September 18, 2022 | Inflation Sinks In

Many who thought inflation had peaked made 180-degree turns this week after seeing the latest Consumer Price Index release. July data, which had seemed to look better, now looks more like a head fake. The August report showed no improvement and, in some ways, an intensification of the inflation pressure, especially at the core services level.

This shouldn’t surprise us. Once inflation gets started, stopping it is hard—even when the central bank has the necessary tools.

A central bank that already used its best options will have an even harder time. And that’s where the Federal Reserve is. The Fed’s own policies helped spark this inflation. Extinguishing it was never going to be quick or easy. Yet price inflation isn’t entirely the Fed’s fault. You could argue it stems from the giant COVID stimulus spending.

Inflation arises from a complex mixture of monetary policy, fiscal interventions, market psychology, and consumer choices. Today, we’ll explore those and think about what is coming.

| Subscriber: “This service has literally changed the way I read and consume financial/economic news and analysis.” |

Rising Floodwaters

The first thing to remember about inflation is that expectations and reality are two different things, but expectations matter a great deal. They influence the behavior in real, current time that generates future reality. You make plans based on your expectations, of weather or driving conditions or budgets. Inflation is the same. People make different choices when they expect more inflation.

Let me try to explain this with a metaphor. Suppose a giant rainstorm drops large amounts of water at the upstream end of a river. People in towns downstream, knowing floods are coming, will start evacuating and, if they have time, try to protect their property.

Inflation has a similar effect. Maybe you postponed your vacation because airfares were higher every time you checked. But when you check again and see a drop, you get a sense of relief even if the price is still far higher than you wanted to pay.

The difference, of course, is that floods are more predictable than inflation. Scientists can forecast river levels pretty accurately if they know how much rain fell. Human choices won’t change the result. But human choices do change supply and demand, which dictate goods and service prices.

Let’s also remember that we who follow the economic data are attuned to all this in a way most consumers and even business owners are not. They’re too busy running their shops, doing their jobs, or taking care of their families. Their inflation “expectations” reflect their own personal experiences and whatever they see in the media.

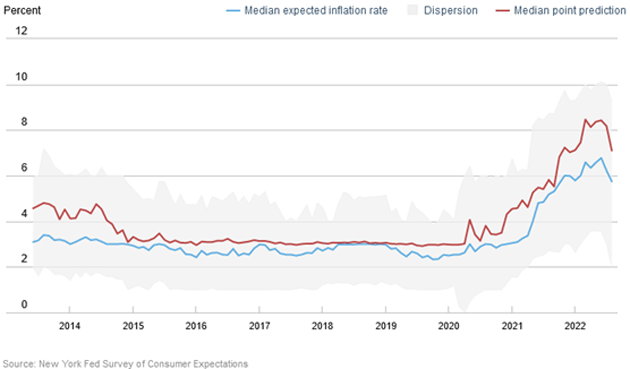

The New York Fed tries to quantify this with a monthly consumer survey. The July survey, released in early August, showed sharply lower inflation expectations.

Source: Federal Reserve Bank of New York

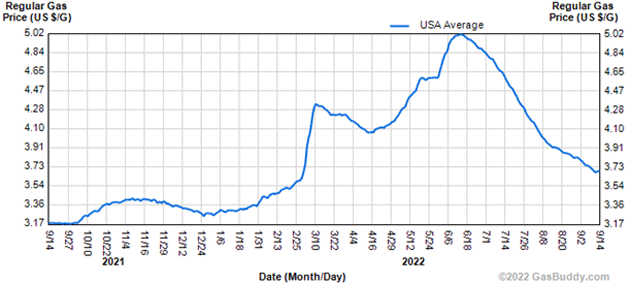

As in our metaphor, the floodwater was still quite high here, but many people thought it had crested. And not unreasonably, since one price they regularly monitor, gasoline, really had crested in June.

Source: GasBuddy.com

Having experienced months of higher prices every time they bought gasoline, a few weeks of decline was enough to convince folks the worst was over. But gasoline isn’t the only living cost, or even the most important, just one that people notice because it is uniquely, repeatedly visible.

This dynamic set up the disappointing August CPI report. Gasoline prices may have peaked, but inflation certainly hasn’t.

“Deeply Entrenched”

Before the August CPI data came out Tuesday morning, consensus expectations were for a slight drop in the headline rate (thanks to energy and a few other categories) and a less severe gain in the core rate. Both expectations were incorrect. Headline CPI rose instead of falling, and core CPI rose twice as much as the experts forecasted.

