September 19, 2022 | 2022: Three Quarters of Pain and Counting

As we start the third week of September, with the US Fed’s much-telegraphed rate hike on Wednesday (+.75 with some 30% betting odds of a full percent!), markets are peaked. Bitcoin (-71%) continues to lead the crypto Ponzi down the back side of heartbreak hill.

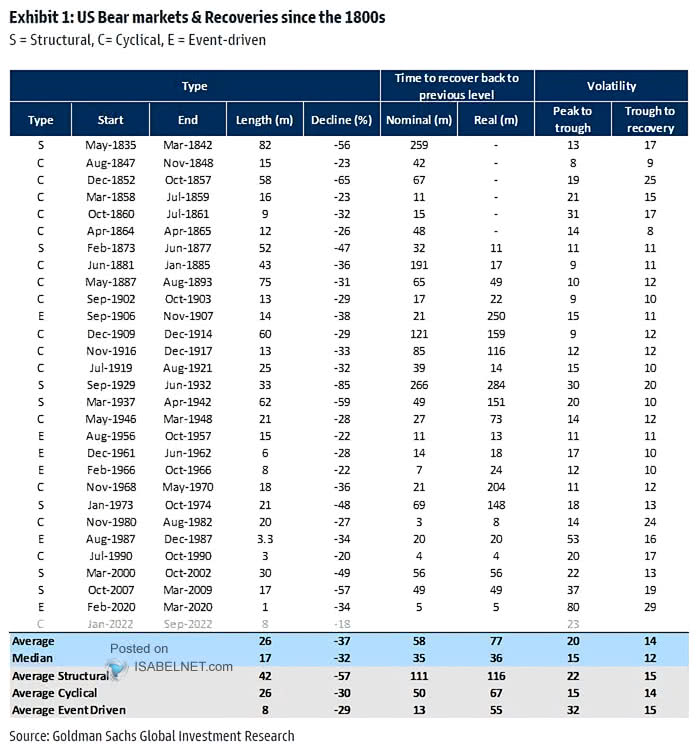

So far, the S&P 500 -20%, the Nasdaq -29%, and the Russell 2000 -27% are about halfway through drops seen during previous recessionary bear markets (most recently 2008, 2000, 1980-1982 and 1973-74, as shown below courtesy of IsabelNet.com). To date, Canada’s TSX -13% is just a quarter through the price correction experienced during those precedents.

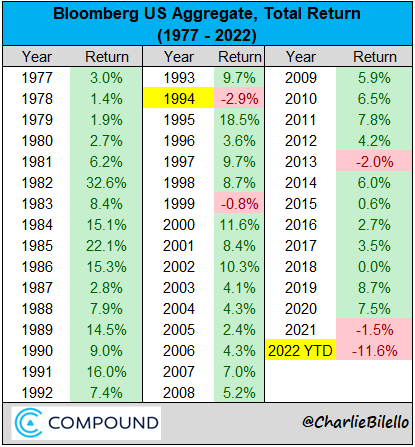

Different this time, the aggregate bond index -13.1% over the past 21 months (the US below courtesy of Charlie Bilello), has clocked its worst total return since 1970.

It is typical for lower-grade corporate credit/bonds to lose value with falling equity markets and rising defaults. On the upside, investment grade bonds are one of the rare assets that have historically rebounded near the end of central bank tightening cycles and into the depths of recessions, with solid return years always following past losses (as shown above). Of course, bonds held through interim market declines are required to pay interest semi-annually and return principal (face value) on the stated maturity date. Equities offer no such assurances.

Cash reserves have been the most valuable portfolio buffer this year; unfortunately, as usual, most came into this downcycle with less than 5% cash.

The discussion below offers further insight into the inflation-driving and deflating monetary policy cycles and why investment-grade bonds remain a rarely valuable allocation port for retirement funds during recessionary storms.

This week I spoke with Dr. Lacy Hunt, executive vice president of Hoisington Asset Management and author of both “A Time to Be Rich” and “Dynamics of Forecasting: Financial Cycles, Theory and Techniques.” We discussed the consequences of the Federal Reserve’s actions, the impact of higher interest rates, and the durability of inflation. Here is a direct video link.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Danielle Park September 19th, 2022

Posted In: Juggling Dynamite

Next: Bringing Down The House »