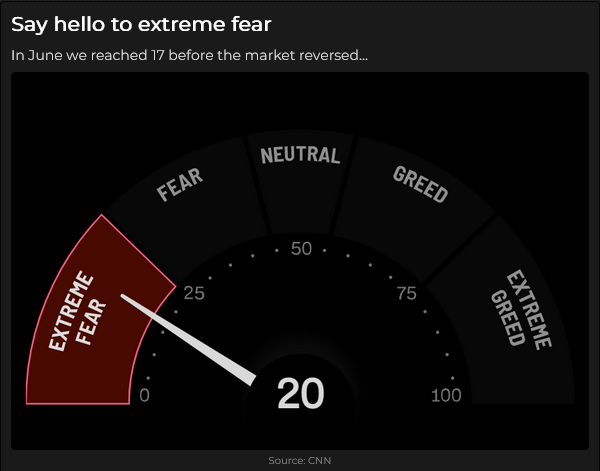

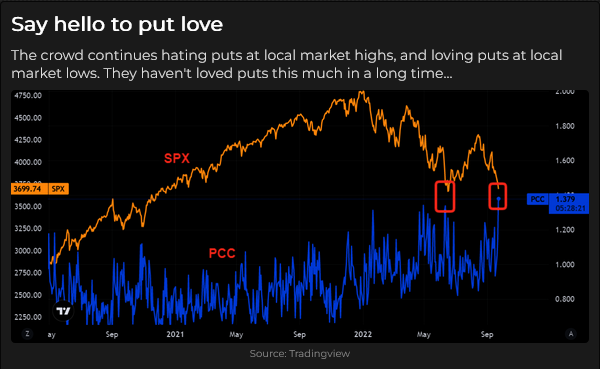

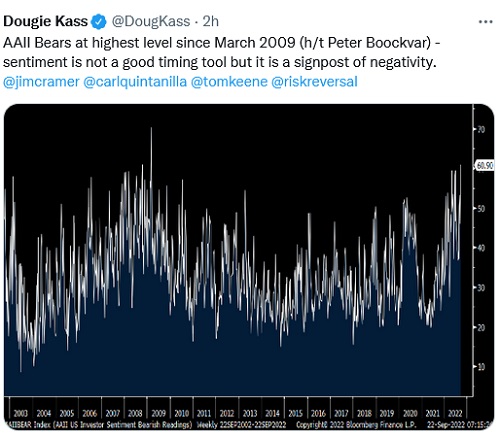

Market sentiment is exceptionally risk-off

The speed of the increase in interest rates has been the “most important thing” driving negative financial market sentiment, but Putin’s decision to ramp up the war against Ukraine and to use “all available means” to defend Russia added to geopolitical stress.

My short-term trading

I started this week long T-Note futures that I bought late last week, but I was stopped for a slight loss in the Sunday overnight session. I was trying to “bottom-pick” a market that has traded sharply lower every week since July, so I was dealing with small sizes with tight stops.

I continued my “bottom picking” approach this week in stock indices, gold, T-Notes and the Canadian dollar with mixed results – some profits but small net losses. At the end of the week, I’m long OTM calls on the T-Notes.

On my radar

I’ll repeat what I wrote last week: Market sentiment is very bearish – for a good reason, there are lots of things to worry about, with an aggressive Fed – and the consequences that may come from that – topping the list, but the question always is, “How much is already in the price, and what’s your time frame?

In a short-term time frame, I think there is a LOT of negativity in the price, and risk assets could rally. In a longer-term time frame, I can imagine both the market being much lower and much higher – I don’t want to let my “feelings” of where the market might be months from now to interfere with my observations of short-term price action.

Quote of the week

This quote is another steal from my friend Kevin Muir the Macrotourist.

Jack Schwager featured Marty Schwartz in his first Market Wizards book in 1989. Marty went on to make (and occasionally lose) millions of dollars.

The Barney report

Barney and I usually go for a 30-minute walk at sunrise. It gives him a chance to stretch his legs, do his business and earn a few treats by finding golf balls for me. My wife and I take turns taking him out for a long mid-day walk (she usually keeps him on a leash, but I like to allow him to run off-leash – he loves doing that!), and then I take him out for another 30-minute special after dinner.

He’s been wolfing down his breakfast and dinner the past few weeks; now that the summer heat wave is over. I’ll have to weigh him again soon because I think he’s gaining weight after levelling out around 60 pounds this summer.

He’s just over one year old now, and he has learned some good behaviour, but every once in a while, he “goes crazy” for about a minute – has a “Zoomie,“ as one of my friends calls it – and then settles down again. I love the little guy!

Here’s Barney keeping an eye on me from the LazyBoy in my office – patiently waiting for me to quit playing around with my computers and play with him instead!

Victor in Calgary October 20 – 22 to attend Josef Schachters’s Annual Energy Conference

The conference will run all day Saturday, October 22, at Mount Royal University in Calgary. Josef and his team have organized a fantastic conference, and if you have any interest in the energy markets, I highly recommend that you make plans to attend. Get all the info you need.

Victor will be in Vancouver next weekend – playing golf with his son!

Drew and I will tee it up around 1 pm on Saturday, October 1, at my favourite golf course in Vancouver – King’s Links. Owner Brad Newell and his team keep this golf course in fantastic condition. It is a proper links-style course, right beside the Pacific Ocean, the fairways and greens are fast, and it is almost always windy – so it can be challenging, but I love the place!

I’ll have to get the TD notes out on Friday next week to accommodate my golfing plans, so they may be shorter than usual.

A request

If you like reading the Trading Desk Notes, please forward a copy or a link to a friend. Also, I genuinely welcome your comments, and please let me know if you’d like to see something new in the TD Notes.

Listen to Victor talk about markets

I’ve had a regular weekly spot on Mike Campbell’s extremely popular Moneytalks show for >22 years. The September 24 podcast, with Jeff Olin, the real estate guru, as Mike’s special guest, is at: https://mikesmoneytalks.ca.

I recorded my monthly 30-minute interview with Jim Goddard for Howe Street Radio on September 9. Listen to that interview at: https://www.howestreet.com/category/talk-digital-network/radio-podcasts/this-week-in-money/.

Subscribe: You have free access to everything on this site. Subscribers receive an email alert when I post something new – usually 4 to 6 times a month.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Nothing on this website is investment advice for anyone about anything.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Victor Adair September 24th, 2022

Posted In: Victor Adair Blog