We sometimes laugh at the “core” rate because of course, real people can’t exclude food and energy from their spending. That’s not its purpose, though. Core CPI shows whether those more volatile commodity prices are becoming embedded in other goods and service prices. We seem to be reaching that point, particularly in services.

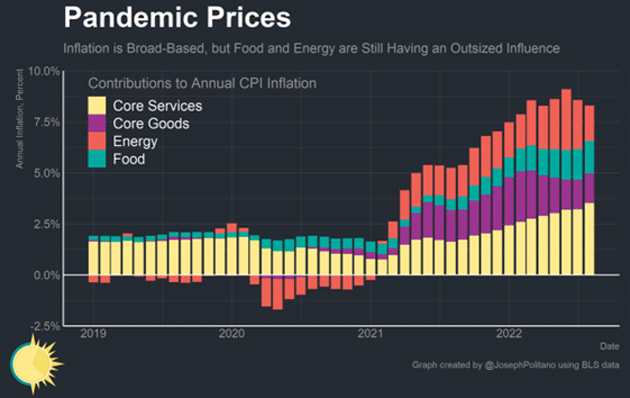

This chart breaks down the year-over-year CPI percent change by food, energy, and the goods and services portions of the core index. Notice what a large and rising percentage core services inflation is!

Source: Joseph Politano

In 2019–2020, energy prices had very little effect on CPI – except to actually reduce it when COVID hit. Similarly, goods prices were all but invisible until mid-2021. Core services were the main inflation contributor until energy joined the party last year. Now energy’s relative contribution is shrinking while service prices are a growing part of the total.

We think of “services” as restaurants, haircuts, hotels etc. Healthcare is another big one, but housing is actually the biggest service category. You pay rent, your landlord “serves” you by putting a roof over your head. If you own your home, you pay imputed rent. In either case, housing is the biggest single expense for most households, and its price has been rising steadily.

Why is housing more expensive? That’s a much bigger discussion, but energy prices are part of it. Construction and construction materials are energy intensive. From there, it flows throughout the economy. High housing costs prevent many workers from living in proximity to the available jobs, forcing wages and other prices higher.

Worse, the Fed’s inflation-fighting policies actually raise housing costs by pushing mortgage rates higher. So do the higher property taxes many states and localities are enacting so they can maintain public services in the face of labor shortages and other rising costs. It’s a vicious cycle. Or actually, one of many vicious cycles as inflation sinks deeper into the core.

Let’s examine a particular quirk about housing inflation. The rent portions of CPI (both actual rent and owner’s equivalent rent) come from surveys asking people about their housing costs. They don’t ask the same people every month, and they rotate through different regions every six months. The findings are averaged into CPI over time, not immediately.

That’s why we see housing inflation in the August number, even though we can look at the current data and see that housing and rents have seemed to peak. August data doesn’t reflect what actually happened in August but is actually an average of what happened over the last 12 months.

And that is why we are going to see core services—of which housing is a major component—continue to push inflation higher. Six months from now, we’ll theoretically start to see a drag on housing in the inflation equation.

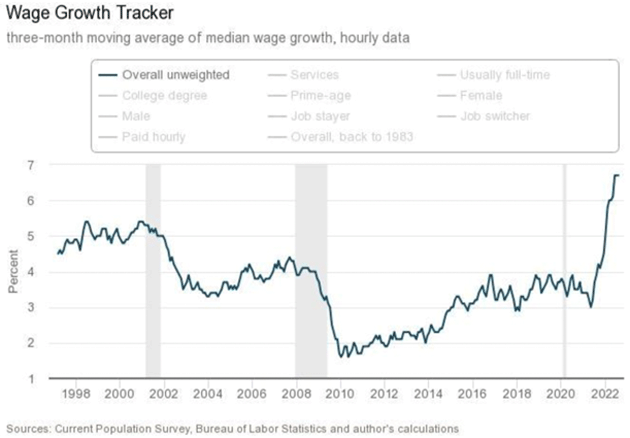

(By the way, housing isn’t the only data with quirks and distortions. Calculating inflation is a very complex undertaking, and each item has its own issues. That said, the BLS is doing its best.) The same could be said for wage inflation: it is very sticky, and it has been rising and clearly contributes to core services inflation. The latest railroad union contract (not critiquing—I wasn’t at the table) will set a new standard. As an economist, you can’t look at that deal and not see more wage inflation.

