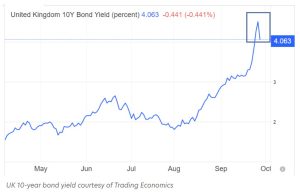

With inflation at 9.9%, the Bank of England (BoE) had to step in (i.e. “pivot”) yesterday and announce that it would re-start Quantitative Easing in order to lower interest rates and save the British economy from collapse.

This was an emergency move by the BoE because leveraged pension funds were getting margin calls on their bond holdings that had lost 30-50% of their value due to the high rate of inflation.

The 10-year bond yield plunged from 4.65% to 4.06% on the news.

Will the Fed follow Suit?

For reasons explained here, I wanted to believe the Fed when they said they would keep raising rates to fight inflation – even if the end result resulted in degrees of pain.

After what the BoE did today, I’m not so sure anymore.

Furthermore, with everybody’s eyes on Britain, people are overlooking the financial crisis that’s occurring in Europe.

Germany is in Trouble Too

With 7.9% inflation, pension funds in Germany are being forced to liquidate their bond holdings because its bond markets have also imploded.

People are wired to believe the future will resemble the recent past – but in reality, things that never happened before happen all the time.

Welcome to the Hotel California everyone. As investors, you can check out anytime you want but you can never leave.