The Fed voted unanimously to raise the Fed Funds rate by 75 basis points today – up to a range of 3.0 to 3.25%.

This is the third straight rate hike in a row of this size.

With inflation at 8.3% in August, “high inflation is very painful for people at the lower end of the income spectrum,” said Fed Chairman Jay Powell.

“People are seeing their wage increases eaten up by inflation,” Powell said today. When you spend all your money on necessities, and then those prices go up, that really hurts, he said.

We’re taking forceful and rapid steps” to get this inflation under control, Powell said – and as I explained at my Sept 17, 2022 seminar, you should believe him.

Housing Outlook: Look Out Below

After the “unsustainable” price increases recently, “the housing market will have to go through a correction … to get to where people can afford housing again,” Powell said.

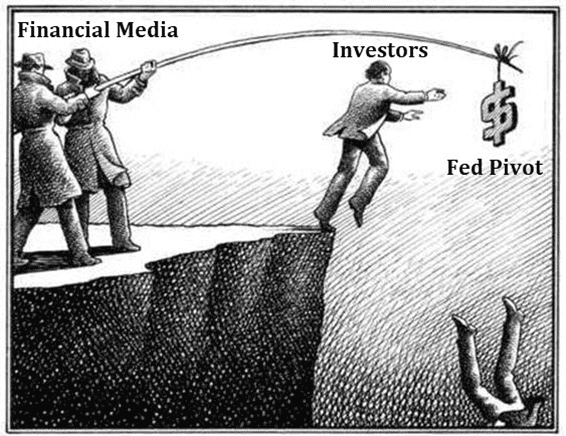

Even with inflation currently raging at 8.3%, the Financial Media wants you to believe that the Fed will soon “pivot” and start lowering rates again to keep housing prices inflated.

Ladies and gents, that would be a bad bet to make.