Source: Atlanta Federal Reserve Bank

This will be an ongoing process for the next several years as unions and workers take advantage of their new leverage. After roughly 40 years holding the short end of the stick, good for them!

Pervasive Inflation

Like what you’re reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

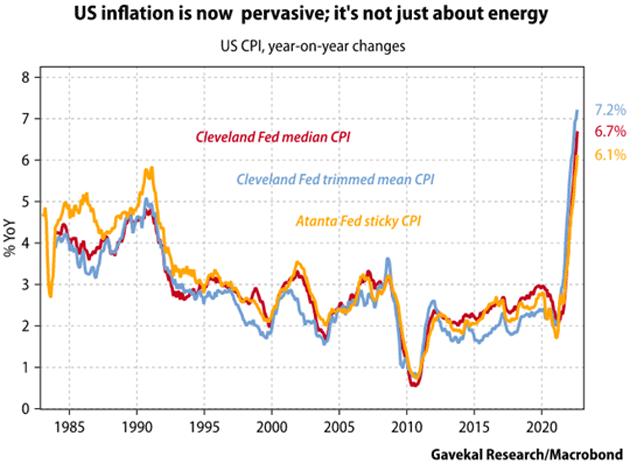

Gavekal Research Chief Economist Anatole Kaletsky shared this chart after the CPI report, showing some other indicators designed to reflect inflation’s depth and “stickiness.”

Source: Gavekal Research

Here’s Anatole.

“These indicators imply that inflation well above 6% is now widespread and deeply entrenched in the US economy. Delving into the monthly changes of these series reveals no evidence that inflation is ‘peaking’ or even decelerating. In fact, the 0.74% month-on-month increase in the median CPI in August was the biggest monthly increase ever recorded in this series, whose history goes back to January 1983.

“This is particularly significant because the median CPI shows the most typical price increase across the broad economic sectors sampled for CPI data. According to the Fed’s own research this ‘provides a better signal of the underlying inflation trend than the CPI excluding food and energy’ and is ‘better at forecasting PCE inflation in the near and longer term than the core PCE.’

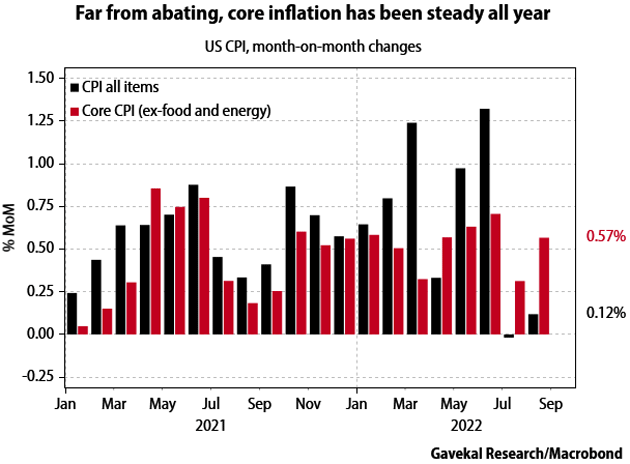

“The second chart shows monthly changes in the headline and core CPI measures. It explains why I believed back in May that there could be no relief from terrible US inflation news at least until the end of this year. The red bars, representing core CPI, show that non-energy inflation, far from decelerating and almost vanishing in recent months as sometimes suggested, has been remarkably steady throughout this year, advancing almost every month at an annualized rate of 6% to 6.5%.

Source: Gavekal Research

“This chart also shows that whatever happens to prices in the weeks ahead, base effects resulting from the very low CPI readings in the summer of 2021 almost guarantee that year-on-year inflation will remain elevated at least until November.”

This suggests the Fed is highly unlikely to change course anytime soon. A pause with these kinds of numbers would make them lose all credibility. The tightening will continue until we see an improvement in morale several months of falling core inflation. And even then, they will probably just pause the tightening. Outright easing is even further away… with recession likely first.

| Newest Episode of Global Macro Update with LACY HUNT, Now Streaming. This week, Ed talks to SIC favorite, Lacy Hunt. Click the player image to start streaming now. Be the first to hear about the newest interviews and episodes by signing up for the free Global Macro Update e-letter, sent to inboxes every Friday. |

When Will Inflation Actually Fall?

Right now, the market doesn’t believe Jerome Powell’s inflation rhetoric. Before the latest inflation data, traders assumed a 3.5% fed funds top before Powell would blink. I don’t think the data will give him that opportunity if he is serious about fighting inflation, and I think he is.

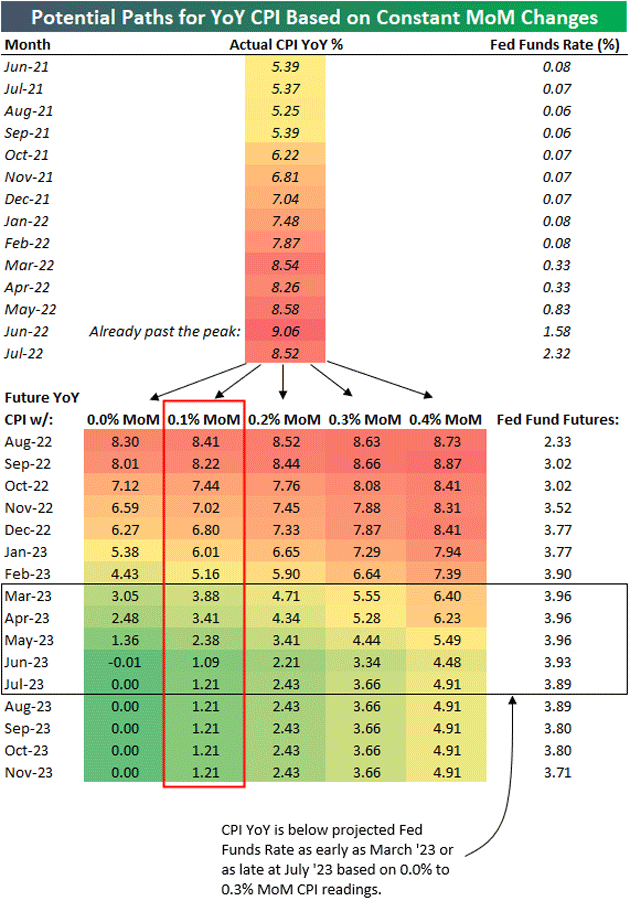

Here is an interesting chart from Bespoke Investment Group in London. They look at the preceding 12 months of actual CPI and then show what inflation would be at various monthly average levels of inflation. Look at the chart, and then I’ll try to explain.

Source: Bespoke Investment Group

Last month, inflation increased 0.1%. Bespoke shows that if inflation keeps increasing 0.1% a month, it will be March before yearly inflation drops below 4%—and May before it has a 2% handle. If inflation was absolutely zero, then by March we would be in an area where Powell might indeed think about pausing.

Absent some complete collapse of the economy in the fourth quarter, inflation is still likely to be 6% in December, with the fed funds rate at (or very close to) 4%.

Continued Seepage

While the current inflation problem predated Russia’s invasion of Ukraine, the resulting energy spike certainly made it worse. In like manner, lower energy prices would probably help but not solve the problem.

In 2019, before COVID, crude oil was running in the $50–$60 range. It plunged in 2020, recovered, and then moved even higher. It was already around $90 before the war. It popped well over $100 and is now back near that $90 range. So it may be stabilizing, but at a higher level than prevailed in 2018–2019.

Math says if energy prices simply stay flat from here, the impact on inflation rates will start to fade. The impact on consumers won’t fade because these higher prices have a cumulative effect. Their persistence means people and businesses have less to spend on other things, with effects that add up over time.

The problem is more fundamental. Even a recession can only reduce oil prices so much when the loss of Russian supply offsets lost demand. But what would bring Russia’s energy exports back online? An end to the Ukraine incursion is a necessary, though probably insufficient, step.

Recently, Ukrainian advances excited a few traders, but probably shouldn’t. George Friedman thinks the war will intensify. This is from a note he sent last week.

“One side must defeat the other. Neither side can afford the cost of failing such an attack. The Russian advantage is manpower. There are reports from multiple sources, including American ones, of large numbers of Russian troops training in the Russian Far East. The Russians need more troops, so these reports are believable. Russia is not going to defeat an army armed with American weapons with the number of forces it has deployed thus far. The Russians face a choice of attacking with overwhelming force or losing the war. They will choose the former.

“The Russians are protected by a political and military reality. The U.S. is not interested in hitting Russia directly, either with conventional or nuclear weapons. Russia can hit back. Neither side wants a direct Russo-American war. Reinforcements can be hit upon crossing into Ukraine, but the Russians will send a vast number of trainees because heavy casualties at every stage is inevitable.

“So long as Putin is president, every effort will be made to win, because he cannot afford anything less than victory. And I don’t see any other possible strategies except the manpower one, which I assume will happen very soon or after the winter. It does not seem to me that the current forces deployed by Russia can do more than hold on to some areas. There needs to be reinforcement. Putin may have other strategies, but they are hard to envision.”

George conditions his conclusion, “So long as Putin is president,” and indeed there is some talk that Putin’s regime is in peril. But we don’t know that any replacement would end the Ukraine campaign. They might even enlarge it.

Western Europe is preparing for a full Russian gas cutoff this winter. Russia doesn’t have the infrastructure to send those exports anywhere else. Both sides will suffer. To our point, there’s no reason to think energy prices will drop significantly from here. Whatever oil, natural gas, and coal is available on the world market will catch plenty of bids.

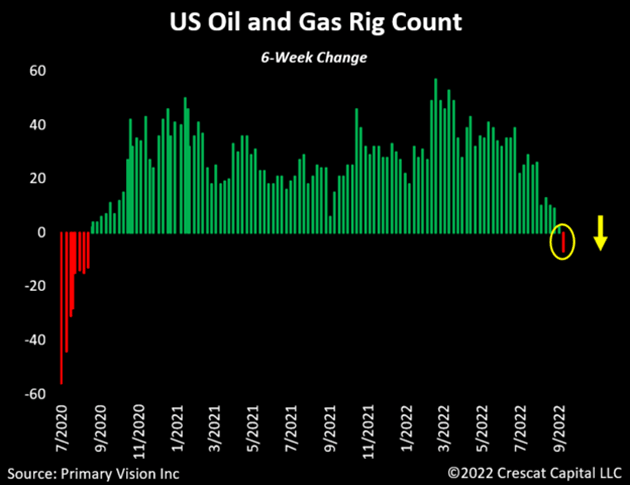

But who is going to “hit that bid?” World production is and has been flat for almost 10 years. The US has been the marginal producer of increased production, but that seems to be changing as ESG is on the rise—or an abundance of caution to not create another price crash like 2014 among US oil drillers. US rig count seems headed down.

Source: Crescat Capital

If gasoline starts rising again, will we see inflation expectations rise as well? Not necessarily, but that’s the way to bet. That means energy inflation, whether static or rising, will continue seeping into core inflation—at least in the absence of lower demand.

Given the CPI’s composition, inflation can’t fall much unless housing prices break. What would change that? I suppose a recession with higher unemployment might push some people out of their McMansions into smaller homes, but that’s actually where the shortage is worst. Apartment rents are crazy. And who would buy the big homes they leave empty?

I don’t like ending on a down note, but I see few solutions here. The solution was for Fed officials to do some things differently 10 years ago, or even two years ago. Now they’re stuck. And we’re all stuck with them.

Powell doesn’t want to be another Arthur Burns. I don’t think he necessarily aspires to be Paul Volcker, who was definitely not liked while he was raising rates and tanking the economy, but given his recent speeches and their bluntness, he sounds capable of taking fed funds to 5% if he believes it necessary to defeat inflation.

And that means every monthly release of inflation data that doesn’t support a rapidly falling inflation number is going to create another headache for the market. The last one was almost a 1,300-point down day. How much potential disappointment is in your wallet? Maybe you should think about hedges and risk management if you haven’t done so already.

Cleveland and Other Parts

I will be going to Cleveland sometime in the middle of October for a few more tests and to see doctors I missed the last time. Nothing really serious, just taking care of business. Getting old is not for sissies.

I will need to get to Dallas at some point, probably Washington DC, and I would like to get to New York. I had really expected to be traveling a great deal more when I moved to Puerto Rico, but that has not been the case. Zoom (and all its competition) has really changed the nature of my communication, but there’s nothing like one-on-one or small groups.

Have a great week! And if you can’t get there in person, reach out and touch with Zoom or whatever. It’s always good to see a friendly face! And speaking of friends, don’t forget to follow me on Twitter. I am like a few names from 50,000 followers, and while it doesn’t make any difference in the grand scheme of things, it’s one of those small things that will make me smile.

Your really wondering what Powell will do analyst,

John Mauldin

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

John Mauldin September 18th, 2022

Posted In: Thoughts from the Front Line